Eloi_Omella

Introduction

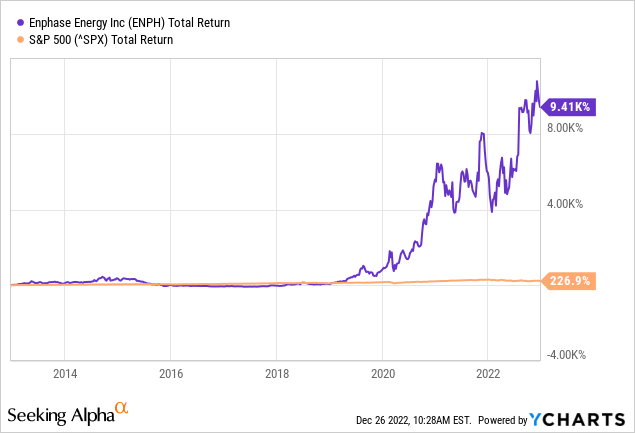

The value of Enphase Power, Inc.NASDAQ:ENPH) shares have elevated lately. Over the previous decade, it has returned an annual 26.4%. The corporate is profitable as a result of it’s energetic within the photo voltaic business, which is a part of a clear vitality megatrend.

The corporate’s quarterly efficiency exceeded expectations. The speedy growth of the enterprise is because of the top quality of the merchandise provided, and the superb customer support. The enterprise has been capable of considerably lower its prices, leading to a big improve in its gross margin. When the worth of Enphase shares fell, I added extra shares to my funding portfolio.

Firm Overview

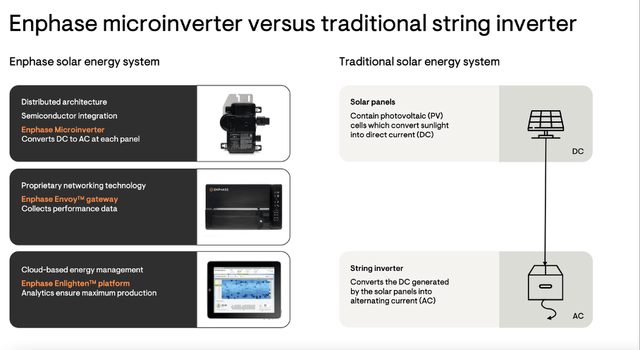

Emphasize aggressive benefit (Enphase 3Q22 investor relations)

Photo voltaic microinverters, designed and manufactured by Enphase Power, are used to transform DC electrical energy produced by photo voltaic panels into AC electrical energy appropriate to be used in properties and companies.

Microinverters from Enphase are suitable with a variety of photo voltaic panel techniques and are designed to be easy to arrange and keep. A couple of hundred international locations use the corporate’s know-how in photo voltaic vitality techniques for properties, companies, and utilities. Enphase offers greater than microinverters; in addition they promote battery storage techniques and software program to watch and enhance vitality output and consumption patterns.

Enphase Operates In A Giant Whole Addressable Market

Enphase SAM (Enphase 3Q22 investor presentation)

The time period “serviceable addressable market” (SAM) refers back to the basic wants that may be met with the corporate’s choices. On account of the truth that the full addressable market (“TAM”) takes under consideration the demand for all photo voltaic vitality services, not solely these provided by Enphase, the scale of the SAM could also be smaller than in TAM.

Photo voltaic vitality system demand from residential, industrial, and industrial shoppers, in addition to demand from utilities and different massive vitality customers, are all accounted for by Enphase’s SAM. In keeping with Enphase, its SAM will attain $23 billion by 2025. In 2025, income is anticipated to be $4.7B, which is able to put Enphase’s market share at 20%. There’s nonetheless loads of room for Enphase to develop, as the corporate is quickly increasing and gaining market share.

