A long time coming – pv magazine International

From pv journal 02/23

Because the penetration of renewables into the grid will increase, the storage of regularly provided power turns into extra invaluable. The advantages of long-term power storage are apparent: storing scattered clear power and pouring stated photo voltaic and wind electrical energy again into the grid in instances of peak demand, ideally cheaper than standard which is fossil gasoline energy.

The trick stays power storage at scale. Even the place the inexperienced shoots of concepts and promise for LDES expertise sprout, the roots are intertwined in a graveyard of failed ideas.

Length or utility?

LDES is roughly outlined as programs able to delivering eight or extra hours of storage capability, though some place the cutoff level at 10 hours. A report by the US federal physique Nationwide Renewable Vitality Laboratory (NREL) lately tried to shift the main target of the definition from length to utility, arguing that length of storage “doesn’t mirror how the saved power or the quantity it offers to the grid.” As such, it settled on a definition of “greater than 10 hours,” provided by the federal government’s accomplice physique Superior Analysis Initiatives Company for Vitality (ARPA-E). That description suits most functions and covers applied sciences which are new to the grid and people which have been used for generations, corresponding to hydropower.

Battery energy

Lithium-ion batteries have capability and electrical coupling points that make them too costly for long-term storage. Cyril Yee – director of Massachusetts-based clear power physique the Grantham Basis, and former chief innovation officer of local weather expertise entity Third Spinoff – stated pv journal Lithium-ion batteries have many issues with scale and lifelong.

“One factor I am not loopy about for lithium is the cycle-life, which is not very lengthy — we’re speaking about 3,000 cycles,” Yee stated. “Grid belongings are usually 20-year belongings, that is what utilities use. There isn’t any means a lithium battery goes to final 20 years and, usually, different battery applied sciences and chemical substances like excessive threat. Typically, we’re sturdy in [LDES] house.”

Sam Lefloch factors to industrial decarbonization as the economic sector main the Third Spinoff, and additional emphasizes the purpose. “When you go to tens or lots of of hours of storage, you should linearly enhance the price of the gear used to cost and discharge.”

Funding points

Whereas LDES appears essential, and with funding extra available from innovation and local weather funds – Yee and Lefloch say startups discovering entry to capital will not be a problem – the sector is struggling to go from promising concepts to profitable companies, with monetization being a key situation.

“Certainly one of our considerations is [LDES] near-term monetization, as a result of the grid does not want it till you get to a really excessive penetration fee for renewables – 50-plus %,” stated Yee.

Wooden Mackenzie Senior Analysis Analyst Kevin Shang says utilities are notably cautious. “The LDES ecosystem and novel applied sciences exist already in laboratories and analysis institutes, however it’s nonetheless comparatively new for utilities and at a really early stage,” Shang stated. “For the utilities, their precedence is to make sure the energy, stability, and security of the ability system. So it’s comprehensible that they’re gradual, however issues are enhancing.

Sizzling scorching

A very troublesome subject is thermal power storage (TES), a expertise that has attracted funding and early business installations however has largely did not scale properly. Wind engineering and energy conversion provider Siemens Gamesa has accomplished its giant and award-winning demonstrator undertaking in Hamburg, Germany. The demonstrator web site shops as much as 130 MWh of power as warmth for as much as per week, utilizing volcanic rock. Verónica Díaz López of Gamesa was in a position to affirm the pv journal that the undertaking was terminated even after it proved technically possible.

“Siemens Gamesa has determined originally of Might 2022 to cease the demonstration operation of electrothermal power storage,” stated Díaz López, who put the choice on a “lack of a business marketplace for large-scale storage.”

Amongst different contenders solely Azelio, a Swedish firm that shops power as warmth in recycled aluminum as much as 600 C, has managed to commercialize its answer. The corporate reviews that it at present has 13 programs, referred to as TES. PODs. It operates commercially throughout the UAE, Sweden, and South Africa, with the biggest set up supplying as much as 1.3 MWh of storage capability.

Berlin-based TES firm Lumenion says it has switched to solely storing power to be used as warmth in programs with a capability of lower than 100 MWh. Elsewhere, Australian-based 1414 Levels is at present remodeling its thermal power storage system. MAN Vitality Options, in Switzerland, discovered restricted curiosity. Raymond Decorvet, a senior account government at MAN, says that whereas the corporate has nice demand for industrial warmth pumps, the TES enterprise will not be very lively. “I have not seen any huge motion in that, not in power storage,” he stated. “To save lots of the warmth pump, completely. I feel it is due to the query: who pays for it? Who advantages from it? We now have to eradicate the limitations.”

One of many remaining hopes of TES is Malta Inc, an organization transferred from the “moonshot manufacturing unit” of Google proprietor Alphabet, X, which acquired greater than $85 million in funding. Malta has a pumped-heat power storage demonstration facility put in by the Southwest Analysis Institute, a non-profit group primarily based in Texas.

Count on compression

One other main hope of LDES, compressed air power storage (CAES), has a 50-year monitor document, second solely to pumped hydro when it comes to put in scale. Two operations have been used reliably since 1978 and 1991, in Germany (with 290 MW capability) and Alabama (110 MW), respectively. A research performed in 2002 by the Electrical Energy Analysis Institute discovered that about 80% of US geology is appropriate for CAES.

The expertise shops power by compressing air and storing it in an underground cave or container. The air is later launched to drive a turbine. The expertise has a quick startup time, saves a number of power, and enhancements are nonetheless being made. CAES vegetation are increasing in China, the place builders are utilizing disused mines. The world’s largest CAES web site, at 350 MW/1.4 GWh, has begun growth within the Shandong salt mine and should increase to 600 MW.

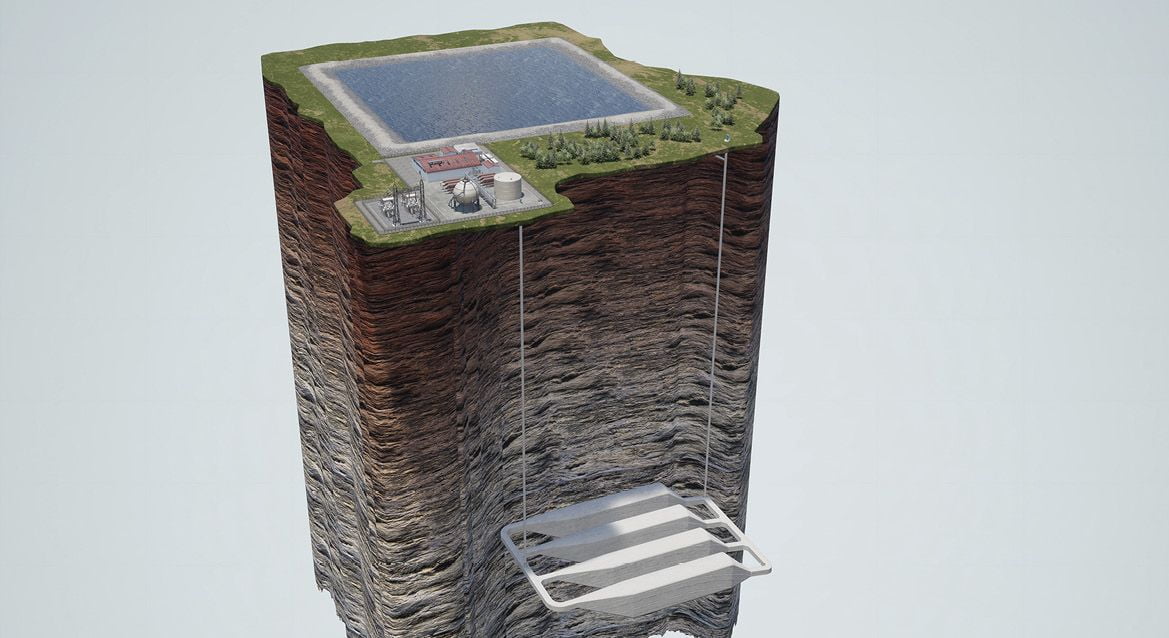

Hydrostor, a Canadian firm with patented superior compressed air power storage expertise, is among the main gamers exterior of China. With a $250 million battle chest, Hydrostor counts Goldman Sachs amongst its traders. Amongst its tasks, Hydrostor is growing a 300 MW to 500 MW advanced-CAES facility in Ontario and the corporate has secured an influence buy settlement (PPA) from group electrical firm Central Coast Group Vitality for a proposed 500 MW facility in California.

Hydrostor CEO Curtis VanWalleghem says the corporate goals to enhance conventional CAES strategies by eliminating geological constraints. Hydrostor advanced-CAES will be positioned “wherever there may be appropriate arduous rock at a depth of 600 m,” says VanWalleghem, which is “greater than 50% of the world.”

“Hydrostor’s A-CAES expertise can ship the identical megawatts and megawatt-hours as pumped hydro energy whereas utilizing as much as 10 instances much less land and as much as 20 instances much less water,” added VanWalleghem.

The CEO claims his firm’s answer is 60% to 65% environment friendly, with capital expenditures for the system “within the $2,500/kW vary for eight hours, or $250 to $300 per kWh of storage capability, for a belongings with 50-plus years of life with out efficiency degradation.” The system is monetized via PPAs.

Batteries drain

One of many greatest LDES electrochemical hopes is Type Vitality, another battery participant with deep pockets. The corporate has raised greater than $800 million for an iron-air battery it says can retailer 100 hours of power at system prices aggressive with standard energy vegetation. The primary battery manufacturing facility within the type is ready for Weirton, West Virginia, with accomplished batteries anticipated in 2024.

Circulation batteries characterize one other vector of hope. Vanadium-based redox stream gadgets are properly understood, and a 2022 undertaking in China is putting in a 400 MWh system. Different strategies utilizing completely different supplies – primarily transferring away from costly vanadium – are additionally gaining market curiosity.

NYSE-listed iron stream battery specialist ESS lately expanded into Europe and with renewable funding within the US exploding, is making ready provide for anticipated demand. Senior VP for enterprise growth and gross sales at ESS, Hugh McDermott, stated pv journal how the corporate ramped up manufacturing: “As quick as potential!” he stated. “We’re transferring shortly to do our half to fulfill the anticipated demand within the LDES market. McKinsey & Firm predicts that we’ll want 30 TWh to 40 TWh of LDES within the US alone by 2040. The primary absolutely automated battery meeting line ESS has an annual manufacturing capability of 75 MW, with McDermott planning to increase capability to 200 MW.

“When it comes to whole price of possession, our power storage programs have a considerably decrease price of possession than lithium-ion,” added McDermott. “That is partly attributable to the truth that our expertise has no biking limitations and our merchandise are designed for a 20-plus-year life with out deterioration or want for addition.”

Know-how firm Third Spinoff is backing half a dozen startups in battery stream, together with new generations of stream chemistry that use natural compounds and various supplies to vanadium, corresponding to zinc-air. However extra funding is required, stated Wooden Mackenzie’s Shang, including, “The essential factor is that the deployment of [LDES] on a big scale there are a lot of advantages. As a society, the reward is nice. However what we have to do now’s extra planning, extra funding, and extra motion. We should make investments at the moment to reap the rewards of tomorrow.”

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].