Maxeon Solar Stock: Profitability Needs To Come Sooner (NASDAQ:MAXN)

Thinnapob/iStock through Getty Photographs

Maxeon Photo voltaic Applied sciences (NASDAQ:MAXN) has a global presence, designing, manufacturing, and promoting photo voltaic system parts. Their TAM is big and continues to develop YoY. With clients starting from small firms to bigger and extra established ones, the enterprise mannequin is very scalable and may regulate to completely different wants.

However on a unfavourable line, the present share worth doesn’t commerce on fundamentals, however optimistic future prospects. I believe their future is thrilling, and I am nonetheless optimistic. But it surely nonetheless thinks that promoting any share is the very best, a minimum of till we see a constructive backside line.

The Photo voltaic Market And Maxeon’s Position

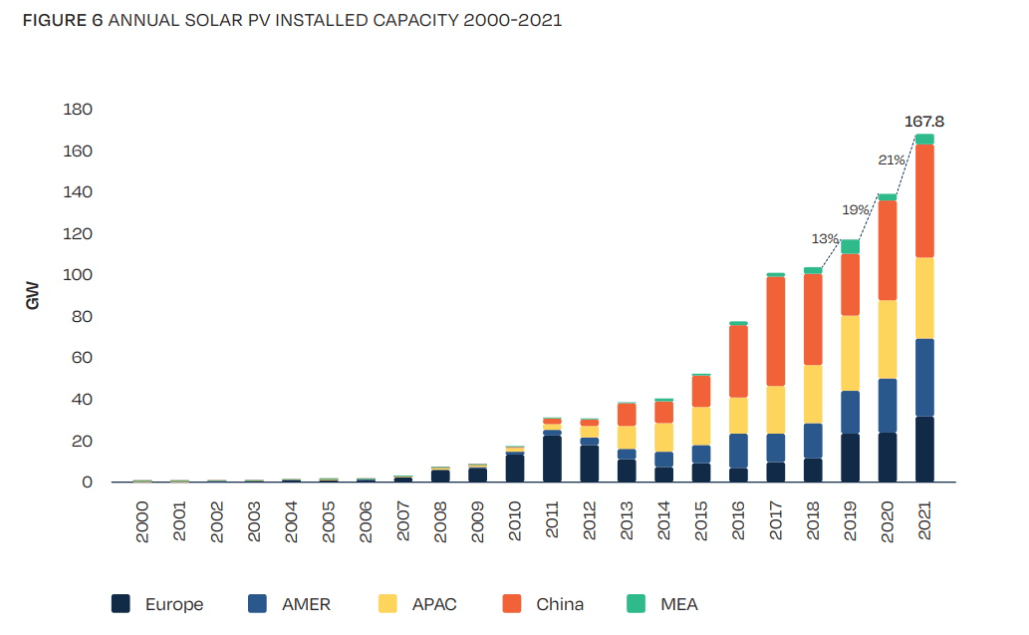

The photo voltaic market is predicted to develop at an annual fee of 20% for the following 10 years. With Maxeon targeted on photo voltaic installations for each industrial properties however primarily residential zones, they’ve a whole lot of future potential. The photo voltaic market is notoriously a really capital intensive market to get into and construct your personal.

Photo voltaic Market Outlook (Maxeon Earnings Presentation)

However for the reason that demand for photo voltaic modules is growing, I hope that Maxeon can streamline their productions a bit extra. That is anticipated to supply the corporate with decrease working prices and that can assist the underside line bounce in the direction of profitability.

One fascinating level I discovered in regards to the residential aspect of photo voltaic adoption is that it is not very accessible. Even when the photo voltaic market is predicted to develop on the fee it has, there will likely be nearly 90% of households in 10 years with out photo voltaic panels. For my part Maxeon ought to be capable of capitalize on this and change into an even bigger participant than earlier than, however once more, they need to concentrate on growing the underside line and incentivizing buyers. to journey.

Firm Considerations

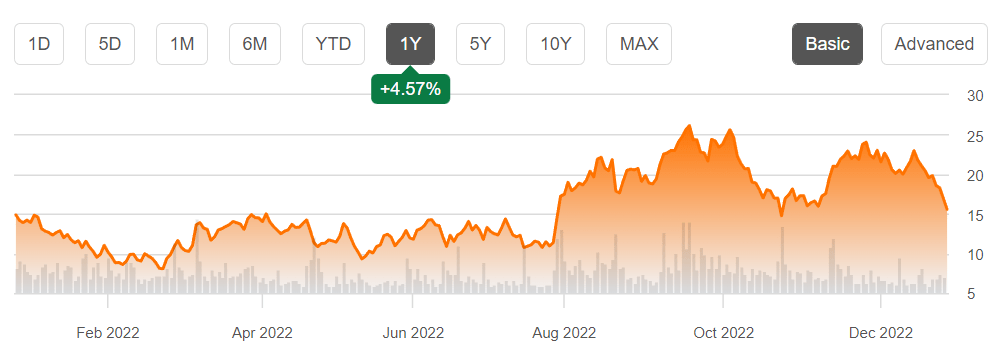

Maxeon Photo voltaic Applied sciences is a small photo voltaic firm in comparison with many different opponents within the house. With the market cap sitting at over $1 billion there have been a number of main modifications within the share worth, such because the current run. In comparison with the remainder of the market, nevertheless, the corporate’s funding this yr might yield about 6%. However there are various dangers on this firm which I’ll undergo additional under.