Enphase Is Effectively Positioned In The Trade Megatrend

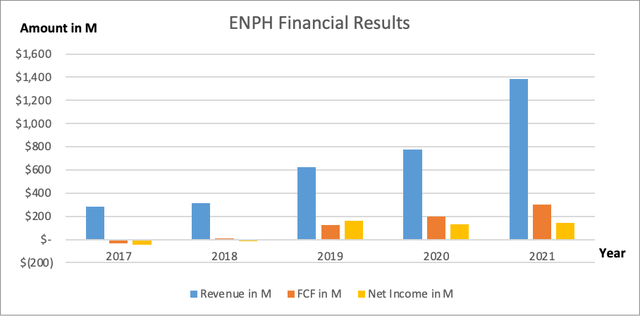

As a result of vitality transition, Enphase Power is ready to develop a quickly increasing market. Income has grown 48% yearly on common over the previous 4 years. Web earnings has change into constructive, and free money circulation is anticipated to succeed in $300 million in 2021. There are sturdy expectations concerning the firm’s progress: Twenty-three analysts have elevated their projections for income and earnings per share. They count on gross sales to extend yearly by 31%, reaching $3.95B by 2024. The anticipated common EPS progress from 2022 to 2024 is 25% yearly. These are formidable predictions, however I’ve little doubt that Enphase will reap nice rewards from the megatrend within the photo voltaic business.

Emphasize monetary highlights (SEC and writer’s personal graphical illustration)

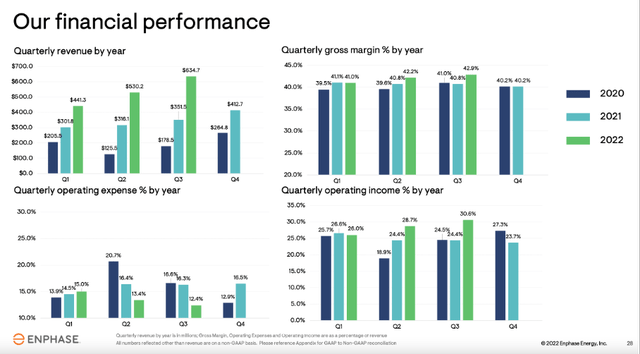

Monetary outcomes for Enphase within the third quarter of 2022 had been sturdy. Quarterly gross sales hit a brand new excessive of $634.7 million, up 80 % year-over-year. The corporate’s free money circulation (“FCF”) was $179.1 million, a rise of 79% year-over-year, whereas gross margin reached 42.9%.

Monetary efficiency (Enphase 3Q22 investor presentation)

Within the third quarter, greater than 47% of all microinverter shipments had been the brand new IQ8 mannequin.

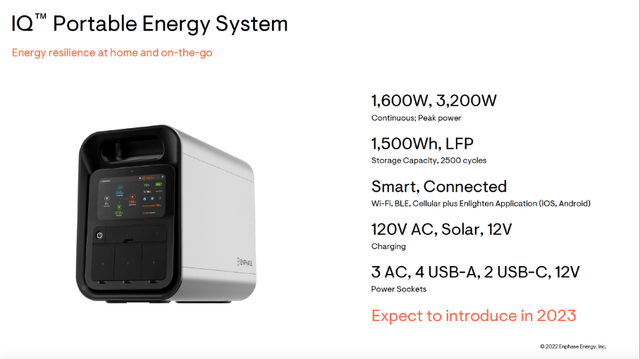

The corporate is making ready for future success in increasing the photo voltaic vitality market. The IQ Transportable Power System can be added to the corporate’s choices alongside its present services to extend gross sales.

IQ Transportable Power System (Enphase’s 3Q22 investor presentation)

Enphase can also be increasing its manufacturing capability to fulfill elevated demand. The present quarterly manufacturing capability of the microinverter is nearly 5 million. The primary quarter of 2023 will see microinverter manufacturing in Romania, growing the corporate’s quarterly output capability to six million microinverters worldwide.

The Inflation Discount Act (IRA) prolonged the funding tax credit score for residential photo voltaic to 30% for one more 10 years and established a standalone storage funding tax credit score with related provisions.

Though there are numerous issues within the chip provide chain. Do not see any points with Enphase. Enhancements are made to the distribution of particular person elements. CEO Badri Kothandaraman is optimistic:

There are nonetheless some tight spots that come up once in a while and our operations crew does an amazing job dealing with the scenario nicely. The logistics scenario has additionally improved barely with diminished supply occasions.

