CATL’s new lithium pricing construction provides Chinese language unique tools producers (OEMs) an efficient low cost of greater than 20%. It made the transfer to win extra orders amid a slowdown within the electric-vehicle market and ongoing efforts by cell makers to safe uncooked supplies.

CATL has reportedly provided steep reductions on battery purchases to its strategic shoppers, together with main Chinese language automotive producers equivalent to NIO, Li Auto, Huawei, and ZEEKR. The Chinese language battery manufacturing facility, which can produce 37% of the world’s electrical automobile batteries by 2022, is not going to supply such reductions to its greatest buyer, Tesla, which operates a gigafactory in Shanghai.

Based mostly on the proposal, which has but to be confirmed, OEMs will have the ability to produce 50% of the batteries of their CATL contracts with battery grade lithium carbonate, at a value of CNY 200,000 ($28.82) per metric ton, if they comply with supply 80% of battery wants from CATL within the first three years. The remaining 50% of the batteries might be bought at market costs.

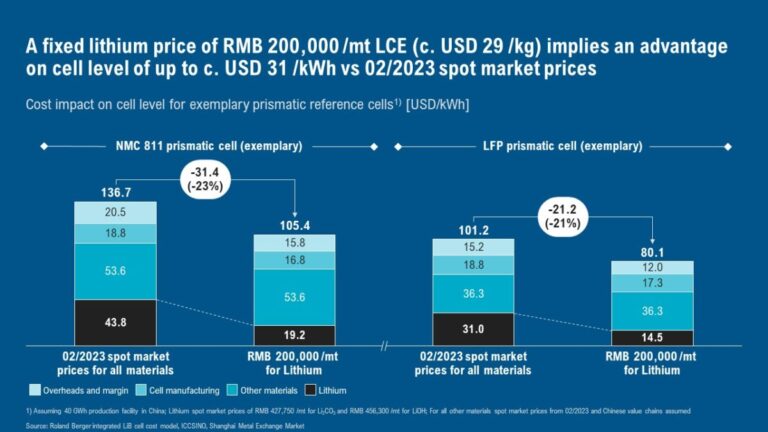

“Contemplating a decrease manufacturing scrap worth and decrease markups based mostly on mounted proportion values, we attain $31.4/kWh. For LFP cells, the respective figures are the $16.5/kWh and $21.2/kWh,” mentioned Wolfgang Bernhart, accomplice on the Munich-based consultancy Roland Berger. “This represents a possible price benefit of greater than 20% in comparison with market costs .”

CATL is ready to supply such costs as a result of it has acquired massive quantities of lithium by means of direct funding. The listing contains CATL’s personal mining subsidy, Guizhou Shidai Mining, an 8.5% stake in Australia’s Pilbara Minerals, and a 24% stake in AVZ Minerals within the Democratic Republic of Congo. It additionally contains the acquisition of Sinuowei and the joint growth of the world’s largest lithium reserves – the Uyuni and Oruro salt flats in Bolivia – with China Molybdenum (CMOC).

“As soon as once more it turned clear,” Bernhart mentioned. “Battery cell producers’ competitiveness might be selected the taking part in discipline of entry to uncooked materials.”

Worth struggle

Cell producers are more and more specializing in securing uncooked supplies by means of both long-term agreements or direct funding. Many of the at present noticed LTAs supply value benefits of 5% to 25% in comparison with spot market costs. Costs are reviewed quarterly based mostly on an agreed components, but additionally some contracts with mounted lithium costs will be noticed, in accordance with Roland Berger.

As well as, the most important cell producers started to vertically combine into mining and refining initiatives by means of direct funding, which gave them the chance to acquire materials on a value foundation.

Whereas some business analysts see CATL’s transfer as an business response to the US Inflation Discount Act, others say the battery maker is just passing on the advantages of longer-term contracts. of lithium offtake. Both approach, it should seemingly assist CATL retain a few of its key prospects in China as electrical automobile gross sales and market sentiment for battery supplies and EVs flip bearish.

Bearish view on lithium

Norwegian-based consultancy Rystad Vitality says this proposed lithium low cost pricing mechanism displays an oversupply in China’s battery markets, with home cell manufacturing hitting a 60% minimize. over 2022. It mentioned the home Chinese language battery-grade lithium carbonate value was CNY 486,000/MT in January 2023, down 18% from the document excessive of CNY 593,000/MT in November 2022. Nevertheless , the present value is greater than 40% greater than the identical interval final 12 months.

It’s estimated that lithium carbonate costs in China will drop by 40% within the fourth quarter from present ranges. Rystad Vitality’s battery cell price mannequin exhibits that if the situations for the costs of different supplies stay unchanged, and the worth of lithium carbonate battery grade decreases to CNY 200,000/MT, then the price of the battery cell decreases by 22.6% and 24.1% for LFP and NMC523 cells. every one.

“It’s seemingly that CATL’s proposal will trigger different Chinese language cell producers to take comparable actions to safe present shoppers,” mentioned Susan Zou, vp of Rystad Vitality.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.