Mixed price signals for solar wafers, narrowing spread between M10 and G12 wafer prices – pv magazine International

Within the new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the primary value developments within the world PV trade.

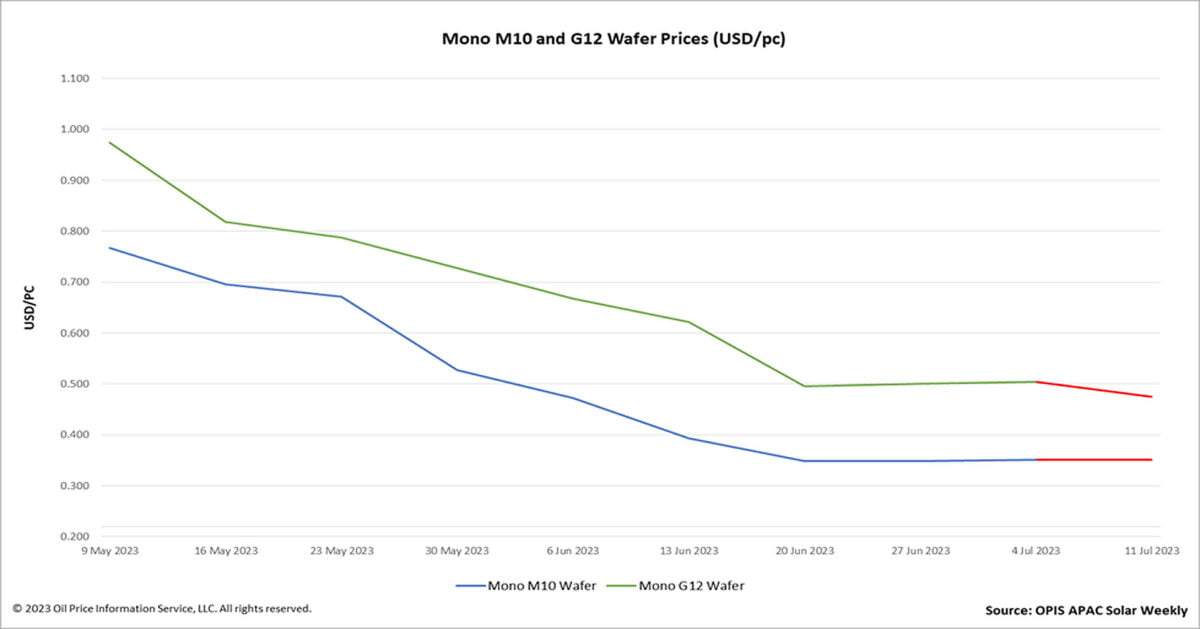

This week, Mono M10 wafers trended flat after final week’s value improve, reporting $0.351 per piece (laptop). A number of sources confirmed this week that the worth of Mono M10 wafers has grown to the extent reported by OPIS final week, which is roughly CNY2.85 ($0.40)/laptop.

One of many components contributing to the worth improve is the decline in wafer stockpiles, with some stock being transferred to cell producer crops. Cell makers have elevated wafer purchases previously few weeks when wafer costs have been low. Lower than 1 billion items of wafers are at the moment stockpiled in wafer services, equal to a few to 5 days’ value of manufacturing and regarded low stock ranges, in accordance with a supply from a big wafer manufacturing facility.

As well as, producers try to recuperate earnings now by elevating costs initially of the second half of the yr, and to enhance the monetary report of this era, defined a supply.

Then again, the costs of Mono G12 wafers noticed a week-on-week fall of 5.75% to $0.475/laptop, marking their lowest level of the yr, in accordance with OPIS evaluation.

In line with a supply from the wafer section, the worth discount of Mono G12 wafers seems to be a pricing technique reasonably than a value adjustment in response to market provide and demand. The value of G12 wafers per W must be comparable and even decrease than the worth of M10 wafers per Watt if producers are to advertise the price benefit of G12 wafers and develop G12’s market share.

Whereas polysilicon costs are low, wafer producers are rushing up their materials purchases and growing working charges, with the common working price of wafer companies growing by 80-100%, a number of sources mentioned. .

In line with a supply, whole wafer output is anticipated to succeed in 52 GW in July based mostly on a median working price of 85%, representing a month-on-month progress of just about 15%. One other supply mentioned that since no less than two main wafer producers will launch new capability within the second half of this yr, the basics of the wafer market will stay dominated by oversupply within the close to future.

OPIS, a Dow Jones firm, supplies vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Photo voltaic Alternate in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].