A superb 12 months for the inverter market: sturdy demand that’s restricted solely by provide chain limitations, however the brand new inverters usually are not very new and present a sluggish evolution of enhancements. Nonetheless, many extra choices have emerged in response to the vitality disaster.

The frenzy of competitors and innovation all through the last decade of the photo voltaic growth has additional perfected the job of turning DC energy into AC. In 2022, course of enhancements and refinements can be more durable to win. And whereas the growth instances are over, the inverter {industry} continues to develop.

But 2022 will not be a narrative of fast instances regardless of demand. Provide chains are nonetheless failing to maintain up, with most inverter producers unable to chop lead instances anyplace near pre-pandemic timeframes. Issues are mentioned to enhance by 2023, however choke factors stay for key parts together with insulated-gate bipolar transistors (IGBTs) and superior chips. And that story leads us to establish a few of the larger tendencies all year long in inverters.

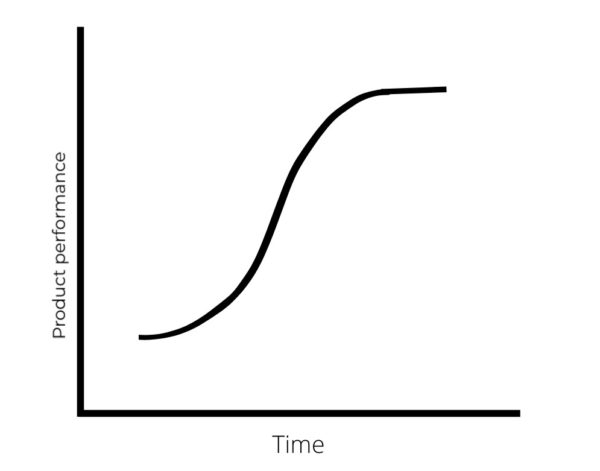

S-curve stalls

PV inverters face a typical late-cycle of a know-how or innovation S-curve, the place the present applied sciences are mature, the speedy improvement of DC-AC inverter know-how has been made, and new earnings are more durable to return by.

On the reverse finish of this typical S-curve is the hydrogen market, which has seen speedy improvement in know-how and merchandise, with new earnings that may be simply achieved via scale and funding.

Nonetheless, PV inverters could also be a approach to attain the tipping level of diminishing returns, because of an energetic change available in the market. For instance, on the residential and industrial degree, many areas have adopted hybrid inverters as default to accommodate battery storage. Different examples embrace accommodating EV charging and, in some unspecified time in the future, vehicle-to-grid options, in addition to digital energy plant capabilities, clever controls and connectivity, amongst others. Nonetheless, the core of DC-AC conversion is mature.

All this may be seen in smaller adjustments in merchandise: new and higher inverters come to the market of all types from a thriving {industry}, however the advertising and marketing departments are pressured to work higher to elucidate advantages aside from uncooked effectivity.

Elsewhere, the high-power string inverters seen all through 2020 and 2021 haven’t been eclipsed in 2022 by greater energy choices, maybe as weight and measurement limits are reached. And, taking a look at new applied sciences, silicon carbide semiconductor PV inverters proceed to point out many alternatives for the {industry}, however electrical automobiles management demand, prices stay excessive, and IGBT- Photo voltaic powered inverter topologies stay the dominant sort.

Manufacturing progress

Inverter manufacturing has elevated considerably in 2022, regardless of the broad financial downturn and harder circumstances for companies. Enphase has dedicated to including 4 to 6 new manufacturing strains, amounting to 4.8 GW to 7.2 GW of photo voltaic microinverter manufacturing capability in the USA, supplied it will probably safe funding via the manufacturing tax credit score ( PTC) system that’s a part of the Inflation Discount Act (IRA).

Fronius additionally introduced this 12 months that it’ll make investments €230 million ($244 million) to broaden manufacturing by 2023, with Martin Hackl, International Director Advertising and marketing and Gross sales of the Photo voltaic Power enterprise unit of Fronius Worldwide, saying , “photovoltaics are in higher demand than ever earlier than and demand is exploding consequently.”

Central inverters

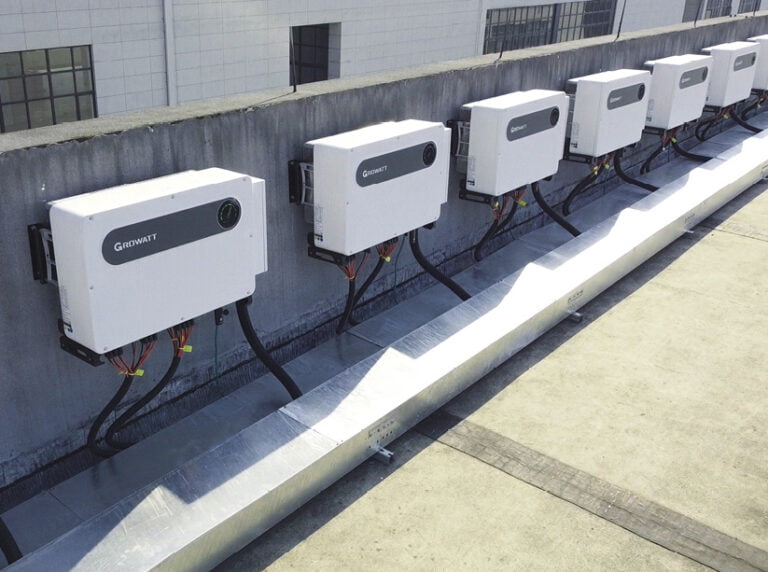

The central inverter market will blossom once more in 2022 with many firms reinvigorating the market. Sungrow launched a brand new “1 + X” modular central inverter resolution to the market, and Gamesa Electrical received awards after the launch of its Proteus PV central inverter.

Sungrow’s choice provides modularity in 1.1 MW increments as much as 8.8 MW to satisfy the calls for of mission builders whereas promising a better vitality yield, whereas Gamesa went for industry-leading effectivity from its Spanish-made inverter, with choices as much as 4,700 kVA in a compact. design.

New collection of string inverters launched all year long, however on a utility scale, central inverters are a few of the extra fascinating merchandise which have entered the market.

Off-grid grows

2022 may also see inverter producers turning niches into extra market alternatives: many off-grid inverters will seem in the marketplace this 12 months, and lots of inverters can be licensed to handle on- and off-grid operation, including some variations to grid-tie-only options. . Apparently, producers that introduced their options to Europe and the US beforehand established markets in areas reminiscent of Pakistan, the Philippines, and South Africa, the place energy outages are extra frequent. In response to the vitality market disaster and the local weather disaster, data from much less steady grid areas has develop into more and more helpful.

Rule of thumb

As inverters attain technical maturity and mission and residential homeowners search much less upkeep and longer life, 2022 will see some helpful research emerge as a information to the lifetime of plant A examine by the Bern College of Utilized Sciences confirmed that the efficiency of most PV inverters and energy optimizers stays optimum for as much as 15 years, nonetheless the present {industry} norm, after evaluating inverter failure surveys. from 1,280 PV methods with 2,151 inverters, the search is sweet. -build fears of inverters left to trigger sooner getting older.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].