sir

Funding Thesis

Enphase Power (NASDAQ:ENPH) and First Photo voltaic (NASDAQ: FSLR) has been rewarded properly to date, because of the large enhance from the Inflation Discount Act and the expansion of California’s photo voltaic incentive program.. Not shocking, as a result of the international renewable vitality The market is anticipated to aggressively increase to $1.99T in worth by 2030, at a CAGR of 8.6%. the demand for international photo voltaic vitality Additionally it is anticipated to develop considerably from one Terawatt in April 2022 to 2.3 Terawatt in 2025, with China accounting for about 30% of that demand, whereas the EU and the US doubled to 2.86% and a pair of.95%, respectively.

Subsequently, it isn’t shocking that ENPH will expertise no slowdown in international demand, with wholesome bookings in Q1’23 regardless of rising inflationary strain. FSLR reported much more spectacular backlogs till 2027, which additional expanded by 31.15% QoQ to 58.1 GWs within the newest quarter, with complete reserving alternatives of as much as 114 GW. There isn’t any full destruction of demand right here, actually.

Mr. Market Optimistically Delivers ENPH & FSLR With Nice Progress

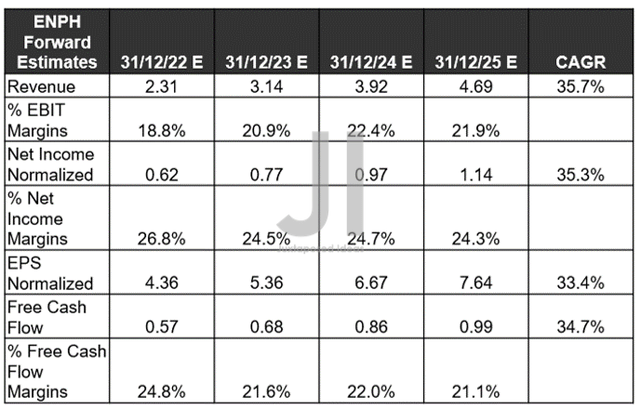

ENPH Projected Income, Internet Revenue (in billion $) %, EBIT %, and EPS, FCF%

S&P Capital IQ

As a result of its glorious FQ3’22 earnings name, ENPH proved our earlier promote ranking to be very incorrect because of the subsequent rally. It’s only pure, then, that the corporate is anticipated to additional ship an upgraded high and backside line development of 9.06% and 16.32% till FY2025, since our earlier evaluation in August 2022. Extra particularly, market analysts venture that the corporate will ship spectacular YoY income development of 35.93% regardless of a possible recession in 2023, whereas increasing its income by 22.93%.

Via ENPH’s current GreenCom acquisition and ClipperCreek, there isn’t any doubt that the corporate will consolidate its renewable choices and supply a whole dwelling vitality administration system, full with EV chargers, IQ8 Microinverters, IQ batteries, and third-party photo voltaic panels. Administration has already guided for an early US launch in H1’23 and presumably the EU after that.

We anticipate this market section to carry out higher, given the early promising indicators of 70% QoQ and 136% YoY income development within the area. Though the US nonetheless accounts for 70.13% of ENPH revenues by FQ3’22, it’s doubtless that the EU might surpass the previous, because the EU authorities hopes to quickly increase the adoption of EVs from 1.2M in 2020 to 30M by 2030, whereas rising. the entire photo voltaic set up from 165 GW to 1 TW on the identical time.

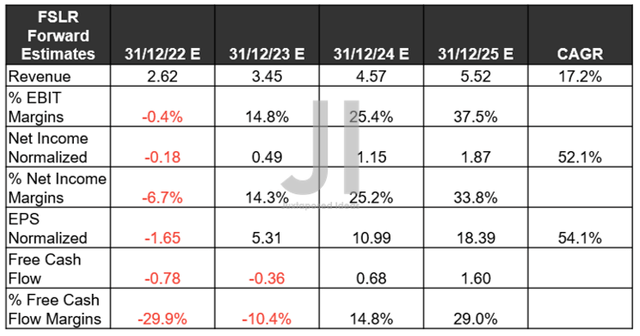

Estimated FSLR Income, Internet Revenue (in billion $)%, EBIT%, and EPS, FCF%

S&P Capital IQ

In the meantime, FSLR has additionally been broadly upgraded by market analysts, with a exceptional enlargement of the highest and backside strains of 11.29% and 17.64%, since October 2022. The corporate is now anticipated to develop in a extra bold income CAGR of 17.2% and EPS CAGR of 54.1%, towards hyper-pandemic ranges of -2.3% and 48.2%, respectively. Its profitability enlargement can be spectacular, given an anticipated EBIT margin of 37.5%, web earnings margin of 33.8%, and FCF margin of 29% in FY2025.

Naturally, it says that there can be no cancellation of orders within the subsequent few years, as is at the moment skilled by Taiwan Semiconductor Manufacturing Firm Restricted (TSM) because of peak recessionary fears and semiconductor chips stock correction. You will need to be aware that the vitality trade can be a cyclical trade, similar to the semiconductor, housing, and delivery markets. Assuming that the renewable vitality sector has the identical conduct because of the giant move of demand and provide, we might even see a part of this optimism rapidly dissolve earlier than the ultimate supply of the FSLR in 2027. excessive that pandemic, prompting dire ahead steerage and inventory losses up to now.

