China’s solar century – pv magazine International

From pv journal 05/23.

China is about to grow to be the primary nation to put in 100 GW(AC) of photo voltaic a 12 months. It’s the world’s largest photo voltaic market and exporter of a lot of the world’s PV wafers, cells, and modules. China’s photovoltaic trade has been in improvement for 20 years and has rocketed prior to now decade to incorporate the export of PV manufacturing tools and course of know-how.

First steps

The trade started in 1968 when researchers from the Institute of Semiconductors of the Chinese language Academy of Sciences found high-resistance n+/p-type photo voltaic cells with higher radiation resistance than p+/n-type cells. . That made the previous eligible to function satellites within the nation in the course of the Cultural Revolution.

Within the Nineteen Seventies and Nineteen Eighties, the Chinese language authorities established state-owned photo voltaic cell factories in Ningbo, Zhejiang province, and Kaifeng, Henan, to provide small cells and modules for the needs in analysis. The ten kW web site in Yuzhong, 40 km from the town of Lanzhou, is the oldest photo voltaic plant in China. It was constructed by the Gansu Provincial Institute of Pure Power in Yuzhong in 1983, and now produces 70% of its authentic output.

PV industrialization

The industrialization of Chinese language PV started with Zhengrong Shi’s basis of Suntech Energy in 2000, with assist from the Wuxi municipal authorities. The College of New South Wales (UNSW) graduate oversaw the opening of Suntech’s first 10 MW annual manufacturing capability cell line in 2002, producing the identical output as China’s complete cell capability. within the final 4 years.

In December 2005, Suntech turned the primary non-public Chinese language firm to be listed on the New York Inventory Change. Suntech’s contemporaries LDK – based in Jiangxi – and Hebei-based Yingli additionally went public in the US, and the trio turned China’s most necessary industrial firms for a time.

Speedy progress

The three firms led China’s first golden age of photo voltaic, from 2002 to 2008, with Longi, Trina Photo voltaic, Canadian Photo voltaic, and JinkoSolar among the many rivals that emerged. Chinese language enterprises, with their manufacturing value benefit and supportive authorities coverage, are constructing a global benefit as demand for PV will increase in Europe and the US.

Initially midstream producers, Suntech, LDK, and Yingli expanded upstream in response to silicon provide constraints, signing long-term provide offers and establishing their very own polysilicon operations.

These investments took a success as the worldwide monetary system suffered a debt disaster in 2008, sharply slowing demand for photo voltaic as debt-ridden nations shortly withdrew. of fresh power subsidies. With the value of polysilicon falling by 90% inside months, Suntech, LDK, Yingli, and many others. are going through the chance of chapter.

The next imposition, by US and European lawmakers, of anti-dumping and countervailing duties on Chinese language photo voltaic merchandise, in 2011 and 2012, meant that China’s PV producers suffered their darkest ever. time and far is misplaced.

Reset button

Beijing responded by trying inward and elevating the photo voltaic technology capability targets set within the twelfth and thirteenth nationwide five-year plans, for the years 2015 and 2020. that energy additional boosts home demand.

Regional authorities and state entities together with the Nationwide Improvement and Reform Fee, Ministry of Finance, Ministry of Science and Expertise, and Nationwide Power Administration (NEA) are pushing initiatives such because the Golden Solar Undertaking, High-Runner Program, and Panorama Power Base Undertaking, to generate home demand for PV.

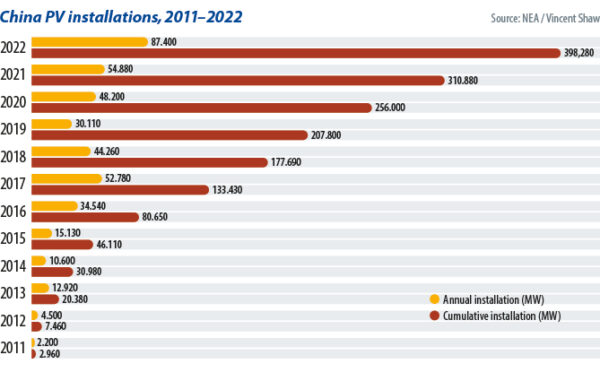

Progress in Chinese language demand, a discount in power value ranges for photo voltaic and the restoration of abroad PV markets noticed photo voltaic rebound in China after 2013.

On Might 31, 2018, nevertheless, as guests to the annual SNEC Shanghai photo voltaic exhibition headed house, the NEA cooled the market in a single day by lowering PV subsidies, efficient the following day. The transfer comes as China’s rising photo voltaic technology capability prompts a rise in incentive charges for a authorities that wishes photo voltaic to compete with out subsidies.

Grid parity

Since day one, Chinese language photo voltaic producers have aggressively tried to decrease manufacturing prices. GCL has invested in steady Czochralski silicon and fluidized mattress reactor know-how to scale back the manufacturing value of monocrystalline silicon from greater than CNY 100 ($14.54) per kilogram to lower than CNY 60/kg. Longi’s diamond-wire slicing of monocrystalline silicon ingots has pushed down the price of wafers and Longi and peer Aiko Photo voltaic have been among the many first firms to put money into passive emitter, rear contact (PERC) photo voltaic cells as a extra environment friendly various to the mainstream. that BSF. (back-surface subject) incumbent.

