HodlX Visitor Put up Submit Your Put up

Though photo voltaic continues to drop in worth, it’s nonetheless not as distinguished as photo voltaic lovers and environmentalists would love, as a result of it’s intermittent, making it difficult to match the availability of photo voltaic vitality. of electrical energy demand.

As well as, photo voltaic panels require extra land than different types of vitality manufacturing. Due to this fact, it’s at the moment inconceivable to construct photo voltaic infrastructure close to inhabitants facilities with poor geography.

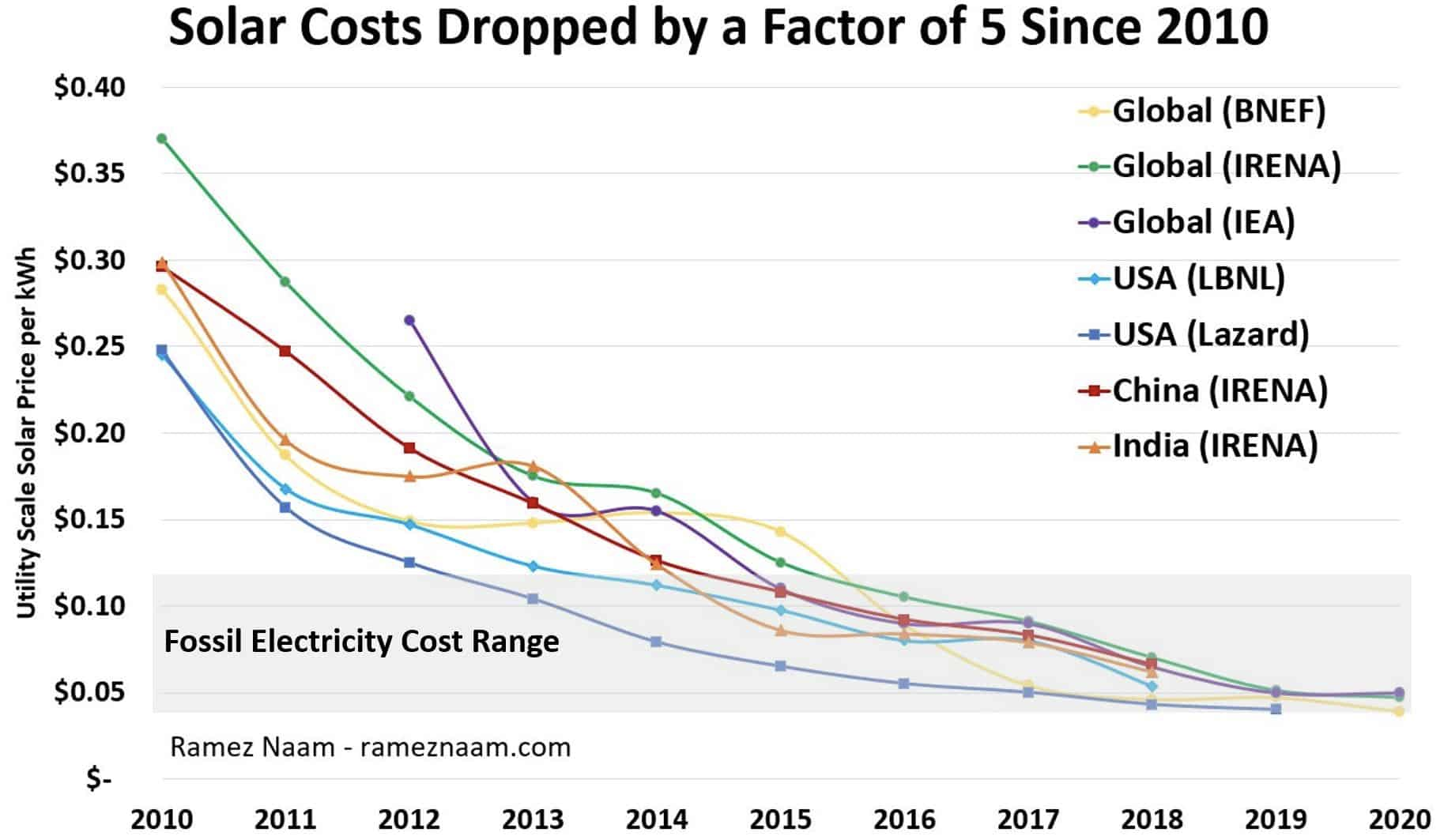

Lastly, whereas the price of photo voltaic has truly fallen by an element of 5 over the previous 10 years, it nonetheless requires a big preliminary funding. This places a monetary constraint on underdeveloped communities to begin utilizing photo voltaic vitality, even when it gives a return on funding in the long term.

