China solar module prices dive – pv magazine International

Within the new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle value developments within the world PV trade.

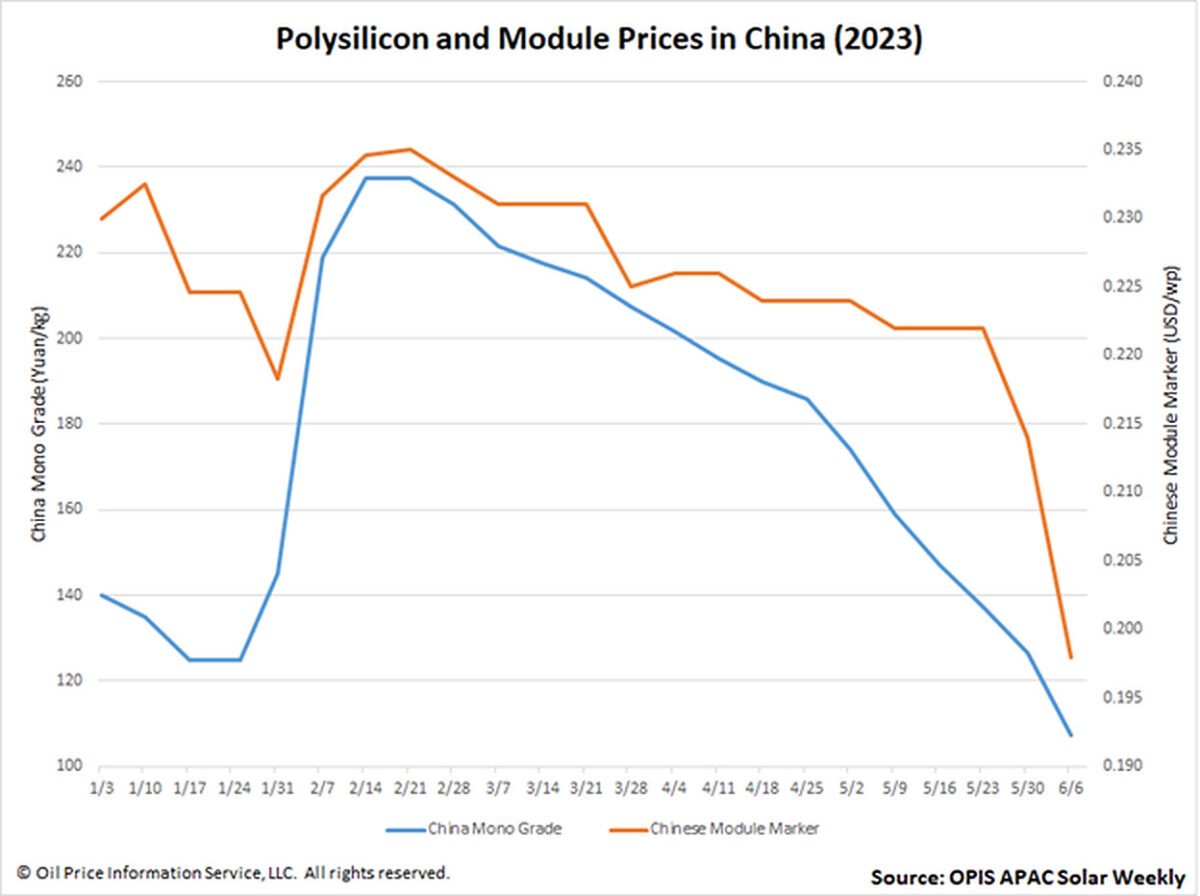

The Chinese language Module Marker (CMM), OPIS’s benchmark evaluation for modules from China, declined for a second week working to $0.198 per W as dramatic downslides in upstream elements of the nation pushed module costs to at their lowest degree in nearly three years, in keeping with OPIS knowledge.

This 7.48% decline – the biggest share decline to this point this yr – takes CMM beneath the psychologically important degree of $0.2/W.

Many market gamers put the decline on China’s rising polysilicon capability and the way China-made polysilicon has returned to what one supply known as a “cheap value.” The latter, assessed by OPIS as China Mono Grade, continued its unstoppable march all the way down to 107.5 CNY ($15.10)/kg.

China’s module costs are falling sharply, with the opening of bids for some current native tasks all decrease than CNY1.5/W, many mentioned. origins. Demand is robust downstream, with 48.31 GW put in within the first 4 months of this yr. Nevertheless, module shipments are decrease than anticipated as a result of potential consumers, anticipating additional value drops, are delaying their purchases, the sources additionally agreed. Consumers will wait so long as their venture permits them to take action, defined a veteran market observer, including that he doesn’t count on the drop in module costs to degree off.

OPIS expects important value volatility going ahead as consumers and sellers alike undertake a wait-and-see strategy to the path of the Chinese language module market. Buoyed demand from what one supply known as “all-time excessive” purchases, with China’s Nationwide Vitality Administration approving a 3rd batch of Gigawatt-based energy tasks, signifies that the drop in costs will discover a ground.

In response to the China Photovoltaic Business Affiliation, the nation is scheduled to put in as much as 120 GW of solar energy by 2023. However producers ought to have numerous module inventories collected, mentioned one other supply, which when launched to the market can ‘g counsel additional decline on the horizon. .

OPIS, a Dow Jones firm, offers vitality costs, information, knowledge and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances in addition to renewable fuels and environmental commodities. It acquired pricing knowledge belongings from the Singapore Photo voltaic Change in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].