In a brand new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the primary worth traits within the international PV business.

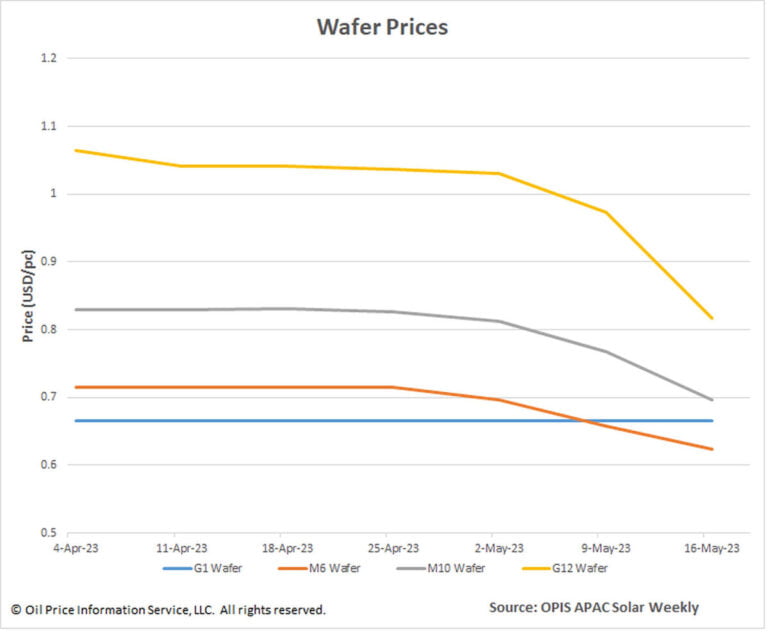

In its newest worth evaluation on Might 16, OPIS noticed wafer costs drop for every week whereas main wafer maker TCL Zhonghuan slashed its costs for the second time in as many weeks. Costs for Mono M10 and G12 wafers, the mainstream sizes, fell this week, with M10 wafers falling 9.26% to $0.696 per piece (laptop) and G12 wafers which dived a sharper 16.02% to $0.818/laptop.

Not proof against this weak point, the much less marketed M6 wafers additionally fell by 5.17% to $ 0.624/laptop. Mono G1 wafer costs remained unchanged at $0.666/laptop as its commerce remained restrained within the face of declining market share.

Chat concerning the motivation behind and outcomes of Zhonghuan’s newest transfer — a major worth reduce of roughly 15% throughout wafer sorts — dominated this week’s market survey. Within the view of many sources, Zhonghuan is making an attempt to extend its market share by undercutting its principal rival, LONGi. By dropping G12 costs extra closely than M10 costs, Zhonghuan seems to be paving the way in which for G12 wafers to increase its share of the general wafer market, including supply.

Though some small wafer makers had been shocked by the velocity with which the market chief slashed costs, it was “affordable” in response to one market participant who believed that the value cuts amounted to a cumulative trickle-down impact within the discount of the home worth of China polysilicon previously months.

Because of the continued softening of polysilicon costs as uncooked materials manufacturing will increase, OPIS expects wafer costs to average within the close to time period and pave the way in which for decrease costs.

OPIS, a Dow Jones firm, supplies power costs, information, information and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical compounds in addition to renewable fuels and environmental commodities. It acquired pricing information belongings from the Singapore Photo voltaic Change in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.