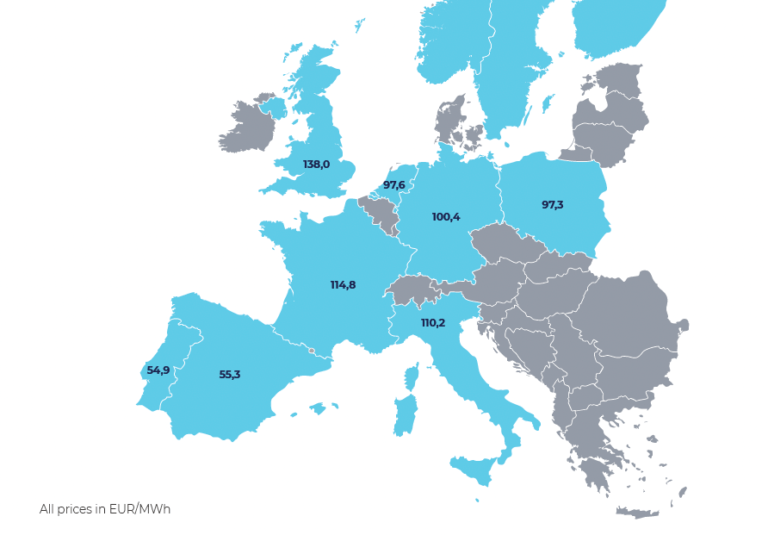

European costs for energy buy agreements rose in lots of nations in November, with the Polish index recording an increase of 19.4%. Portugal registered a rise of 15.5%, adopted by Spain at 15.7%. Germany was the one nation to report a month-to-month decline, with costs falling by 0.8%.

Locations known as Pexapark in Switzerland stated in a latest report on European PPAs that renewables “are absolutely the winners in 2022 and the years to come back in an setting of disaster and difficulties.”

The builders introduced 16 PPAs with a complete capability of 1,881 MW in November. That corresponds to 24% extra capability than in October, making November the month with the best variety of signed offers in 2022, by way of megawatts.

The rise in capability is partly because of two contracts signed by Microsoft in Eire (900 MW), representing virtually half of the whole month-to-month quantity. There was additionally exercise in Germany, as EnBW signed two new PPAs for 900 MW offshore wind farms. The composite worth index for renewable PPAs elevated by 7.4% month on month.

The Polish index recorded probably the most outstanding enhance, at 19.4%. Portugal registered a rise of 15.5%, adopted by Spain at 15.7%, as a result of enhance in futures costs. Germany was the one nation to register a decline, with costs sliding by 0.8% month on month, as a result of fall in home futures costs.

“Nevertheless, regulatory uncertainty is rising as EU member states start to make use of the much-discussed EU revenue tax on the nationwide degree,” Pexapark stated.

Final November, the European Union authorized new provisions to intervene within the electrical energy market and launched a cap on renewables of €180/MWh. Nevertheless, the proposed nationwide revenue cap insurance policies differ. The length of many nationwide insurance policies is longer than that seen within the EU regulation, and can solely apply till June 30, 2023.

Some member states have drafted complicated rules that don’t calculate precise revenue, however concentrate on a generic market worth. This strategy is detrimental to present PPAs, because it exposes producers to the chance of being taxed on revenue they didn’t earn.

Relying on the ultimate rules, the short-term PPA market could also be negatively affected, with lowered liquidity within the futures market. Regulatory uncertainty can even complicate cross-border PPA pricing.

“Regulatory interventions make sense for customers, however we should keep in mind that interventions deliver the next threat notion from the investor’s perspective, which interprets into greater expectations in return, greater prices, and, lastly, a slower vitality transition,” stated. Pexapark.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.