Module makers together with Trina Photo voltaic, JinkoSolar, and CSI have developed new approaches together with multi-busbar know-how, half-cut cells, bifacial panels, stacked tiles, and bigger wafers.

The ensuing merchandise might produce subsidy-free electrical energy on the similar value as grid energy in some areas by 2019, and in most initiatives two years later, as Beijing ends subsidies.

Chinese language Premier Xi Jinping in 2020 introduced that the nation will purpose for peak carbon emissions in 2030 and carbon neutrality in 2060. The greater than 100 GW(AC) of latest photo voltaic capability anticipated this 12 months might hit greater than 130 GW subsequent 12 months, in line with commerce physique the China Photovoltaic Business Affiliation.

Coverage assist

The Chinese language authorities’s capability to intervene within the home economic system units it aside from US and European authorities who need to rely solely on fiscal coverage and tax levers.

The nascent Chinese language photo voltaic trade imports uncooked supplies and manufacturing tools and depends on exports to develop, which initially prompted Beijing to supply tax incentives linked to manufacturing.

When the US and EU slapped duties on Chinese language merchandise, policymakers flocked to sources of capital and used market competitors to bolster PV firms whereas providing tax incentives and supporting land use coverage. That important response established a complete provide chain with Chinese language uncooked supplies and manufacturing tools, and boosted native demand.

Residence comforts

China has the most important single market on the earth in addition to a complete industrial system and comparatively low labor prices, permitting it to reap the benefits of its scale and achieve a aggressive value benefit. On the similar time, the nation’s infrastructure is comparatively steady. Built-in transportation can enhance logistics effectivity and considerably cut back prices and a well-developed communication system might help firms combine provide chain assets and create cluster results.

For a typical Chinese language module producer, the uncooked materials for the monocrystalline silicon in its modules could come from silicon vegetation in Inside Mongolia or Qinghai. Silicon ingots come from vegetation in Yunnan and are processed into high-efficiency photo voltaic cells in factories close to module vegetation in Jiangsu or Zhejiang.

These supplies are despatched to the module fabs the place they’re processed with auxiliary supplies and equipment offered by close by suppliers and eventually despatched to the west and northwest of China, for the development of ground-mounted energy. vegetation, or to ports within the east for export.

Personal vs. public

Not like most different home industries, most of China’s main PV gamers are non-public firms, with Miao Liansheng proudly owning Yingli, Gao Jifan Trina Photo voltaic, and Peng Xiaofeng LDK. Personal possession implies that such firms have low decision-making hierarchies and may shortly reply to market modifications, in contrast to their state-owned friends. In comparison with extra conventional industries, China’s photo voltaic sector has operated in a extremely worldwide and specialised free market surroundings from the start.

On the similar time, most non-public entrepreneurs in China are skilled and open-minded and are typically extra brave within the face of limitless market challenges than their counterparts in conventional sectors. Even the imposition of EU and US duties, or the drastic modifications in China’s nationwide coverage, or fluctuations in provide chain costs, didn’t shake their dedication to develop the PV enterprise. .

Above all, the Chinese language authorities has proven robust religion and dedication to exchange conventional fossil-fuel based mostly electrical energy with renewable power. It’s the foundation of the event of your entire PV trade in China and it seems to be steady and dependable.

Major challenges

Chinese language PV nonetheless faces many uncertainties that might have an effect on future progress, nevertheless.

First, the world economic system is now going through the chance of recession. The World Financial institution, World Commerce Group, and OECD lowered their progress forecasts for the worldwide economic system final 12 months and this, and warned economies going through an elevated danger of recession resulting from of rising meals and power costs, inflation, and better rates of interest in developed nations.

The outlook for the Chinese language economic system is equally bleak. After a horrible expertise within the prevention and management of Covid-19 final 12 months, China is within the midst of a troublesome restoration and a decline within the property market, sluggish automotive gross sales, and the home debt. that authorities of disaster proportions all check the economic system. The anticipated decline will result in a lower in demand for electrical energy, together with renewable power, which is able to instantly have an effect on the event of the photo voltaic sector.

On the similar time, geopolitical dangers are additionally looming. Main photo voltaic markets within the EU, US, and India have all introduced an intention to construct their very own PV provide chains. Does this imply that extra commerce safety insurance policies can be launched? Will extra commerce boundaries be erected towards China’s PV merchandise?

Different challenges in China embrace whether or not the grid can accommodate increased volumes of intermittent renewable technology capability. Will the obligatory power saving ratios imposed by native governments on renewable websites – together with PV – result in important value will increase that hurt funding?

Regardless of the storm clouds, nevertheless, China’s achievement of 100 GW(AC) annual photo voltaic installations remains to be worthy of congratulations from all concerned within the power transition and confirms the brilliant way forward for the enterprise the place we’re shifting.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].