The Duke Power Companyby (all – Free Report) non-regulated industrial model, Duke Power Sustainable Options, lately marked its entry into the Mississippi photo voltaic market by buying the 100-megawatt (MW) Wildflower Photo voltaic mission from Clearway Power Group.

By way of the acquisition, the corporate is taking a step ahead in growing its photo voltaic power portfolio to attain clear power objectives.

Acquisition Particulars

The Wildflower Photo voltaic mission, which is anticipated to be constructed by the tip of 2022, has sufficient capability to energy practically 21,000 houses. Duke Power’s first photo voltaic power mission in Mississippi is anticipated to be commissioned by the tip of 2023.

At first of its operations, the mission will present as much as 80 MW of photo voltaic power produced by Toyota North America per a 15-year digital energy buy settlement between the 2 corporations. This can assist Toyota’s manufacturing facility scale back carbon emissions from its operations.

As well as, the settlement consists of constant prospects of producing revenue from the mission in the long run.

Growth Prospects

Utilities in america are more and more specializing in lowering their carbon footprint from their operations with a view to present clear and sustainable power to prospects. Of their quest to be extra environmentally pleasant, corporations boast sturdy renewable power targeted funding initiatives.

The most recent report from the EIA means that 22% of US electrical energy era in 2022 and 24% in 2023 shall be renewable sources. This implies a rise from 20% of US electrical energy era in 2020 from renewable sources. The report pegged photo voltaic and wind sources to contribute many of the improve in renewable capability additions over the 2 years.

Duke Power has lowered its carbon emissions by 2021 and greater than 44% since 2005. It has expanded its 2050 net-zero objectives to incorporate Scope 2 and a few Scope 3 emissions.

To realize its purpose, Duke Power is investing closely in renewable initiatives. DUK’s photo voltaic and wind energy companies boast an funding of $5 billion, whereas it owns and operates roughly 500 MW of photovoltaic solar energy initiatives in over 50 photo voltaic crops in entire nation.

The current acquisition made by the corporate will increase its renewable portfolio and will increase its dedication to achieve its goal by 2050.

Associate Actions

Utilities with objectives set to proceed increasing into the renewable area to satisfy inexperienced power targets of their operations are as follows:

American Electrical Energy Firmby (AEP – Free Report’s plans) embrace increasing its renewable era portfolio to roughly 50% of complete capability by 2030. Its 2023-2027 capital funding forecast consists of $8.6 billion in regulated renewable plans.

American Electrical’s long-term (three to five-year) earnings development price is focused at 6.2%. AEP shares are up 8.8% previously month.

Individuals (AEE – Free Report) targets to broaden its renewable portfolio by including 2,800 MW of renewable era by the tip of 2030 and a complete of 4,700 MW of renewable era by 2040 and 800 MW of battery storage by 2040.

Ameren has long-term earnings development of seven.2%. AEE shares have returned 10.8% previously month.

CMS Power (CMS – Free Report) goals to spend $2.8 billion on renewables, which incorporates investments in wind, photo voltaic and hydroelectric era assets within the 2022-2026 interval. The corporate goals to attain net-zero methane emissions by 2030 and net-zero carbon emissions by 2040.

CMS Power boasts a long-term earnings development price of 8%. CMS shares returned 9.1% to its buyers final month.

Value Motion

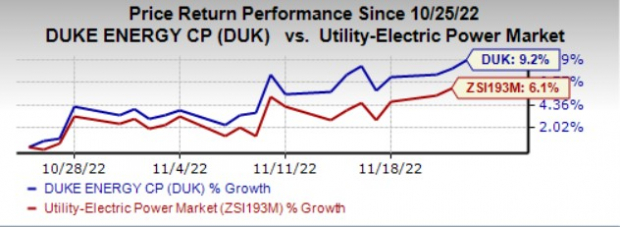

Prior to now month, Duke Power shares have rallied 9.2% in comparison with the business’s development of 6.1%.

Picture Supply: Zacks Funding Analysis

Zacks rank

Duke Power at the moment carries a Zacks Rank #3 (Maintain). You will note the entire checklist of Zacks #1 Rank (Robust Purchase) shares immediately is right here.