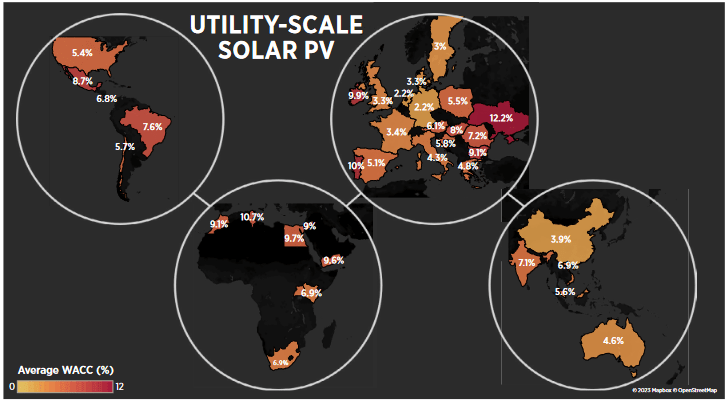

The Worldwide Renewable Vitality Company (IRENA) has launched new capital value knowledge for photo voltaic PV, onshore and offshore wind for the interval between 2020 and 2021. The outcomes present that Germany and the Netherlands have the bottom prices of European capital at 2.2 %, whereas the US, China, India, and Australia present values of 5.4%, 3.9%, 7.1%, and 4.6%, respectively.

IRENA has printed a first-of-its-kind report on the price of financing for renewable energy, overlaying photo voltaic PV, onshore, and offshore wind applied sciences in all main international markets.

The company obtained knowledge from 172 survey responses from 56 consultants in addition to 33 interviews. The responses offered value of capital (CoC) knowledge from 45 international locations for a minimum of one among three renewable applied sciences on six continents.

The price of capital expresses the anticipated monetary return, or the minimal required price, for investing in an organization or a venture. It’s calculated as a weighted common between the prices of debt and fairness, the place the price of debt is the rate of interest secured by a venture from lenders, and the price of fairness is the monetary return anticipated to shareholders in trade for offering capital.

The price of capital is a significant determinant of the levelized value of electrical energy (LCOE) for photo voltaic PV and different renewables. In keeping with IRENA, the entire value of electrical energy for a consultant PV venture will increase by 80% when the CoC is 10% moderately than 2%.

“Even small variations in CoC that aren’t correctly accounted for between international locations and applied sciences may end up in vital misrepresentation of renewable vitality prices and result in poor coverage making,” mentioned IRENA within the report. “Dependable knowledge and an improved understanding of the composition of the CoC and its drivers are important to the event of tailored assist mechanisms and market designs that have in mind totally different technological and nation dangers.”

The outcomes present that for all places surveyed the price of capital for utility-scale PV is lowest in Germany and the Netherlands, each at 2.2%. In Europe, Sweden follows at 3%, with Denmark and the UK at 3.3%. The CoC in Spain, France, and Italy are 5.1%, 3.4%, and 4.3%, respectively. Eire, Portugal, and Ukraine confirmed the worst outcomes, at 9.9%, 10%, and 12.2%, respectively.

In North America, the US has a CoC of 5.4% and Mexico 8.7%. Chile beat Brazil in South America, with 5.7% towards Brazil’s 7.6%. The most effective ends in Africa got here from South Africa and Kenya at 6.9%, whereas Tunisia had the worst end result among the many African international locations surveyed at 10.7%. China had among the best international outcomes at 3.9%, with Australia following intently behind at 4.6%, after which India at 7.1%.

Good ends in China, North America, and Western Europe are attributed to a mature PV market, based on IRENA. “In these areas, renewable vitality financing is underwriting the deployment of renewable energy era capability,” it mentioned within the report.

The company additionally famous that the share of CoC debt is low in North America and Western Europe however for various causes. In the US, the share of debt is often low, between 35% and 65%, as a result of “the tax credit used to speed up the deployment of photo voltaic and wind encourage using fairness,” whose prices are low solely due to the tax credit, IRENA defined. . However, the share of debt is often higher in Europe, at 80% or extra, however the price of debt could be very low because of the low base charges from the banking sector.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.