JinkoSolar JKS is without doubt one of the largest photo voltaic panel producers on the planet and it stands to learn from the huge enlargement of renewable and different vitality within the US and past. The photo voltaic large’s earnings outlook for subsequent 12 months has risen since its Q3 launch in late October.

JinkoSolar inventory is buying and selling nicely off its highs and its valuation stage is extraordinarily engaging for a corporation targeted on development in a probably game-changing trade. Moreover, JKS inventory rose above a key transferring common on Wednesday.

JinkoSolar Fundamentals

JinkoSolar manufactures several types of photo voltaic panels geared toward completely different facets of the market. The corporate sells its gives to residential clients for his or her roofs, in addition to high-performance techniques for native industrial and industrial vitality manufacturing. JKS additionally sells its photovoltaic (PV) panels to bigger vitality and energy producers.

JinkoSolar boasts that a couple of million houses worldwide are outfitted with JinkoSolar PV panels. JKS has benefited from an inside push from the Chinese language authorities to spice up photo voltaic panel manufacturing within the nation.

JinkoSolar’s vertically built-in manufacturing course of helps it decrease the price of manufacturing complicated, high-tech PV panels. JinkoSolar operates from 14 world manufacturing bases in China, the US, Malaysia, and Vietnam. China’s export manufacturing is essential as tensions rise between the US and the world’s second-largest financial system.

Picture Supply: Zacks Funding Analysis

The Photo voltaic Enlargement and Top

The close by chart reveals JinkoSolar’s spectacular income development. However all this enlargement is new. Actually, photo voltaic panels and photo voltaic vitality did not achieve any actual traction till the mid-2010s.

Photo voltaic is now an enormous trade fueled by a mixture of authorities forces and incentives, in addition to private and non-private funding. The enlargement of wind and photo voltaic has helped renewables develop their share of the US electrical energy combine from 10% in 2010—when it got here largely from hydroelectric—to twenty% final 12 months.

Total, photo voltaic accounts for roughly 3% of complete US electrical energy technology. At the moment, renewables solely make up about 12% of complete US vitality consumption, with photo voltaic making up solely 12% of that slice of the pie.

The mix of speedy development and huge scale is what makes the photo voltaic vitality trade so fascinating. The US Vitality Data Administration initiatives that renewables will double their share of the US electrical energy technology combine by 2050, with photo voltaic making up a big chunk of the positive factors. And different vitality now accounts for 75% of the expansion in complete world vitality funding.

Picture Supply: Zacks Funding Analysis

Development Outlook

The Chinese language photo voltaic agency’s world module cargo doubled year-on-year in Q3. The corporate has additionally efficiently improved its manufacturing effectivity and the operating of our extra environment friendly panels, each of that are important to the trade’s long-term development.

JinkoSolar’s profitability improved sequentially in Q3, with its gross margin up 100 foundation factors to fifteen.7%. Analysts are racing to boost their FY23 estimates after the discharge of Q3, which isn’t a straightforward activity amid the present financial surroundings.

Zacks estimates that its income will rise 84% in 2022 from $6.34 billion to $11.65 billion (on high of final 12 months’s 19% development). The corporate then plans to develop its gross sales by one other 40% in FY23 to $16.34 billion—a $10 billion enlargement in simply two years.

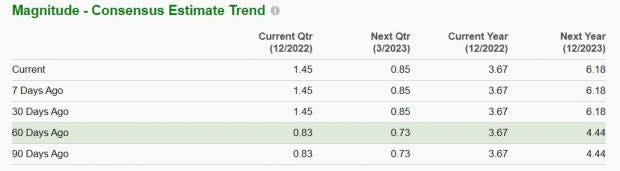

JinkoSolar’s adjusted earnings are anticipated to rise 116% in FY22 to hit $3.67 per share after which rise 68% larger in FY23. Moreover, the consensus EPS estimate for 2023 has jumped 39% since its launch to assist it earn a Zacks Rank #1 (Sturdy Purchase) right this moment.

Efficiency and Pricing

JinkoSolar inventory has risen 105% over the previous 5 years to lag its trade, with JKS up 175% over the previous three years in comparison with a 160% rise within the Zacks Photo voltaic trade. Lately, JKS managed to leap 10% in 2022.

Regardless of exhibiting up in 2022, JinkoSolar’s inventory has fallen for the reason that summer season to commerce almost 33% under its excessive. This pullback units up a pleasant entry level. Moreover, the present worth goal gives an almost 30% upside to Wednesday’s closing worth. And the inventory jumped above its 50-day transferring common on Wednesday after it rose in common hours.

JinkoSolar is buying and selling at simply 7.7X trailing 12-month earnings in comparison with 44.1X the Zacks Photo voltaic trade common. This group of corporations contains different standouts comparable to First Photo voltaic FSLR and Sunrun RUN.

First Photo voltaic and Sunrun are a part of the photo voltaic PV house. First Photo voltaic trades at 37.1X ahead earnings, whereas Sunrun trades at over 60X. These examples assist spotlight how a lot worth JinkoSolar gives buyers. JinkoSolar additionally trades under the S&P 500’s 17.5X, in addition to a 40% low cost to its personal five-year median.

Picture Supply: Zacks Funding Analysis

Backside Line

Traders ought to be conscious that the US authorities and the Biden administration are attempting to curb imports of Chinese language photo voltaic panels whereas the nation is making an attempt to spice up its personal manufacturing, which is microscopic as compared. As such, JinkoSolar now manufactures panels in varied components of the world and sells them in China, Europe, and past. And the US merely wants the panels because it tries to satisfy its self-imposed emissions targets.

JinkoSolar’s development outlook is clearly spectacular because the photo voltaic trade positive factors momentum within the US, China, Europe, and past. Photo voltaic accounts for under a small portion of US electrical energy technology right this moment, however its function is predicted to extend within the coming a long time.

Traders might need to contemplate rising publicity to at the very least a couple of photo voltaic shares. JinkoSolar gives buyers the possibility to do exactly that by means of its ADR shares which are buying and selling at an enormous low cost to their peak. As well as, JKS presently presents a wonderful mixture of near-term and long-term development, coupled with spectacular worth.

As a be aware, I personal JinkoSolar inventory as a part of Zacks new buying and selling service – Different Vitality Innovators.

Need the most recent suggestions from Zacks Funding Analysis? Now, you’ll be able to obtain the 7 Greatest Shares for the Subsequent 30 Days. Click on to get this free report

JinkoSolar Holding Firm Restricted (JKS) : Free Inventory Evaluation Report

First Photo voltaic, Inc. (FSLR): Free Inventory Evaluation Report

Sunrun Inc. (RUN): Free Inventory Evaluation Report

To learn this Zacks.com article click on right here.

Zacks Funding Analysis