The corporate’s speedy growth within the sector’s mega-trend exhibits no indicators of slowing down. The corporate’s current restoration from the European vitality disaster attributable to the Russian fuel boycott makes the vitality transition an much more pressing situation. I imagine that due to its wonderful market place, Enphase will proceed to develop quickly within the coming years.

Shares are costly

Whereas the corporate’s progress prospects are brilliant, traders must also think about the present share value.

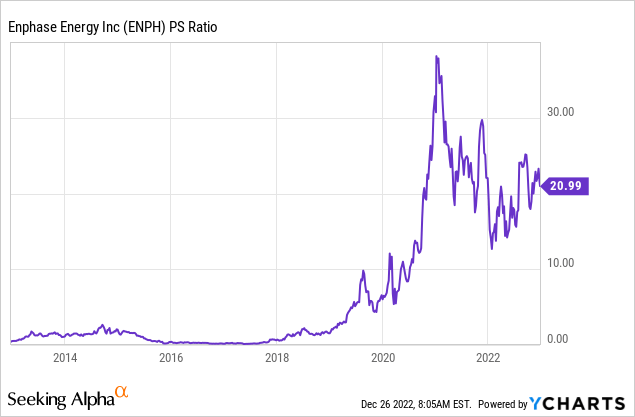

For a progress firm, I often favor the worth to gross sales ratio. With rising gross margins, as within the case of Enphase, this ratio is undesirable. Gross margin was 42% (GAAP), up from 20% in 2017.

Over time, the corporate has grown tremendously. With a Value To Gross sales ratio of 21, the corporate is extremely valued. The P/S ratio is rising at an alarming fee, because the chart exhibits.

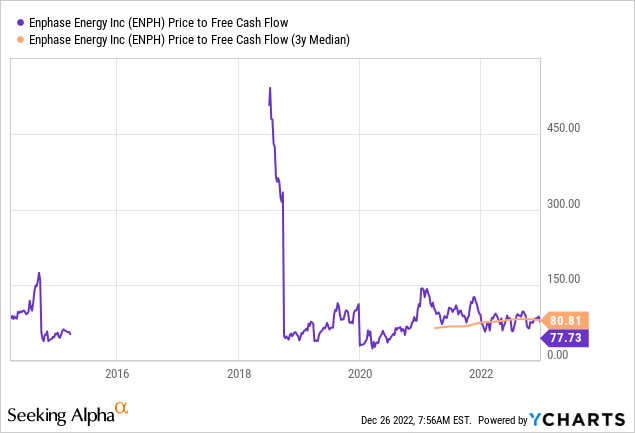

On account of the regular progress of the gross margin, a comparatively excessive P/S ratio is anticipated. The P/FCF (free money circulation) ratio seems to be the most suitable choice for gaining perception into the corporate’s valuation. As seen within the graph under, the present P/FCF ratio of 78 is decrease than the three-year common of 81.

With a 53% improve year-on-year from 2021, free money circulation exhibits continued speedy growth. On the present inventory value, the worth of free money circulation can be 23 by the top of 2025 if this speedy growth is maintained over the subsequent three years. Contemplating that the Federal Reserve has been elevating rates of interest to stop extreme inflation, I feel the corporate’s present valuation is a bit costly.

Conclusion

Photo voltaic microinverters are used to transform DC electrical energy generated by photo voltaic panels into AC electrical energy appropriate to be used in properties and companies. A couple of hundred international locations use the corporate’s know-how in photo voltaic vitality techniques for properties, companies, and utilities. Enphase is increasing quickly and gaining market share shortly. Income has grown 48% yearly on common over the previous 4 years.

Offered by Enphase Power, Inc. sturdy quarterly outcomes as gross sales elevated 80% 12 months over 12 months. Analysts count on gross sales to extend yearly by 31%, reaching $3.95B by 2024.

The speedy growth of Enphase Power, Inc. the photo voltaic mega-trend exhibits no indicators of slowing down. Prices decreased and gross margin elevated to 42%, from 20% in 2017. With a 53% year-on-year improve from 2021, free money circulation exhibits continued speedy growth. The inventory valuation of Enphase Power, Inc. an vital a part of funding choice making. I feel the present valuation of the corporate is sort of costly. When the worth of Enphase shares fell, I added extra shares to my funding portfolio.