gorodenkoff/iStock through Getty Pictures

Funding Thesis

Array Applied sciences, Inc. (NASDAQ: ARRY) manufactures and provides photo voltaic monitoring methods and associated merchandise in the US and internationally. The inventory has been on an upward trajectory this 12 months, outperforming the market with a margin of about 50% YTD.

Searching for Alpha

At present, the inventory is buying and selling at $20.95, close to the 52-week excessive of $23.61. I attribute the excellent efficiency to the rising demand for inexperienced power within the US and the world. The affect of renewable power is rising on account of technical advances. Because the world’s power demand continues to rise, increasingly international locations are growing new strategies of manufacturing and storing renewable power.

The US authorities helps its inexperienced power sector. Among the many issues the federal government has accomplished is Biden’s tariff moratorium and the inflation discount act of 2022. Each laws straight have an effect on the inexperienced power sector positively. These laws and the rising demand for inexperienced power help my sturdy ARRY case.

Array

Supply: Array

The regulatory setting

There’s long-standing dissatisfaction with authorities regulation from many corners of the financial world. Firms and their representatives usually criticize authorities laws as unreasonable obstacles to financial development, productiveness, and job creation. Many companies have used loopholes, moved operations abroad, and violated antitrust guidelines to keep away from laws. In essence, the rising variety of legal guidelines and the complexity of the tax system positively and negatively have an effect on American firms. Due to this fact, the federal government’s relationship with companies can have two types: cooperative and antagonistic. Due to this, I’m excited by predicting the place the newest authorities regulation could lead American companies, particularly ARRY.

1. Biden’s Tariff Moratorium

In response to issues raised by the American photo voltaic trade, the Biden administration has introduced its intention to loosen restrictions on photo voltaic panel imports from Southeast Asia. America authorities introduced a 24-month tariff moratorium on photo voltaic panels manufactured in Cambodia, Malaysia, Thailand, and Vietnam on June 6. The suspension was in response to complaints from the US photo voltaic trade in regards to the penalties. in a Division of Commerce (‘ DOC’) inquiry into whether or not photo voltaic panels imported from these international locations originating in China could be topic to a 250% retroactive tariff. The moratorium exempts US companies from retroactive taxation. The federal government additionally acknowledged its intention to extend home manufacturing of photo voltaic power elements and scale back dependence on imported photo voltaic panels by means of using the Protection Manufacturing Act.

About 80% of the crystalline-silicon modules used within the US photo voltaic enterprise come from Southeast Asia; due to this fact, the DOC inquiry disrupted their provide chain. As deliberate, the DOC inquiry had unintended implications that hampered the flexibility of US photo voltaic firms to develop new initiatives. Consequently, the photo voltaic trade is reporting a excessive fee of delays and cancellations of latest photo voltaic installations scheduled for 2021 and 2022. The tariff moratorium comes because the Biden administration -progress in the direction of a 2024 aim of tripling home photo voltaic manufacturing capability. Since President Biden took workplace, home photo voltaic technology capability has grown by 15 gigawatts. This output will quantity to 22.5 gigawatts on the finish of his first time period, sufficient to energy greater than 3.3 million houses per 12 months. It additional reveals how the US authorities is dedicated to supporting the nation’s photo voltaic sector.

The plain query to ask any potential investor is, apart from the results of this regulation on the trade, how will ARRY profit as an organization? To reply them, I referred them to the corporate’s Q2 2022 name transcript, the place the corporate’s CEO stated that Biden’s government order welcomed aid and a window of certainty for his or her prospects. He added that they’ve set begin dates for a number of of the $240 million initiatives they beforehand flagged as in danger of their first quarter name, and consequently, they now count on these initiatives to maneuver ahead. . The help of the US authorities in line with this sector is nice and traders ought to count on nothing wanting a growth for this firm and the trade in my opinion.

