Africa-focused solar fund raises $92.7 million – pv magazine International

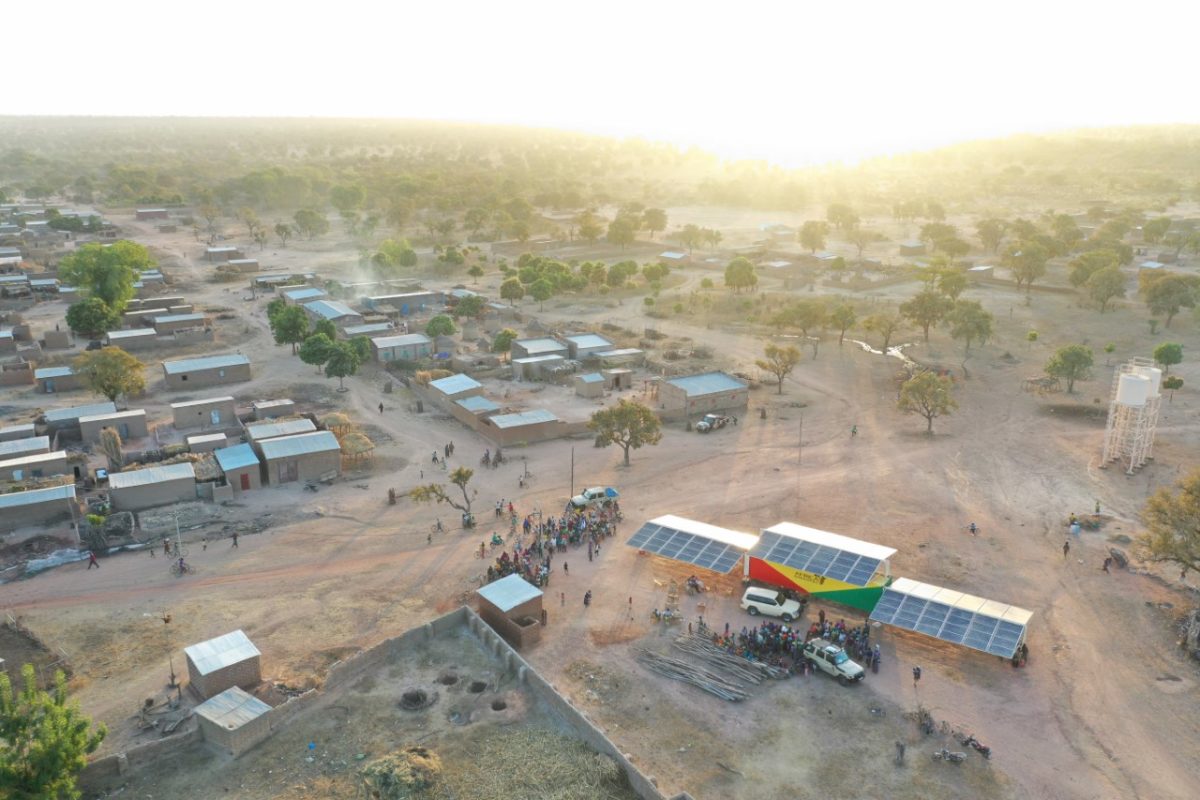

Rgreen Make investments and Echosys Make investments raised €87.5 million ($92.7 million) via the Afrigreen Debt Influence Fund. They stated they are going to use the cash to finance on-grid and off-grid photo voltaic tasks for small and medium-sized business and industrial clients in Africa.

French funding agency Rgreen Make investments and funding advisor Echosys Make investments have introduced the primary shut of their new Afrigreen Debt Influence Fund. The 2 corporations raised €87.5 million, from an preliminary goal of €100 million. The funds will finance on-grid and off-grid photo voltaic vegetation for small and medium-sized business and industrial clients in Africa.

The primary closing features a dedication from the European Funding Financial institution (EIB), Worldwide Finance Corp. (IFC), the Finland-IFC Blended Finance for the Local weather Program, the Belgian Funding Firm for Growing International locations (BIO), and Proparco. Societe Generale and BNP Paribas additionally participated within the first spherical of funding.

“Africa boasts 39% of the world’s whole renewable potential, and but funding in renewable power has lagged, as a consequence of a set of things together with the shortage of applicable monetary devices , which notably impacts essentially the most dynamic market phase, business and industrial photo voltaic customers,” stated Olivier Leruste, the president of Echosys Make investments, which is the three way partnership that manages the funding technique of the Afrigreen Debt Influence Fund.

BloombergNEF stories that international investments in renewable power will improve by 9% yearly till the height interval in 2021. Nonetheless, investments fall by 35% in Africa, which represents solely 0.6% of all international renewable power investments . Afrigreen stated it goals to bridge this funding hole via direct lending and asset-based debt amenities for regional and worldwide builders and business and industrial corporations in Africa.

“Representing 90% of all companies, small and medium-sized companies, and industries are a phase struggling to draw financing,” stated Rgreen Make investments CEO Nicolas Rochon. “We goal a various portfolio consisting of 20 to 30 investments, which intervene to satisfy long-term debt financing wants hovering between €10 million and €15 million, with a mean ticket of round €5 million in eight to 10 years.”

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].