A lot has been mentioned about the advantages that putting in photo voltaic and batteries can supply companies however, as firms face rising enter value inflation, is the upfront funding an excessive amount of to bear or are there fast Electrical energy prices make the choice a no brainer?

The rising value of power costs is a serious concern for companies world wide. Fluctuations in power prices can have a major influence on an organization’s backside line, making it difficult to price range successfully and stay aggressive. Luckily, advances in battery and photo voltaic power storage present an answer to assist hedge in opposition to power value dangers.

Picture: GridBeyond

as pv journal readers know, battery storage and PV techniques work collectively to permit companies to generate their very own electrical energy and retailer extra power to be used during times of excessive demand or low daylight. By utilizing these applied sciences, companies can cut back their dependence on grid electrical energy, which is commonly topic to risky pricing constructions.

Companies that rely totally on grid electrical energy are on the mercy of the power market. When power costs rise, their working prices rise, which might have a major influence on their profitability. By investing in battery storage and photo voltaic techniques, companies can generate their very own electrical energy and cut back their reliance on the grid. This provides them higher management over their power prices and helps them keep away from rising power market costs. We already know rather a lot, however how does that precept take form in observe?

Illustration

Suppose a producing fab in Victoria, Australia with an annual power consumption of 8.76 GWh installs a 2 MW photo voltaic system and a 1 MWh battery storage facility, linked to a microgrid. The typical electrical energy value is AUD 0.27 ($0.18)/kWh and the positioning can earn income by collaborating within the Australian Power Market Operator’s Wholesale Demand Response Mechanism (WDRM). The latter program permits customers to answer the wants of the grid by altering their electrical energy load profiles and pays them to take action, with funds various from AUD 1.50 per kilowatt to a discount of peak demand, to AUD 13/kW, primarily based on 2022 costs and relying on the month.

If the manufacturing fab’s photo voltaic system generates electrical energy for six hours per day and the battery is charged and discharged as soon as per day, right here is an estimate of the potential value and income financial savings.

The photo voltaic system generates 13 MWh per day from the six hours of its 2.17 MW working capability. The manufacturing unit’s industrial load demand is 24 MWh per day but it surely solely consumes 6 MWh of the electrical energy generated by the panels, as a result of mismatch between photo voltaic technology hours and unit manufacturing exercise. By discharging the battery one megawatt-hour per day for industrial use, the fab makes use of solely 17 MWh per day of grid energy, as a substitute of 24 MWh, leading to every day value financial savings of AUD 1,890 and month-to-month financial savings of virtually AUD 56,700.

On high of that, if the manufacturing unit has a peak energy demand of three MW for one hour per day, utilizing its microgrid and battery to cut back the height load to 2 MW can herald AUD 5,000 month-to-month revenue, primarily based on WDRM weekday peak demand. decreased cost to AUD 5/kW.

Grid exports

With manufacturing value solely 6 MWh of the 13 MWh generated by the photo voltaic array per day, and assigning an extra megawatt-hour to cost the battery, the remaining 6 MWh may generate a every day revenue of AUD 600 if offered to the grid at AUD 0.10/ kWh, for an AUD 18,000 month-to-month revenue stream.

That every one provides as much as month-to-month power financial savings and incentive funds of AUD 79,700 for our notional fab in Victoria.

That is, after all, an excellent instance and doesn’t have in mind components such because the precise load and solar-generation profiles, which aren’t flat as assumed within the easy instance talked about above, in addition to the arbitrage income alternatives accessible for the battery enhance financial savings by avoiding peak grid electrical energy costs and promoting extra power again to the community at one of the best instances.

A battery also can earn revenue by collaborating in frequency management ancillary markets, balancing provide and demand within the occasion of an sudden generator failure to take care of the frequency degree.

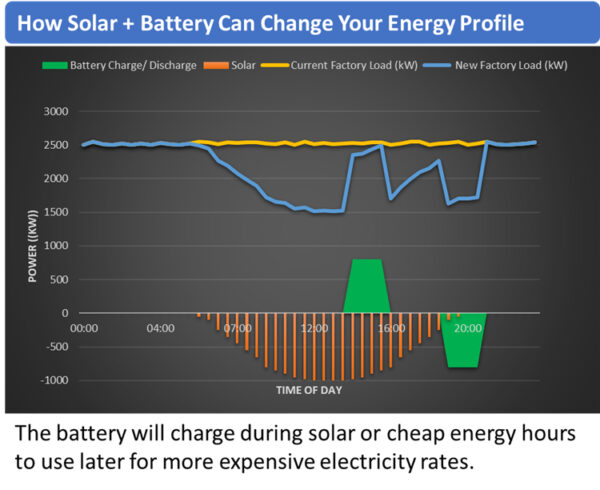

A extra lifelike illustration of the interplay between load, photo voltaic, and battery storage is illustrated within the diagram under.

Precise financial savings and income will depend upon varied components resembling location, measurement, and sort of set up; power costs; and demand profiles in a selected area. The interplay of all these variables on any given day ensures that the decision-making course of turns into more and more advanced. Underneath such circumstances, it’s helpful to make use of mathematical optimization packages to realize one of the best outcomes and get the best return on funding. The essential level to notice is {that a} battery coupled with photo voltaic adjustments the funding danger profile, guaranteeing that a few of the uncertainties related to weather-based energy technology, at the very least partially, eased.

Battery storage and photo voltaic techniques supply companies a brand new resolution to hedge in opposition to power value dangers. By producing their very own electrical energy, decreasing their reliance on the grid, and storing extra power, companies can cut back power prices and enhance their power effectivity. As well as, investing in these applied sciences may also help companies enhance their power independence, cut back their carbon footprint, and contribute to a extra sustainable future.

With these advantages in thoughts, it’s clear that battery storage and photo voltaic is a crucial funding for companies looking for to rise in opposition to power value dangers and stay aggressive in a continuing altering market.

Concerning the creator: Paul Conlon is the pinnacle of modeling & forecasting at Dublin-based artificial-intelligence-backed power companies firm GridBeyond and is an everyday speaker at trade conferences, on power value forecasting and danger administration. Paul has greater than 20 years of expertise within the power and expertise sector and is an skilled in lots of analytical strategies used within the fuel and electrical energy markets. He has labored in varied roles inside power and consulting organizations masking market design, regulation, and buying and selling.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.