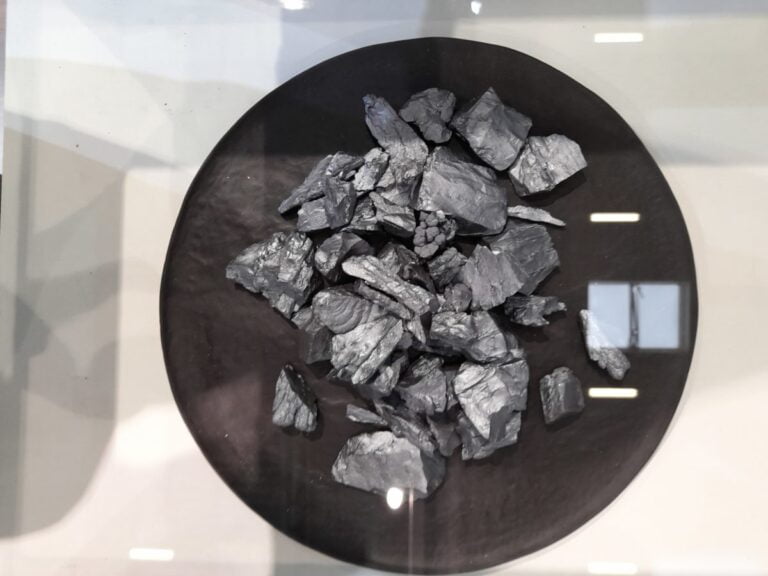

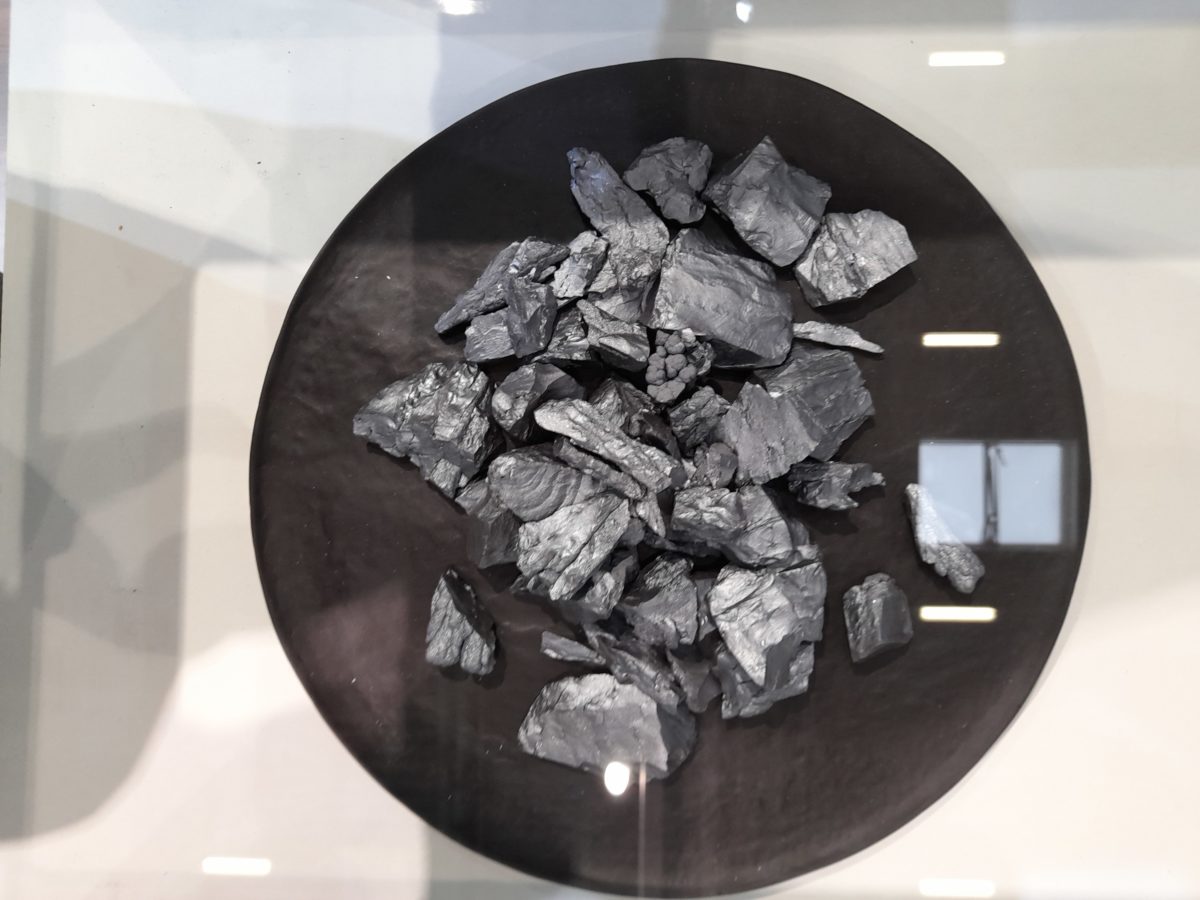

Demand for polysilicon has elevated in current months.

Picture: pv journal

The CSRC authorizes the buying and selling of business silicon futures on the Guangzhou Futures Alternate. It mentioned it goals to develop pricing mechanism for industrial silicon, and claims that the transfer will enhance the danger administration capabilities of varied market entities.

Johannes Bernreuter, an analyst of polysilicon, mentioned that the introduction of future industrial silicon is a response to the rise in costs of silicon metallic within the third quarter of 2021.

“Maybe, it will give polysilicon producers an opportunity to counter the fluctuating value of silicon metallic,” Bernreuter mentioned. pv journal.

Nonetheless, he famous that polysilicon costs have stabilized at excessive ranges.

“That is simply the standard seasonal drop on the finish of the 12 months,” he mentioned. “With predictions of a sharper decline, we stay cautious for the primary half of 2023.”

In late November, PV InfoLink mentioned polysilicon costs are in an “distinctive downward” development, after months of excessive costs. It mentioned it expects costs to drop from late November to early December.

“Dangerous stock will proceed within the polysilicon sector till the top of the month,” mentioned the consulting agency, noting that it expects to see the primary decline in polysilicon stock in two years.

Final October, PV InfoLink predicted that costs would fall from round CNY 300 ($41.85)/kg, excluding VAT, and right down to as little as CNY 150/kg by the top of 2023.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.