The Worldwide Vitality Company (IEA) says that unsubsidized warmth pumps are already competing with fuel boilers in mature markets reminiscent of america, Canada, Japan, Italy, and China. It says world gross sales will rise to report ranges by 2030.

Warmth pumps are already cost-competitive with fuel boilers in some mature heating markets, based on the “Way forward for Warmth Pumps” report, not too long ago printed by the IEA.

“foundation on common 2021 gentleness costs and [projected] wooden costs… a new warmth BOMBS on warmth the common home on a COLD local weather is the cheaper somewhat than a naturally fuel shortening boiler on lol on the COMMANDING LEAD warming up markets, typically or no subsidy,” stated the report.

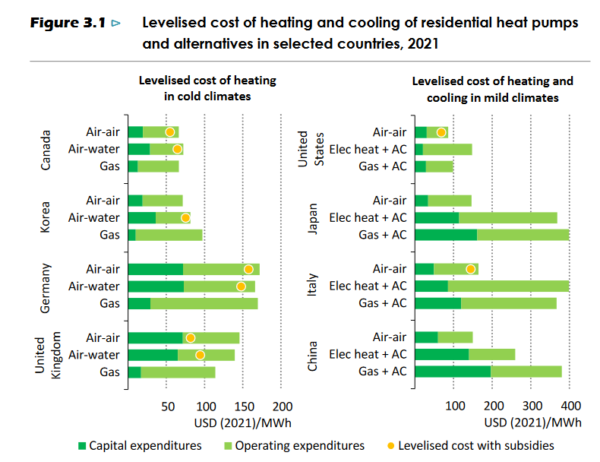

The USA, Canada, Japan, Italy and China are among the many international locations the place unsubsidized warmth pumps are cost-competitive with fuel boilers, based on the IEA. Nonetheless, in markets reminiscent of the UK and Germany, subsidies are nonetheless wanted to make them cost-competitive.

“Though emphasis the prices on a warmth BOMBS performed it complete life is the that the most cost-effective warming up choice, Finance incentives, together with grants and UNDER–curiosity mortgage, potential nonetheless can be wanted on lowered the initials prices burden, that potential stop the constructing TAG PROPERTY from inserting a warmth BOMBS on the first place,” stated the report.

The IEA discovered that monetary incentives for warmth pumps exist already in additional than 30 international locations, which collectively cowl greater than 70% of present heating demand. The company says it expects warmth pump gross sales to succeed in new highs in 2030, after rising by almost 15% in 2021. Final 12 months, warmth pump gross sales elevated round 35% within the European Union, adopted by North America round 15%, Japan and South Korea round 13% every, and China round 12%.

Nonetheless, warmth pumps will solely account for 10% of the world’s heating wants in buildings in 2021, based on the report. The present whole put in capability of warmth pumps in residential and non-residential buildings is greater than 1,000 GW, with nearly half of the capability put in in North America. Europe has the second highest put in capability, adopted by Japan, South Korea, and China. The remainder of the world mixed has much less put in capability than another nation.

“Many models are utilized in delicate to scorching climates, the place they’re used primarily for cooling however nonetheless signify the principle supply of heating (for some months of the 12 months),” the report stated. “Nonetheless, the penetration of warmth pumps is now highest within the coldest elements of Europe, assembly 60% of the overall heating necessities of buildings in Norway and over 40% in Sweden and Finland thanks of long-standing coverage help.”

Warmth pump gross sales in Europe might rise from 2 million in 2021 to 7 million in 2030 if governments achieve hitting their emission discount targets and vitality safety goals, says the IEA. The area is predicted to succeed in almost 500 GW of warmth pump capability in buildings by 2030. The company predicts China’s put in capability to see the quickest progress between 2021 and 2030, surpassing Europe because the second largest warmth pump market by 2030. North America is predicted to stay the market chief till then.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].