Corporate ESS funding in Q1 hits $2.2bn

April 21, 2023: Company funding for power storage firms totaled $2.2 billion within the first quarter of this 12 months, in accordance with a report printed on April 17.

The Mercom Capital Group report mentioned sensible grid firms raised $1.1 billion throughout the identical interval.

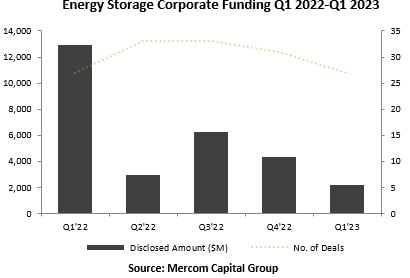

$2.2 billion in whole company funding – together with enterprise capital (VC) funding, debt funding, and public market funding – was achieved in 27 offers.

The overall decreased by $4.3 billion in 31 offers reported by Mercom within the fourth quarter of 2022.

In the meantime, Mercom mentioned funding was down considerably year-on-year in comparison with $12.9 billion in 27 offers in Q1 2022.

LG Vitality Answer’s $10.7 billion IPO contributed 83% of Q1 2022 funding and skewed whole funding, Mercom mentioned.

VC funding of power storage firms, together with non-public fairness and company enterprise capital, totaled $1.1 billion in 19 offers in Q1 2023, an 8% year-over-year lower in comparison with $1.2 billion in 22 offers in Q1 2022.

Quarter-over-quarter funding was 35% decrease in comparison with $1.7 billion in 22 offers in This autumn 2022.

In response to Mercom, the highest 5 VC-funded battery storage firms in Q1 2023 are Electriq Energy ($300 million), Our Subsequent Vitality ($300 million), WeView ($87 million), NanoGraf ($65 million ) and Caban Programs ($51 million) .

Introduced debt and public market financing for EES tech in Q1 2023 fell 58% quarter-on-quarter with $1.1 billion throughout eight offers, in comparison with $2.6 billion throughout 9 offers in This autumn 2022.

Nonetheless, introduced ESS undertaking funding reached $2 billion in 9 offers in Q1 2023, in comparison with $749 million raised in seven offers in This autumn 2022.

Company funding within the sensible grid sector totaled $1.1 billion in 18 offers in Q1 2023, a 42% lower in comparison with $1.9 billion in 23 offers in This autumn 2022, in accordance with Mercom.

In a year-over-year comparability, funding in Q1 2023 elevated 230% in comparison with $331 million in 15 offers in Q1 2022.

There was a 66% decline quarter-over-quarter for sensible grid VC funding in Q1 2023, with $280 million raised in 14 offers in comparison with $846 million in 15 offers in This autumn 2022.

In a year-over-year comparability, funding in Q1 2023 was 14% decrease in comparison with Q1 2022, when $327 million was raised in 13 offers.

Mercom mentioned the highest 5 VC-funded sensible grid firms in Q1 2023 embody EO Charging ($80 million), CHARGE+ZONE ($54 million), Magenta Mobility ($40 million), ConnectDER ($27 million) , and Indra ($21 million).