Falling costs, 15 GW of US solar module production, TOPCon trends – pv magazine International

From pv journal USA

The US Inflation Discount Act of 2022 consists of $370 billion in spending for renewable vitality and local weather measures. The invoice consists of greater than $60 billion for home manufacturing all through the clear vitality provide chain. This historic stage of funding is essential to reaching America’s manufacturing freedom and clear vitality safety.

A current report from Wooden Mackenzie signifies that builders, engineering procurement development (EPCs) firms, and producers will likely be looking out for steerage from the US Treasury Division and the IRS for readability to plan. in new photo voltaic growth and funding in new manufacturing amenities. inside the USA.

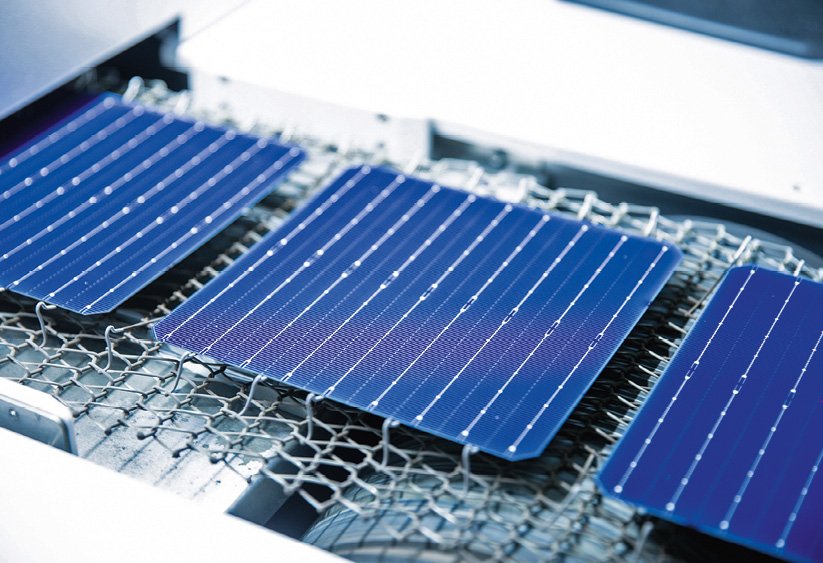

The report appears at traits on this rising business, together with a deal with TOPCon heterojunction (HJT) modules, development within the world residential inverter market, an enlargement in tracker manufacturing, an anticipated decline in photo voltaic challenge prices and an outline of future challenges. .

TOPcon vs. MINUTE

TOPCon, which stands for tunnel oxide passivated contacts, is anticipated to surpass heterojunction (HJT), and the Wooden Mackenzie report says that mono PERC “is the expertise that balances maturity and effectivity”, indicating that TOPCon has most development potential as a result of course of. enchancment and price optimization.

“PERC panel expertise additionally has a really quick studying curve and the steadiness between them will rely upon which one is ready to enhance effectivity or cut back prices sooner than the opposite,” Stefan Gunz, the pinnacle of photovoltaics analysis at Fraunhofer in Germany. Institute for Photo voltaic Vitality Methods (ISE), mentioned pv journal a yr in the past.

Wooden Mackenzie analysts estimate that TOPCon modules attain 25% effectivity in mass manufacturing and might enhance to twenty-eight.7%

Upgrading manufacturing from mono PERC manufacturing to TOPCon is an easy and comparatively low-cost funding, and analysts estimate {that a} lab effectivity of 27% might be achieved by bettering metallization and thinner wafers. Wooden Mackenzie says that some producers anticipate the common wafer thickness for large-format TOPCon modules to lower by 20 μm this yr to 120 μm, which can result in many of the reductions in value in 2023.

The Inflation Discount Act inspired module manufacturing within the US on account of $30 billion in manufacturing tax credit in addition to $10 billion in funding tax credit to construct clear expertise manufacturing amenities. Wooden Mackenzie expects US module manufacturing capability to exceed 15 GW by the tip of this yr.

The large query, nonetheless, is the definition of “home-made elements”, and whether or not it implies that the modules are assembled in the USA, or whether or not all of the elements are made within the US. The problem for module makers is that there’s just about no wafer or cell manufacturing within the US, though that has modified with current bulletins by firms together with Qcells and CubicPV. The distinction within the interpretation of home content material “might considerably have an effect on the capability to supply the module within the subsequent 5 years”, the report argued. Analysts estimate that round 45 GWdc of latest capability bulletins will come on-line by 2026.

