China polysilicon price fall decelerates as it reaches ground-floor – pv magazine International

In a brand new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the primary value tendencies within the international PV business.

The World Polysilicon Marker, the OPIS benchmark evaluation for polysilicon produced exterior of China, continued to carry regular at $30 per kg for the fourth week working. The basics of this market, characterised by restricted availability and few offers in place, are nonetheless in place.

Polysilicon costs range extensively amongst completely different international producers; one producer claims to have mentioned costs of barely greater than $25/kg together with his clients, however no agreements have been reached on this value but. One other international supplier continues to be giving a value within the $35–36/kg space for the time being. A supply confirmed this week that Chinese language companies have come collectively for negotiations with the late producer.

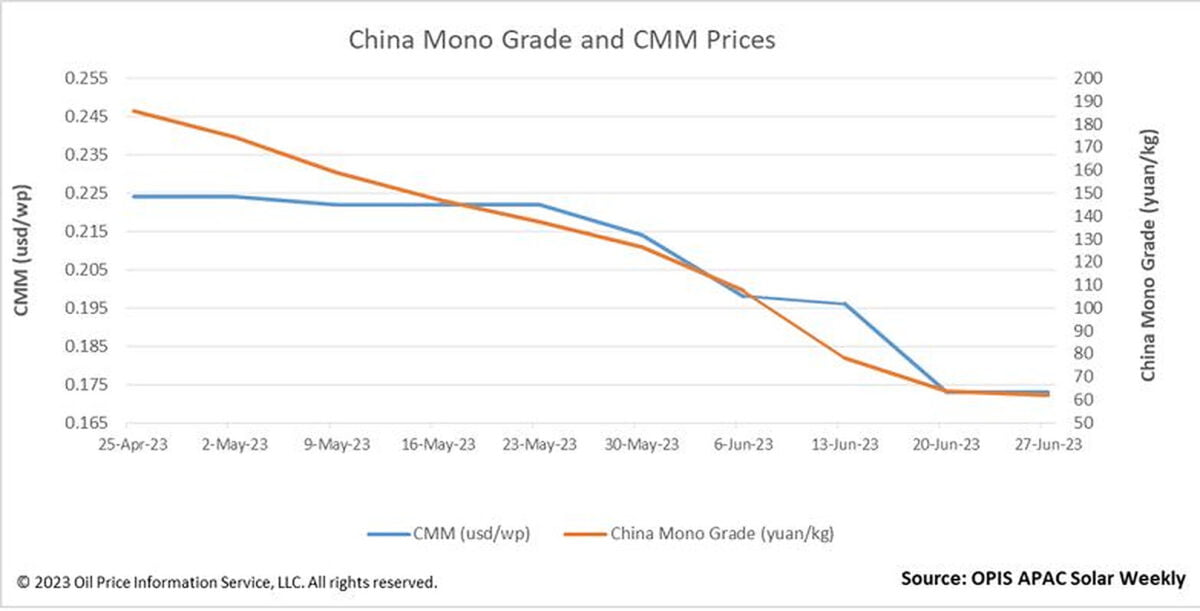

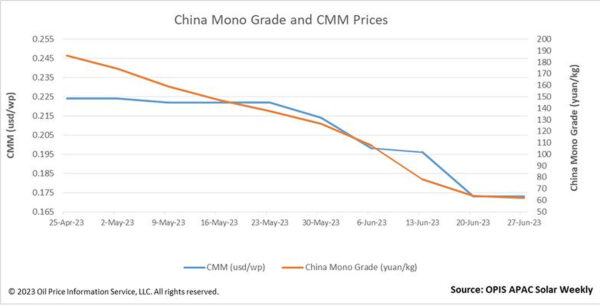

China Mono Grade, the OPIS benchmark for Chinese language-made polysilicon, is close to its ground, falling one other 2.36% weekly to CNY62 ($8.54)/kg, the bottom determine in almost three months. 12 months. Costs are nearer to the CNY60/kg mark, which is the commonly accepted price of manufacturing polysilicon, indicating that there isn’t a room for sharp declines. Because of this, the proportion decline of China Mono Grade fell into single digits for the primary time this month.

Considerations over oversupply proceed to be the primary theme within the story about Chinese language polysilicon, and lots of contacts agree. One supply estimates that China’s tier-1 producers are at the moment sitting on about 80,000 MT of fabric, whereas one other supply places China’s complete polysilicon stockpiles at greater than 100,000 MT.

Nonetheless, a supply identified that the brand new manufacturing capability, which was purported to be launched in June, has been delayed. The insider mentioned it might be higher to “delay manufacturing and keep on the sidelines” as a result of these services have excessive manufacturing prices and can incur losses in the event that they produce polysilicon in in the present day’s low-cost market.

There was a glimmer of calm within the downstream enterprise on account of China Mono Grade pricing changing into much less unstable this week. Wafer costs additionally stabilized for the primary time after falling for greater than two months. The Chinese language Module Marker, the OPIS benchmark evaluation for modules from China, remained regular at $0.173 per W this week after 4 weeks of value declines. Trying forward, OPIS believes that manufacturing prices within the provide chain will now not be the decisive consider pricing, and that subsequent modifications in demand could have a big influence on the costs of every a part of the make

OPIS, a Dow Jones firm, supplies vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge property from the Singapore Photo voltaic Trade in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].