Within the new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the principle worth traits within the world PV business.

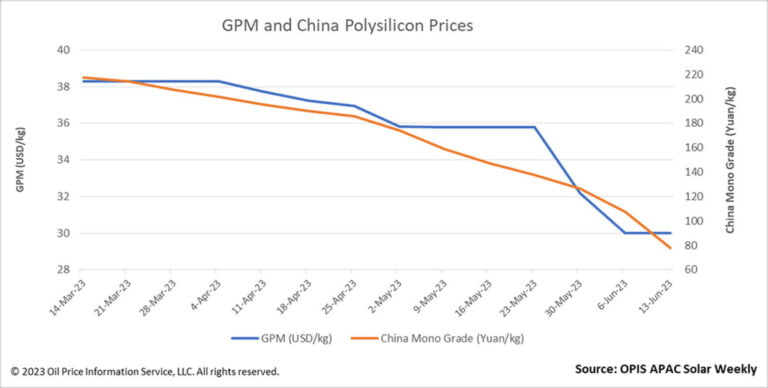

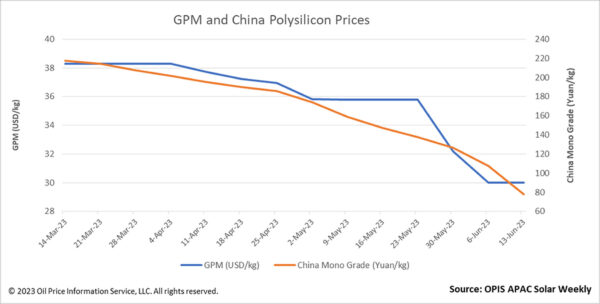

The World Polysilicon Marker (GPM), the OPIS benchmark evaluation for polysilicon exterior China, remained regular this week at $30 per kg, with the market seeing restricted transactions and smaller worth quotes, in accordance with of OPIS Photo voltaic.

Ex-China polysilicon costs remained the identical for a second week operating, with most gamers providing no new worth factors throughout the OPIS market survey. Nevertheless, and increasing the sample from final week, a number of sources indicated how costs within the Chinese language polysilicon market remained in freefall.

Costs for polysilicon in China, assessed by OPIS as China Mono Grade, continued to interrupt information, diving additional to CNY78 ($10.96)/kg, its lowest determine in practically three years. 12 months, which additionally leaves to today a lot mentioned, psychologically important. determine of CNY100/kg of mud. This 27.44% plummet takes the crown from final week’s dramatic proportion decline, and is now 2023’s largest proportion decline in China’s polysilicon costs.

This sharp decline comes as market fundamentals in China additionally stay unchanged, with polysilicon output persevering with to outpace demand, a supply reiterated. Transactions are literally going down at 10% under the figures quoted by massive and small producers, and wafer producers now have a powerful negotiating place when putting buy orders with polysilicon enterprise, the supply added.

Apart from a couple of well-known producers, many polysilicon producers can now not break even at costs between CNY70/kg and CNY80/kg, and a brutal pricing struggle is at the moment in full swing, in accordance with a supply. These main producers are anticipated to proceed a worth struggle, profiting from their decrease manufacturing prices and bigger scale of manufacturing on this and subsequent 12 months to disclaim the small and new market share of the participant, the supply added. On this approach, they’ll preserve their excessive floor in polysilicon when the phase faces a big oversupply.

OPIS, a Dow Jones firm, supplies vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge property from the Singapore Photo voltaic Alternate in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.