Inverters, trackers

The anticipated development of photo voltaic within the US will circulation by way of the provision chain, which can enhance the expansion of inverters and trackers, and different supporting elements. The Wooden Mackenzie report says that current coverage modifications, together with the EU’s REPowerEU, India’s implementation of Manufacturing Linked Incentives (PLI) and the US IRA, will speed up the adoption of photo voltaic on this international locations, thereby serving to international locations obtain their internet zero targets.

Based on the report, the residential inverter market will develop worldwide by 2023. With rooftop photo voltaic gaining momentum, particularly in international locations like India and Germany, there will likely be a corresponding development out there for microinverters, string inverters and DC optimizers. , the most well-liked inverter choices for rooftop installations. In reality, string inverters with a number of most energy level trackers (MPPTs) will see elevated market penetration by 2023.

Residential inverters will see extra use of synthetic intelligence in its algorithms. Module-level energy electronics (MLPEs) and single-phase string inverters, the most well-liked in rooftop photo voltaic installations, will see an 11% market share in world inverter shipments by 2023. Inverter manufacturing will enhance with main gamers including manufacturing strains and new entrants becoming a member of the market, and the following competitors will trigger value reductions from 2% to 4% in 2023.

An ongoing problem for inverter producers is the worldwide chip scarcity, which Wooden Mackenzie analysts anticipate to proceed by way of 2023 and spill over into 2024. The scarcity is inflicting inverter producers to take chips from low-end producers earlier than conducting rigorous in-house testing to make sure the standard, effectivity and lifetime of their inverters. Wooden Mac predicts that inverter costs will not drop till later this yr.

Home tracker manufacturing is gaining momentum in lots of elements of the world because of authorities incentives in addition to logistical points skilled throughout the COVID-19 pandemic. Based on Wooden Mackenzie analysts, tracker costs will drop in India and the USA. They anticipate additional stability in metal provide within the US and India, particularly with the enlargement of current metal manufacturing. Europe, nonetheless, will nonetheless face an imbalance within the metal market. As greater than 60% of the tracker composition is metal, this rebound in metal demand will end in extra competitors within the tracker market share for distributors, mentioned Wooden Mackenzie analysts, who challenge that the value of 2023 for trackers will fall to five% in the USA, Brazil and China.

Photo voltaic prices

Capital expenditure prices will proceed to say no, pushed partially by elevated use of TOPcon modules. Wooden Mackenzie analysts additionally anticipate the value of polysilicon to drop this yr and so they estimate that the prevailing 300 GW of world capability will attain 900 GW by the tip of 2023.

“We estimate that over 1 million Mt of polysilicon enlargement will come on-line by 2023. Many of the new capability will likely be in China. Nevertheless, we consider that the roughly 10% scheduled to be outdoors of China might command a value premium as it might be exempt from tariffs and different coverage dangers. .

An ongoing problem is the uncertainty surrounding antidumping/countervailing (AD/CVD) tariff prices. With the US Division of Commerce anticipated to announce its ultimate willpower in Could 2023, Wooden Mackenzie estimates that duties might vary from 16% to 254% based mostly on the nation of origin. The preliminary willpower, launched in December 2022, discovered tier 1 firms, equivalent to Trina, BYD, Vina (a unit of Longi) and Canadian Photo voltaic, evading Chinese language tariffs. The preliminary willpower removes Hanwha and Jinko which can end in some reduction in module availability in 2023.

In the USA, builders will proceed to deal with IRA necessities, together with prevailing wages and home content material bonus additions for utility-scale initiatives that start development in 2023. For initiatives To get the total 30% funding tax credit score or the manufacturing tax credit score, all initiatives bigger than 1 MWac should pay their employees a minimal wage and set up an apprenticeship program.

In Europe, the REPowerEU coverage goals to put in 320 GW of photo voltaic PV by 2025 and 600 GW underneath the EU photo voltaic vitality technique. To attain these formidable targets, it’s crucial to ascertain a powerful manufacturing hub inside the area. The brand new European Photo voltaic Photovoltaic Trade Alliance, will create a framework to assist safe financing for the manufacturing and growth of analysis and innovation in module expertise, and different zero-carbon applied sciences.

The ultimate problem for PV manufacturing in Europe, in accordance with Wooden Mackenzie analysts, is the associated fee competitors from the APAC area because of increased vitality, labor and materials prices, however can profit from prospects who’re prepared to pay a premium for higher expertise and provide chain transparency.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].