Thankfully, revolutionary expertise has emerged in recent times that can drastically speed up the unfold of photo voltaic vitality. Bitcoin miners can work from wherever, flip off their machines at will and do not care which vitality supply powers their exercise. Miners function the proper purchaser of final resort for distributed vitality sources, serving as a buffer for distributed vitality sources.

Bitcoin mining will enhance the photo voltaic business

The Intergovernmental Panel on Local weather Change (IPCC) outlines the totally different vitality combine profiles that the world financial system should preserve with a view to stop international warming from exceeding the essential 1.5 levels Celsius or two levels Celsius.

A few of their proposed pathways require us so as to add wind and photo voltaic equal to 1.4% of world electrical energy provide every year, whereas extra aggressive pathways require photo voltaic equal to a few % of world electrical energy. electrical energy provide yearly.

Jessica Jewell, affiliate professor of Power Transitions at Chalmers College of Know-how, not too long ago calculated that the IPCC’s beneficial paths to a renewable future are solely possible for some international locations. With out a paradigm shift in expertise, it appears unlikely that the IPCC objectives can be met.

Though Bitcoin miners do not care which vitality supply they use, they do care about the price of every candidate vitality supply. Since the price of photo voltaic is usually an preliminary funding, photo voltaic panels are an efficient manner for Bitcoin miners to run their machines for a very long time.

As reported within the Bitcoin Clear Power Initiative whitepaper, the unsubsidized price of photo voltaic vitality is between three and 4 cents per kilowatt-hour. about 2.5 cents per kilowatt-hour cheaper than coal or pure gasoline. For vitality source-agnostic miners, photo voltaic vitality is a simple selection.

Bitcoin miners can clear up the vexing photo voltaic intermittency downside in at the least two methods. One, they’ll agree on a contract to solely devour electrical energy that isn’t requested by others, assuring the inhabitants that miners is not going to compete with locals for electrical energy when the photo voltaic provide is low. And two, miners can supply the grid their extra vitality throughout surprising spikes in demand, akin to throughout excessive climate occasions.

Ark Make investments, an American funding administration firm, calculates that photo voltaic can solely present 40% of the grid energy with out rising the value of electrical energy because of the intermittency of photo voltaic.

The mixing of Photo voltaic with Bitcoin mining, nonetheless, permits vitality suppliers to not solely revenue from the distinction between the value of electrical energy and the value of Bitcoin but additionally permits vitality suppliers to proceed to fulfill the calls for of the grid with out lowering income.

Past idea

The union of photo voltaic vitality and Bitcoin mining shouldn’t be an idealistic hypothetical. Regardless of the present bear market, a younger Bitcoin mining firm has begun mining Bitcoin at a solar-powered location in Colorado.

The corporate selected to go for solar energy at a time when many Bitcoin miners have been washed out of the market resulting from rising vitality costs and declining revenues (ie, the sharp drop in Bitcoin costs).

Given the cost-effectiveness of utilizing photo voltaic (see primary within the picture under), the migration of Bitcoin mining to renewable vitality sources isn’t a surprise.

Image one

The Bitcoin mining firm is planning to construct extra Bitcoin mining operations that can use solar energy. Its second and third amenities will run 87-megawatt photo voltaic farms and 200-megawatt photo voltaic farms, respectively.

In Texas, three main corporations are collaborating to construct a Bitcoin mining facility powered by photo voltaic and battery storage expertise. In response to the CEO of one in every of these corporations, this mission will function a proof of idea for utterly clear Bitcoin mining at scale.

As a result of Bitcoin miners can work from wherever, they’ll subsidize renewable vitality initiatives constructed removed from inhabitants facilities. As talked about earlier, one of many points within the photo voltaic business is that it isn’t low cost to develop in busy geographical places as a result of it requires a variety of land.

Bitcoin miners are more than pleased to position themselves in distant places subsequent to photo voltaic infrastructure and canopy the associated fee borne by photo voltaic suppliers of sending their vitality to distant vitality customers. Bitcoin mining can truly deliver to life distant, renewable vitality that in any other case may not be viable.

Kent Halliburton is the president and COO of Sazmining, the world’s first Bitcoin mining platform created to attach particular person retail miners with carbon impartial/destructive Bitcoin mining amenities. Kent is a enterprise operator with deep experience in Bitcoin mining and photo voltaic vitality. Beforehand, he led advertising and enterprise improvement for a publicly traded photo voltaic vitality firm, managing a group of greater than 100 folks with nine-figure gross sales targets.

Observe Us on Twitter Fb Telegram

Disclaimer: The opinions expressed in The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses chances are you’ll incur are your duty. Day by day Hodl doesn’t advocate shopping for or promoting any cryptocurrencies or digital property, neither is Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia