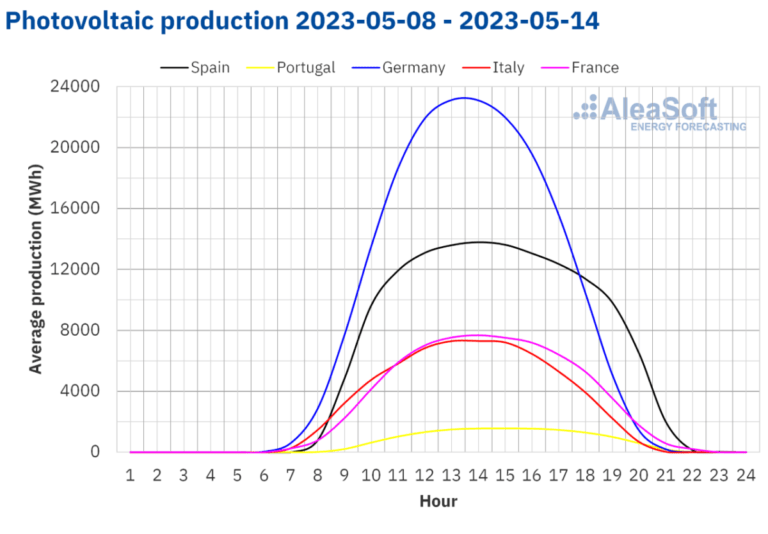

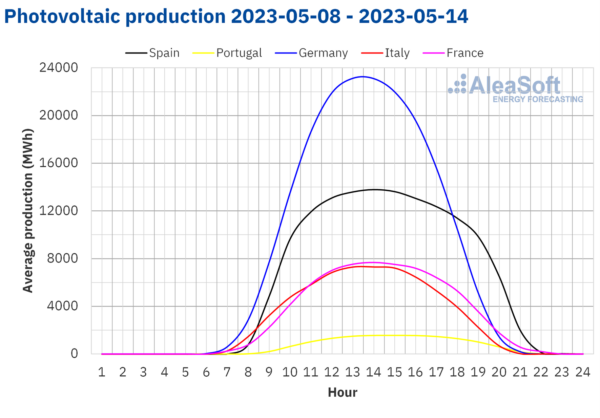

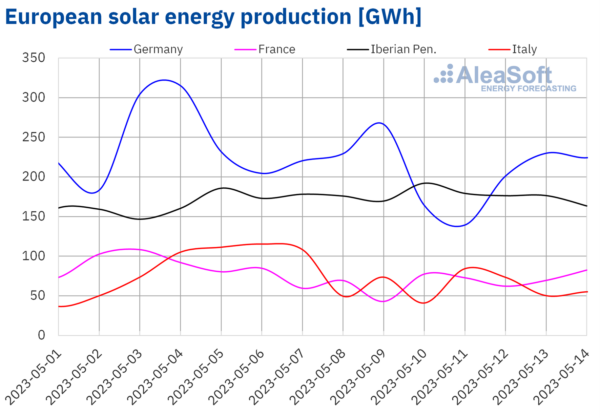

Within the week of Could 8, the manufacturing of photo voltaic vitality elevated in comparison with the earlier week within the Iberian Peninsula, 10% in Portugal and 5.6% in Spain. In Portugal, on the finish of the week, the 4 hours with the best worth within the historical past of this photo voltaic photovoltaic vitality manufacturing market had been registered, exceeding 1,634 MWh in every of them. The file worth of the best manufacturing was registered on Saturday, Could 13 between 13:00 and 14:00 with 1,645 MWh generated by this expertise. In Mainland Spain, the third and fourth highest photo voltaic photovoltaic vitality manufacturing values in historical past had been registered between 13:00 and 15:00, that are greater than 15,100 MWh.

Nonetheless, within the remaining markets analyzed by AleaSoft Vitality Forecasting, a lower in photo voltaic vitality manufacturing was registered, which was 29% in Italy, 21% in France and 13% in Germany. For the week of Could 15, AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasting exhibits that it might proceed to extend in Germany, whereas in Spain and Italy it might lower.

