BY BEN COOK

- Vitality Conservation Report introduces the financial savings corporations to the rise

- The businesses on our listing have just lately obtained important funding

- However will they fulfill their undoubted potential?

Which vitality storage corporations are set to make waves within the coming yr?

Right here, Vitality Conservation Report revealed ‘Ten Vitality Storage Firms to Watch In 2022’.

What units these corporations aside? To start with, what all these corporations have in widespread is that they’ve all just lately obtained important – given their respective sizes – funding quantities. In different phrases, these corporations do not simply discuss the discuss, additionally they have very dependable enterprise methods that persuade what are sometimes skeptical buyers to assist them with laborious cash.

The businesses on the listing range in measurement. Whereas one just lately raised almost $1 billion in an IPO, on the different finish of the dimensions, an organization just lately accomplished a funding spherical that took its whole funding to $20 million.

Nonetheless, regardless of the distinction in measurement, these ten corporations all share essential traits. Particularly, every of them is predicted to extend their profile within the coming yr as they make investments to extend their providing.

We predict we’ll be listening to much more about these corporations over the following 12 months as they increase their footprint within the ever-growing storage sector.

Right here is Vitality Storage Report’s ‘Ten Vitality Storage Firms to Watch In 2022’:

1. FLUENCE

Led by: Manuel Perez Dubuc

Backstory: The preliminary public providing closed in November after producing proceeds of almost $1 billion. Earlier than the IPO, in September 2021, the storage tech firm accomplished the most important vitality portfolio transaction in Europe when it agreed to a take care of ESB to supply methods for 308MWh of storage in Eire. Final month, it was introduced that Fluence will ship Taiwan’s first vitality storage system.

What to observe for: Fluence hopes that the IPO, amongst different targets, will allow it to beat provide chain uncertainty by creating mass manufacturing amenities world wide that facilitate the meeting of merchandise close to main market. Will US-headquartered Fluence reach creating the native organizational construction it wants?

2. ENERGY VAULT

Led by: Robert Piconi, co-founder and CEO

Backstory: It is a large yr for Vitality Vault, which is ready to listing on the New York Inventory Change within the first quarter of this yr. To facilitate the itemizing, Vitality Vault final yr merged with Novus Capital Company II, a particular function acquisition automobile (SPAC), in a deal that valued Vitality Vault at almost $1.6 billion.

What to observe for: US-headquartered Vitality Vault desires to make use of the proceeds from the itemizing to enter new territories equivalent to Australia, South Africa and South America. Will the itemizing give it the push it wants?

3. ESS

Led by: Eric Dresselhuys, CEO

Backstory: Lengthy-term vitality storage firm ESS went public in October after its mixture with particular function acquisition firm (SPAC) ACON S2 Acquisition Corp. The deal resulted in an injection of $308 million into ESS.

What to observe for: On the time of the itemizing, it was claimed that ESS’s iron stream batteries would grow to be the “gold commonplace within the trade” and that going public would allow the corporate to determine “market management”. Will ESS hit these targets?

4. HYDROTOR

Led by: Curtis VanWalleghem, CEO

Backstory: It was lifted off for Hydrostor this week with the announcement of a most popular fairness financing dedication of $250 million from Goldman Sachs. Hydrostor’s superior compressed air vitality storage makes use of air saved in a purpose-built cavern the place ‘hydrostatic compensation’ is used to keep up the system at a continuing stress throughout operation.

What to observe for: Goldman Sachs has, understandably, spoken to Hydrostor, saying the corporate is “effectively positioned to grow to be a number one participant” in utility-scale long-term vitality storage. Will the corporate fulfill this potential?

5. ENERGY FORM

Led by: Mateo Jaramillo, CEO

Backstory: In discharge mode, Type Vitality’s iron-air ‘reverse rusting’ system includes the battery taking oxygen from the air, changing the iron steel into rust. Then in charging mode, {an electrical} present is utilized, which adjustments the rust again to iron, releasing the oxygen again into the air. Buyers are satisfied the know-how is scalable – in August final yr, Type Vitality closed a $240 million Sequence D funding spherical.

What to observe for: Type Vitality says its battery offers vitality at a less expensive value than lithium-ion batteries, however skeptics recommend commercializing the battery might be difficult attributable to prices and manufacturing necessities. . Can Type Vitality show the doubters mistaken?

6. GOOD ENERGY GETTING

Led by: Jeff Bishop, co-founder and CEO

Backstory: That is all altering at Key Seize Vitality (KCE), which, simply 5 weeks in the past, closed a deal that noticed clear vitality firm SK E&S grow to be the bulk proprietor of KCE, an organization with 274 megawatts (MW) of standalone vitality storage initiatives in building and operation, and a improvement pipeline of three,000 MW.

What to observe for: SK E&S says it expects to take a position $1 billion in KCE – with this type of funding within the pipeline, how excessive can the corporate go?

7. OUR NEXT ENERGY

Led by: Mujeeb Ijaz, founder and CEO

Backstory: Michigan-based Our Subsequent Vitality (ONE) – based in 2020 – develops vitality storage merchandise which might be anticipated to extend the vary of electrical autos and due to this fact increase adoption. ONE’s know-how has attracted buyers and, in October final yr, the corporate secured $25 million in a Sequence A funding spherical supported by Meeting Ventures, Breakthrough Vitality Ventures, BMW i Ventures, Flex and Volta Vitality Applied sciences .

What to observe for: Investor Breakthrough Vitality Ventures mentioned ONE’s battery innovation “will ease client nervousness and make electrification extra engaging for vehicles and ships”. Drivers sitting on the fence will likely be watching ONE’s improvement with curiosity.

8. YOTTA ENERGY

Led by: Omeed Badkoobeh, CEO and co-founder

Backstory: Texas-headquartered Yotta Vitality has designed a ‘sensible passive thermal module’ that seamlessly integrates into the again of photovoltaic (PV) panels, which, it says, “will increase life and efficiency”. In a Sequence A funding spherical accomplished final November, Yotta raised $13 million – from WIND Ventures, Doral Vitality-Tech Ventures, Riverstone Ventures, EDP Ventures and SWAN Affect Community. The spherical brings the corporate’s whole funding to $20 million.

What to observe for: The corporate’s buyers declare that Yotta’s know-how, in comparison with rival merchandise, is a extra inexpensive solution to develop business and industrial photo voltaic and storage know-how world wide. They are saying will probably be “transformational”. Time will inform…

9. NORIKER POWER

Led by: Marc Thomas, managing director

Backstory: UK vitality storage developer Noriker Energy hit the headlines final month when it was introduced that Norwegian vitality firm Equinor had acquired a forty five p.c fairness stake within the firm. Noriker has developed a portfolio of 11 websites with a complete capability of greater than 250MW.

What to observe for: Equinor mentioned the tie-up might be used to reinforce the UK’s current renewables portfolio by deploying batteries in shut proximity to its onshore wind property to spice up returns. Will this plan work?

10. PLUS POWER

Led by: Brandon Keefe, basic supervisor

Backstory: Among the many highlights for Plus Energy final yr was securing $219 million in mission financing and credit score amenities for the 185MW Kapolei Vitality Storage (KES) mission in Hawaii. What makes it much more outstanding is the truth that the financing was introduced in the identical month that Engie deserted a mission to develop 240MW of vitality storage on the island, citing rising connection prices in addition to the worldwide chain. provide and manufacturing points.

What to observe for: Will Plus Energy succeed the place Engie failed and convey a serious vitality storage mission to fruition in Hawaii?

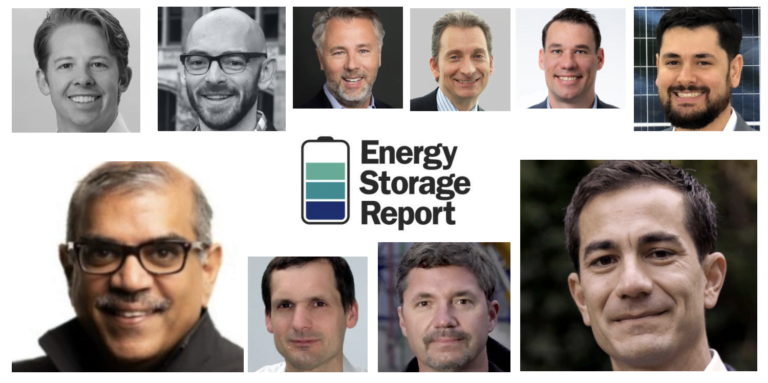

PICTURE (clockwise from the highest left): Brandon Keefe (Plus Energy); Jeff Bishop

(Vitality Extraction Key); Eric Dresselhuys (ESS); Manuel Perez Dubuc (Fluence); Curtis VanWalleghem (Hydrostorm); Omed Badkobeh (Yotta Vitality); Matthew Jaramillo (Type Vitality); Robert Piconi (Vitality Vault); Marc Thomas (Noriker Energy); Mujeeb Ijaz (Our Subsequent Vitality)