Cell prices slip, weighed down by sustained falling upstream prices – pv magazine International

Within the new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the principle value traits within the world PV trade.

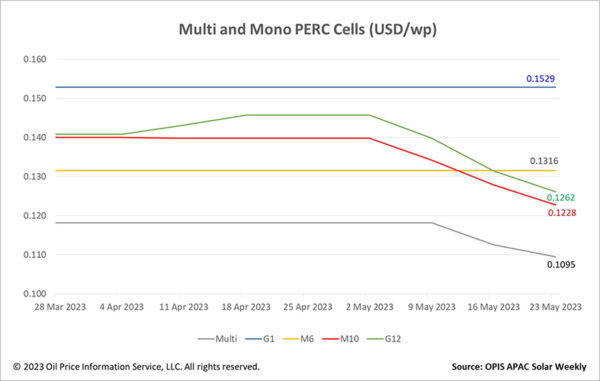

Cell costs fell for the third week in a row on account of continued declines in upstream costs. On Might 23, OPIS reviewed the principle market choices, Mono M10 cells at $0.1228 per W and Mono G12 cells at $0.1262/W. The costs of each cell sizes sustained a median of 4% lower week by week.

The costs of Mono G1 and M6 cells remained unchanged throughout the week at $0.1529/W and $0.1316/W respectively; only a few transactions round Mono G1 and M6 cells have been reported out there. Multi cell costs, nonetheless, fell 2.75% to $0.1095/W this week with a supply from a serious Multi cell producer explaining that costs are anticipated to drop additional on account of important value cuts in upstream supplies.

Though costs within the PV worth chain are presently falling, a market participant revealed that cell costs are anticipated to stabilize within the coming weeks because of the restricted enlargement of p-type manufacturing. cells. Regardless of this expectation, cell producers are nonetheless sustaining excessive working charges of their strains as a result of the stock within the cell section market remains to be at a manageable degree.

In response to a supply at a number one Tier-1 cell producer, they’ve shifted a big a part of their manufacturing strains from M10 cells to G12 cells because of the excessive demand of G12 cells which additionally resulted in a wider variation. in value between Mono G12 and M10 cells. The present 20-80 market share ratio between n-type TOPCon and p-type cells is predicted to degree at 50-50 by mid-2024, the supply defined additional.

Transferring ahead, cell value traits are anticipated to reflect stream costs, however with a small and gradual drop.

In the meantime, the market gamers beneath confirmed that the module costs remained unchanged this week regardless of the excessive value actions. Like its friends, a supply at a number one Tier-1 producer said that they won’t make any pricing bulletins till after SNEC, suggesting that offers have been made between trade gamers throughout the commerce. present “change value”.

OPIS, a Dow Jones firm, supplies vitality costs, information, information and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds in addition to renewable fuels and environmental commodities. It acquired pricing information belongings from the Singapore Photo voltaic Alternate in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].