Graphics: Aleasoft

Graphics: Aleasoft

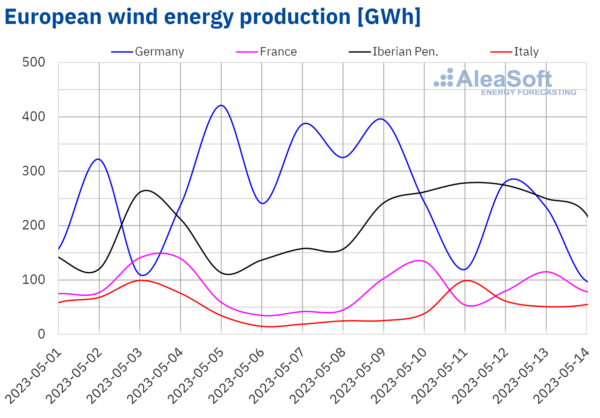

Within the second week of Could, an vital enhance was registered within the manufacturing of wind vitality in Portugal, when it elevated by 89% in comparison with the manufacturing within the first week of the month. Within the Spanish and French markets, the manufacturing of this expertise additionally elevated, 39% in Spain and seven.2% in France. Nonetheless, wind vitality manufacturing in Germany was set 10% decrease than final week, and 4.2% in Italy. For the third week of Could, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasting exhibits that wind vitality manufacturing might lower in a lot of the analyzed markets besides Italy.

Graphics: Aleasoft

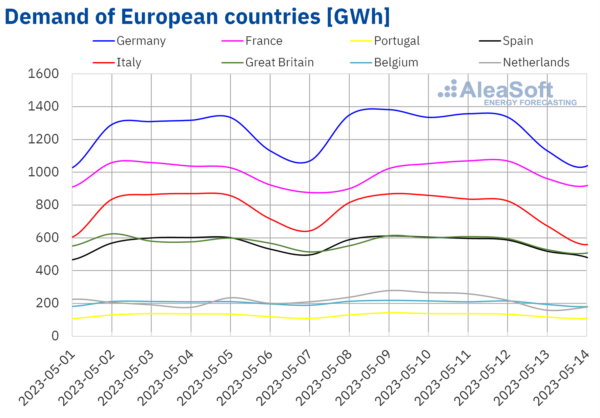

Electrical energy demand

In the course of the second week of Could, electrical energy demand elevated in comparison with the earlier week in virtually all analyzed markets. This conduct is principally on account of demand restoration after day 1 which is a vacation in most markets. The will increase are between 0.9% in Italy and 11% within the Netherlands. Nonetheless, in Nice Britain, the place on Monday, Could 8, the festivities related to the coronation of King Charles III continued, demand decreased by 0.2%.

Relating to the typical temperature, reductions had been registered in comparison with final week within the southern markets of Europe, Spain, Portugal, France and Italy, in addition to in Nice Britain, whereas the temperature elevated in different markets. For the week of Could 8, in response to demand forecasts made by AleaSoft Vitality Forecasting, demand is anticipated to extend in European markets apart from Spain, the place Could 15 is a vacation in Madrid, and in Germany, Belgium and the Netherlands. , the place on Could 18 Ascension Day is widely known.

Graphics: Aleasoft

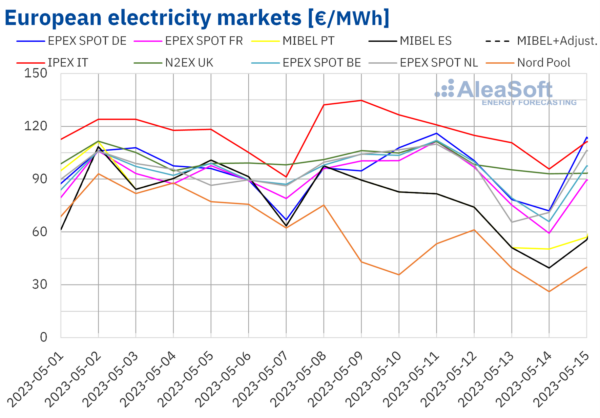

European electrical energy markets

Within the week of Could 8, costs in most European electrical energy markets analyzed by AleaSoft Vitality Forecasting remained secure, though there was a slight enhance in pattern in comparison with the earlier week. The best value enhance, of 5.4%, was registered within the Italian IPEX market. However, costs decreased within the Nordic and Iberian markets. The most important value drop, which was 39%, was the Nord Pool market within the Nordic nations. Within the case of the MIBEL market in Spain and Portugal, the discount was 14% and 17%, respectively.

Within the second week of Could, the best common value, which was €119.36 ($129.98)/MWh, was within the Italian market, adopted by the typical within the N2EX market in the UK, which was €101.47/MWh. However, the bottom weekly common value is that of the Nordic market, which is €47.74/MWh. In the remainder of the analyzed markets, the costs vary from €73.76/MWh within the Spanish market and €95.13/MWh within the EPEX SPOT market in Germany.

Relating to hourly costs, within the MIBEL market in Spain, on Sunday, Could 14, 9 hours of zero-price had been registered, between 9:00 and 18:00. Within the MIBEL market in Portugal, on the identical Sunday, there are three hours of zero-price, from 15:00 to 18:00. However, within the Dutch market, on Saturday, Could 13, between 11:00 and 16:00, a zero-price hour and 4 destructive value hours had been registered. The bottom hourly value, which was -€99.93/MWh, was reached from 13:00 to 14:00 and was the bottom since April 19.

Within the week of Could 8, the lower within the common value of gasoline was compensated by the rise in demand in most markets. Within the case of the Italian market, the manufacturing of wind and photo voltaic vitality decreased, with the best weekly common worth registered. Nonetheless, the rise within the manufacturing of photo voltaic vitality and the associated enhance within the manufacturing of wind vitality within the Iberian Peninsula contributed to the lower within the value registered within the MIBEL market. The worth forecast of AleaSoft Vitality Forecasting exhibits that, within the third week of Could, costs might lower in most European electrical energy markets.

Graphics: Aleasoft

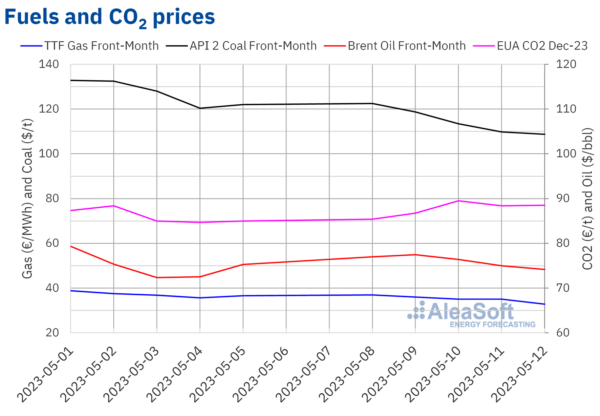

Brent, gasoline and CO2

Brent oil futures settlement costs for Entrance-Month on the ICE market registered a settlement value of $77.01/bbl on Monday, Could 8. This value is 2.9% decrease than final month, however 2.3 % greater than the final session within the first week of Could. On Tuesday, Could 9, costs continued to rise and the best weekly settlement value, which was $77.44/bbl, was reached, which was 2.8% greater than the earlier week. Subsequently, costs declined till the bottom weekly settlement value was registered, which was $74.17/bbl, on Friday, Could 12. This value was 1.5% decrease than final Friday.

Information about america’ plans to fill strategic reserves of crude oil contributed to the weekly highest common value reached on Tuesday, Could 9. Nonetheless, within the second week of Could, the Brent futures costs proceed to be influenced by fears. of an financial recession and issues concerning the instability of the US banking sector.

As for TTF gasoline futures on the ICE marketplace for the Entrance-Month, on Monday, Could 8, they reached the weekly highest settlement value, of € 36.87 / MWh, though this value is 5.0 % decrease than final Monday. Subsequently, a value discount was registered. In consequence, on Friday, Could 12, the weekly minimal settlement value, of €32.77/MWh, was reached. This value is 10% decrease than final Friday and the bottom because the first half of July 2021.

The abundance of liquefied pure gasoline provide and excessive ranges of European shares continued to have a downward affect on costs within the second week of Could.

Relating to the CO2 emission rights future on the EEX marketplace for the reference contract of December 2023, at first of the second week of Could, the costs continued the upward pattern that began final week. On Wednesday, Could 10, the best weekly settlement value, €89.49/t was reached, which was 5.3% greater than the earlier Wednesday. Nonetheless, on Thursday costs decreased and within the final two periods of the week, settlement costs remained beneath € 88.50 / t. Regardless of this, the settlement value on Friday, Could 12, was €88.48/t, 4.1% greater than final Friday.

Graphics: Aleasoft

AleaSoft Vitality Forecasting’s evaluation of the prospects for European vitality markets and the financing and estimation of renewable vitality tasks On Thursday, Could 11, the final webinar of AleaSoft Vitality Forecasting and AleaGreen was held. The subjects lined on this webinar are the evolution of European vitality markets and the imaginative and prescient of the way forward for the vitality sector. Luis Atienza Serna, who’s Normal Secretary of Vitality, Minister of the Authorities of Spain and president of Purple Eléctrica de España for a number of years, joined the evaluation desk of the webinar in Spanish.

The following webinar within the sequence of month-to-month webinars on AleaSoft Vitality Forecasting and AleaGreen will happen on June 8 and it’ll have the participation of audio system from Engie. On this case, along with the evolution of vitality markets, the financing of renewable vitality tasks and PPA will probably be analyzed. Key regulatory points within the electrical energy sector may also be mentioned.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.