We’re beginning to see some early indicators of this occurring, with a number of Chinese language photo voltaic panel producers, similar to Daqo New Power (DQ), Tongwei, and GCL, anticipating to aggressively will produce as much as 1,010K MT polysilicon by 2024 (or approx. equal to 336 GW capability, based mostly on 1.2 kg per 400W photo voltaic panel). That will point out an enormous improve of as much as 353.14% within the subsequent two years, which may set off a surge in provide within the photo voltaic market, because it will increase the entire output of home provide by greater than 3 MT on the identical time. That occasion will definitely put a damper on photo voltaic costs and, thus, a discount in Capex development going ahead.

Then once more, with photo voltaic tariffs nonetheless in place, Chinese language-made photo voltaic panels stay unwelcome within the US and, quickly, the EU. Subsequently, it’s attainable to cut back a few of these headwinds. We’ll see, as a result of FSLR solely hopes to report an annual manufacturing capability of 10.7GW in 2026 throughout the US and one other 10GW internationally in 2025. These numbers appear fairly cautious, reflecting the cautious administration enlargement regardless of a document excessive backlog up to now. Maybe, that is because of the giant focus of bookings within the US at 88%, to take full benefit of the Inflation Discount Act.

Within the meantime, we encourage you to learn our earlier article, which can allow you to higher perceive its place and market alternatives.

- First Photo voltaic: Mr. Market Overcompensates – Do not Get Trapped in a Rally

- Enphase: Time To Promote And Make Cash In This Stellar Inventory

So, ENPH & FSLR Shares PurchasePromote, or Maintain?

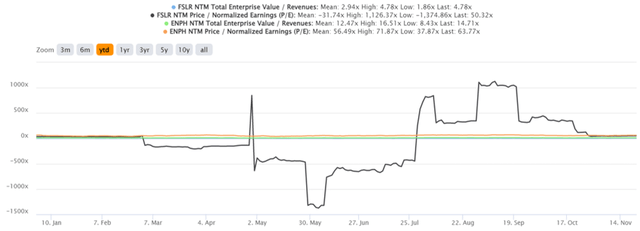

ENPH & FSLR YTD EV/Earnings and P/E Valuations

S&P Capital IQ

Consequently, it isn’t shocking that ENPH and FSLR are buying and selling at a steep premium immediately. The previous at the moment stands at an EV/NTM Income of 14.71x and NTM P/E of 63.77x, near its YTD highs of 16.51x and 71.87x, respectively. At $320.44, the inventory is clearly nearer to its 52-week excessive of $324.84 and an eye-watering premium of 282.57% from its 52-week low of $113.40.

If one thinks that is uncommon, FSLR is much more absurd, buying and selling at an EV/NTM Income of 4.78x and an NTM P/E of fifty.32x. These numbers symbolize a record-breaking soar from beforehand regular valuations of 1.09x and 9.75x, respectively, prior to those hyper optimism ranges. The inventory has recorded a large 218.42% rally since its FQ2’22 earnings name on 27 July 2022. Thus, its potential has been maximized, given a minimal 1.57% upside from consensus value targets.

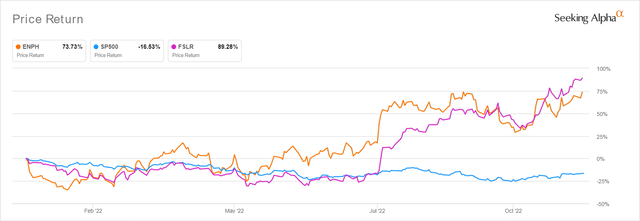

Inventory Worth of ENPH & FSLR YTD

S&P Capital IQ

For sure, each shares are using an enormous tsunami of confidence, particularly after the October CPI spike. 75.8% of market analysts now anticipate the Feds to pivot earlier, with a 50 foundation level hike in December, much like the Financial institution of Canada’s current moderation. In hindsight, we’re prone to see all the market rise above these peak recessionary fears, regardless of raised terminal charges to over 6%. Naturally, it stays to be seen if these sentiments can maintain the remaining will increase in 2023, though we’re not very optimistic because of the extraordinarily wealthy valuation that limits their potential improve. Digestion will come eventually.

Subsequently, ENPH and FSLR stay as Holds for individuals who stay satisfied of their potential subsequent decade. If not, some might wish to take a few of these good-looking features off the desk, as Mr. Market is fast to punish as soon as development slows and sentiment normalizes. The identical has been noticed for high-growth tech shares that have been as soon as extremely regarded by market analysts and are actually, over-beaten because of gradual top- and bottom-line development throughout these disasters throughout the board. market correction.

Alternatively, buyers who improve ENPH and FSLR immediately are prone to do poorly in the long run, because of the small margin of security. Endurance will certainly repay higher, with our value goal within the low $200s for ENPH and low $100s for FSLR. Do not chase the rally now.