Maxeon Share Value (Searching for Alpha)

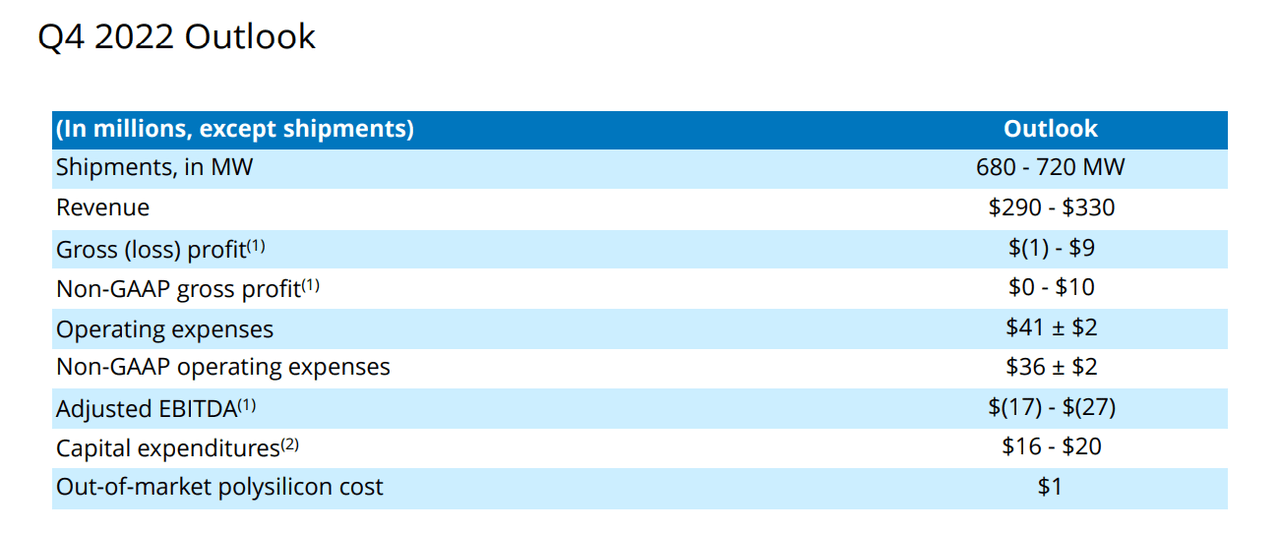

Within the final earnings report supplied by the corporate they forecast to generate between $290 and $330 million, a virtually 50% improve from the identical quarter final yr. This will look like a giant deal, however that ignores that the underside line hasn’t seen the identical improve.

Maxeon’s Earnings Outlook (Maxeon Q3 Earnings Report)

Maxeon’s backside line has been tight for a very long time. They’ve but to realize profitability and I’m involved as an investor trying on the firm. Maxeon has not misplaced the identical quantity as a couple of years in the past so it appears they’re heading in the right direction. However with web margins sitting at -27% I believe endurance is vital.

Apart from having frankly horrible margins, Maxeon has different purple flags. The one which stands out to me probably the most is unfavourable money flows. They are not getting any higher for my part which makes me fear that the cut up meltdown will proceed to occur.

Admire Maxeon Photo voltaic Applied sciences

It is onerous to place a quantity and worth on what Maxeon is value. With most firms which have such unfavourable margins I are likely to avoid them utterly. With unfavourable EPS that makes it onerous to argue why you must pay something greater than 1 cent per share from a price perspective. Wanting on the firm’s worth/guide gross sales of over 8 in comparison with the sector common of three. I believe that solar-related firms are usually a bit overpriced as a consequence of investor optimism. . However an ap/b ratio of 8 is simply too excessive to be value it for my part, go under 1 and also you get lots.

In Maxeon’s case, I will wait till I get a clearer image of what the revenue path seems like. That is an thrilling firm with a booming market to be part of.

There are some things I will likely be looking ahead to within the subsequent quarterly studies that Maxeon will present. Wanting on the tempo of rising working prices relative to revenues generally is a good one. But additionally seeing the order backlog that the corporate has, that provides me a good suggestion of how a lot demand they’re seeing and if there are hiccups by way of product manufacturing and transport.

Conclusion

Maxeon Photo voltaic Applied sciences is an organization working within the photo voltaic power sector. They manufacture and promote photo voltaic modules which might be put in in residential and non-residential zones. They’re rising revenues at a formidable tempo, growing 50% YoY within the final earnings report.

Though revenues are growing at a very good tempo, the underside line is just not on the identical tempo. With out good margins it’s tough to run a enterprise in the long run. With the online margin sitting at -28% it’s onerous for me as an investor to justify placing any cash into this firm. Till that quantity will get near 0, I would not advocate anybody to consider investing.

Lastly, the valuation for me is simply too wealthy. I anticipate they will not be worthwhile even for one more 4-5 years. I maintain lifelike valuations as one in all my most necessary pillars of investing. With unfavourable EPS not anticipated to show constructive for some time, the funding is now “useless cash” and the draw back danger is far larger than the potential return. For all these causes I might not make investments any capital in Maxeon Photo voltaic Applied sciences, and would counsel that buyers promote their positions.