International photo voltaic PV manufacturing capability is ready to almost double subsequent 12 months, reaching almost 1 TW, in accordance with the IEA. This enlargement is sufficient to meet the company’s annual web zero demand for 2050, which expects PV deployment to be round 650 GW by 2030 and round 310 GW by 2024. Nonetheless, the business faces problem of oversupply.

By 2022, international PV manufacturing capability will enhance by greater than 70% to almost 450 GW, with China accounting for greater than 95% of latest additions throughout the availability chain. By 2023 and 2024, international PV manufacturing capability is anticipated to double, with China additionally accounting for greater than 90% of the rise.

Chinese language producers are investing in increasing wafer, cell, and module manufacturing in Southeast Asia. As well as, manufacturing crops are anticipated to be deployed in India and america because of the new industrial insurance policies launched final 12 months.

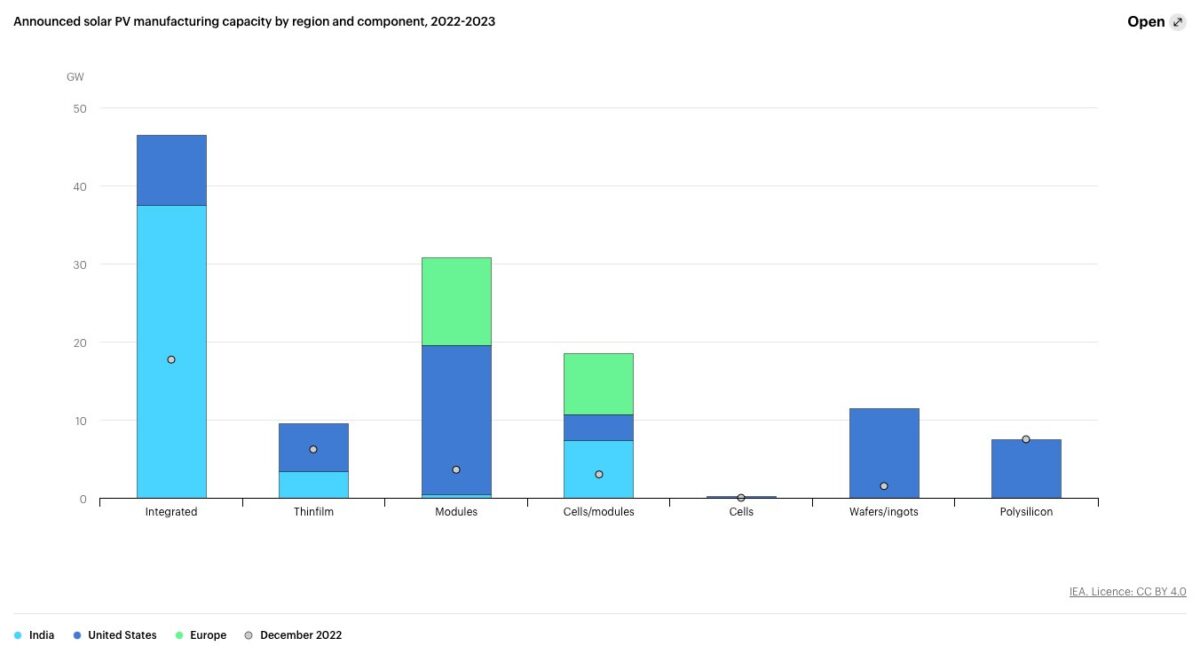

India’s production-linked (PLI) scheme and the US Inflation Discount Act (IRA) have led to a surge in new photo voltaic manufacturing initiatives. Between November 2022 and Could 2023, greater than 120% of such initiatives have been introduced, probably creating nationwide provide chains with greater than 20 GW of capability in every area.

In Europe, new manufacturing capability accounts for less than 14% of introduced initiatives as of August 2022. The EU Inexperienced Deal Industrial Plan and the Internet-Zero Trade Act goal for Europe to supply 40% of the targets of Its PV in 2030, however particular incentives are usually not included now. Excessive industrial power costs additionally enhance the price of manufacturing photo voltaic PV gear in EU nations.

“Within the absence of producing coverage or indoor premiums, photo voltaic PV manufacturing within the European Union can be much less aggressive than in India or america,” the IEA stated.

In Europe, lower than 1% of manufacturing capability is devoted to new cells, whereas ingots and wafers have 9%, and polysilicon manufacturing is simply at 6%. Built-in services produce three or extra parts, however nearly 80% of their introduced capability doesn’t embody devoted polysilicon manufacturing. As well as, the capability of the brand new module meeting crops, which is nearly 30 GW, doesn’t correspond to the introduced capability for different parts, particularly cells and polysilicon. Because of this, these new crops nonetheless must import cells and different parts from China.

Mixed new photo voltaic PV manufacturing bulletins in India, america, and Europe quantity to 30 GW for polysilicon and 100 GW for module meeting.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.