The transition to n-type expertise in mainstream PV manufacturing is a serious growth in PV cell and module manufacturing by 2022. Producers have added TOPCon and HJT capability and racked up course of effectivity milestones.

The event of PV cell and module expertise is one dictated by each energy output and price. And whereas n-type applied sciences, such because the heterojunction (HJT), have lengthy demonstrated superior power yields and conversion efficiencies, lower-cost applied sciences corresponding to a p-type passivated emitter rear contact (PERC) was capable of obtain excessive efficiency at a decrease value. construction.

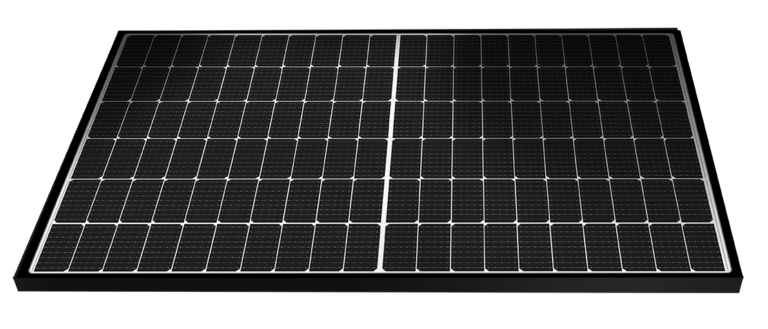

In 2022, PERC stays the dominant PV expertise. Bigger wafer sizes, mixed with half-cut cells, excessive density layouts, and multibusbar cell interconnection, utilizing monocrystalline PERC cells, yield excessive energy outputs and module outputs of 400 W to 500 W and much more.

Nonetheless, with PERC cells approaching their theoretical effectivity restrict of 24.5%, 2022 will see producers return to tunnel oxide passivated contact (TOPCon) and HJT expertise, on n-type wafers. And if value buildings, particularly associated to the consumption of silver for cell metallization, may be lowered, 2022 may very well be seen because the yr during which a serious technological change within the photo voltaic business begins .

“2022 is an thrilling yr,” mentioned Molly Morgan, a senior analysis analyst at UK-based analysts Exawatt. “With mono PERC effectivity enhancements being sluggish, it’s thrilling to see extra producers adopting n-type applied sciences and to see this mirrored within the proportion of n-type modules out there in the marketplace.”

Data fell

Excessive-efficiency information have been achieved by producers of n-type expertise even earlier than the beginning of 2022. In August 2021, the Chinese language HJT producer Huasun introduced that it had achieved cell effectivity which is 25.26% of an M6 format (166mm) cell – equal to the world document. A cell effectivity of greater than 25% exceeds what p-type PERC can obtain and is sort of a watershed for the business.

Specifically, the manufacturing processes developed by Huasun, along with its manufacturing tools accomplice Maxwell, signify a departure from the processes utilized by earlier expertise builders, corresponding to Panasonic and Sanyo. earlier than this.

“Huasun makes use of microcrystalline and nanocrystalline layers, a number of layers, and a two-layer TCO,” mentioned George Touloupas, the director of expertise at high quality assurance supplier Clear Vitality Associates (CEA). “Amorphous silicon absorbs a whole lot of mild. That is why the effectivity of the HJT is identical as TOPCon at this time, even when it has a excessive voltage, as a result of it all the time has mild absorption points that scale back the present. That is one of many large factor that Huasun is making an attempt to enhance now.

In June, Chinese language monocrystalline ingot and wafer big Longi topped Huasun’s HJT document, hitting 26.5% of M6 wafers. Whereas it seems that Longi’s first step in n-type manufacturing is to improve at the least a few of its PERC traces to TOPCon, it could nonetheless undertake HJT within the close to future, and clearly which has put appreciable assets into cell expertise R&D.

Notably, HJT capability is being constructed exterior of China. Rising European PV producers are additionally shifting ahead with HJT, with Meyer Burger and Enel Inexperienced Energy main the best way. Singapore producer REC has one of many longest monitor information of HJT manufacturing amongst this second wave of producers of its award-winning Alpha sequence.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.