TrendForce says that polysilicon will likely be 3.2% cheaper in March than in February. This can result in decrease wafer, cell and module costs and successfully stimulate set up demand.

TrendForce mentioned it expects costs of polysilicon, photo voltaic cells, and modules to drop barely in February, when Chinese language producers unexpectedly raised costs throughout the provision chain.

“The costs of polysilicon started to say no in December final yr, so the key polysilicon suppliers started to restrict the provision out there,” the analysts mentioned, noting that the value drop is said to the fast enhance in polysilicon capability all through the Chinese language trade. “Subsequently, Chinese language polysilicon costs started to rally forward of the Lunar New Yr vacation this January, rising quickly to the present vary of CNY 220 ($31.55) to CNY 240 per kg.”

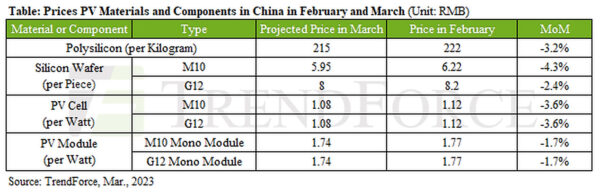

They mentioned they imagine the typical value of polysilicon will drop 3.2% from CNY 222/kg in February to CNY 215/kg in March. Wafer costs, then again, are prone to drop by 4.3%, from CNY 6.22 per piece to CNY 5.95 for M10 merchandise and from CNY 8.2 to CNY 8 for G12 merchandise.

Common costs for M10 gadgets ought to lower by 3.6% from CNY 1.12 per watt to CNY 1.08 for M10 and G2 merchandise. The worth of M10 and G12 monocrystalline panels, in the meantime, ought to fall from CNY 1.77 per W in February to CNY 1.74 in March.

“Wafer suppliers are considerably rising their capability utilization charges as polysilicon provide is increasing once more. Due to this fact, wafer costs won’t be able to maintain their upward momentum as provide turns into extra plentiful, “mentioned TrendForce. “The short-term tightening of wafer provide additionally places strain on cell provide. Nevertheless, there’s widespread expectation for this part of the rise, so cell consumers typically settle for larger costs.

Analysts mentioned the module costs will match the standard vary after the drop within the costs of supplies and elements.

“The autumn in module costs will successfully stimulate set up demand, and the height season for installations is anticipated to reach earlier in comparison with earlier years,” they defined, warning that the PV trade in China might face extreme value fluctuations within the quick time period. “Due to this fact, module suppliers are extra optimistic concerning the market scenario from this March.”

“Total, there’s a appreciable degree of uncertainty within the improvement of the worldwide PV market this yr,” they concluded.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.