2. Inflation Discount Act of 2022 on Renewable Power Tax Credit

President Biden accepted the Inflation Discount Act of 2022 (‘ACT’) on August 16, 2022. Well being care, enterprise taxation, power coverage, and authorized points are coated by the Act. A brand new base credit score quantity will likely be out there below the Act’s revised tax credit score program for choose renewable power initiatives that enter service after December 31, 2021. Photo voltaic will likely be qualify for a PTC base credit score stage of 0.3 cents per kWh (adjusted for inflation). A brand new 6% ITC base credit score will likely be out there for photo voltaic power, gas cell, waste power restoration properties, power storage expertise, eligible biogas properties, and microgrid controllers constructed earlier than December 31, 2024. The Act, in its entirety, favors the inexperienced power trade, and the photo voltaic trade performs an essential position so far as advantages are involved. The advantages that ARRY will get from this Act are of nice curiosity to me and the traders on this article. Talking on the corporate’s Q2 2022 transcript name, the corporate defined the advantages of the inflation act in 2022.

Kevin Hostets,”Whereas the small print of many of the provisions nonetheless must be clarified, what is evident is that this laws will present long-term assurance of incentives for deployment and manufacturing associated to photo voltaic power.

The CEO additional supplied particulars of their preliminary evaluation of the Act. In accordance with him, their preliminary evaluation of the influence on their firm is as follows;

To start with, this can be a vital improvement for the photo voltaic trade. Preliminary estimates recommend that the growth of the funding tax credit score would add 40% extra installations between 2023 and 2027. These installations would add 46 gigawatts of photo voltaic over 5 years.

Second, companies that produce within the US profit from a ten% home content material adder. Whatever the direct beneficiary, these credit assist the trade. In perspective, the present credit of $0.87 per kilogram of torque tube and $2.28 per kilogram of fasteners translate into $0.015-$0.017 per kilowatt, which may be very vital in earnings.

Benefiting from the sturdy demand for photo voltaic power

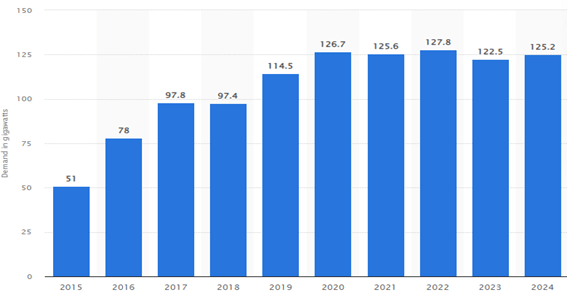

Earlier than 2005, about 5 GW of photo voltaic PV was put in worldwide, with solely about 0.5 GW in the US. By 2020, international photo voltaic PV will attain 710 GW, a rise of 900% in 10 years. Photo voltaic PV grew 1,300% within the US in 10 years to 73.8 GW. As solar energy features in reputation, consultants predict that the trade will broaden by 20.5% between 2019 and 2026. Knowledge from Statista reveals that the demand for photo voltaic power has been rising yearly since 2015, as proven beneath. .

statesman

Trying on the firm’s Q2 of 2022, the corporate is profiting from this rising demand, and I’m satisfied that the corporate will likely be higher within the quick and long run. Within the transcript name, they reported that their year-over-year development and $1.9 billion order guide displays sturdy demand for his or her services and products. Primarily based on the present distribution of demand throughout their order guide, they estimate deliveries of $600 million to $800 million for the remainder of this 12 months. These numbers imply they’re sure of $1.0 to $1.2 billion in 2023 income even earlier than the 12 months begins. The potential influence of the Inflation Discount Act will likely be a constructive addition to this good begin. Given these numbers, I can virtually assure that traders will see sturdy quarters within the coming years. To additional help my proposition, In 2026, the worldwide renewable energy capability is predicted to broaden by 60% from 2020 to greater than 4,800 GW, equal to fossil fuels and nuclear mixed. Photo voltaic PV will present greater than half of worldwide electrical energy capability growth by means of 2026.

Conclusion

Two important items of laws handed by the US authorities are positive methods to extend the corporate’s success in my opinion. The federal government not solely offers help towards extreme challenges that decelerate development but additionally affords incentives when it comes to tax credit and mitigating the results of inflation. The present demand for renewable power, particularly photo voltaic, ensures a worthwhile future for the corporate and a gentle development fee. The corporate’s share value ought to proceed to rise, and its income and earnings are more likely to develop considerably, because of its promising future and the supportive legislative local weather. For these causes, I fee the corporate a powerful purchase.