Bilanol

Shoals Technologies’ (NASDAQ:SHLS) innovative solutions for customers provide a strong market position and strong finances for the company. As a leader in one of the fastest growing solar industries, Shoals will benefit from market acceleration in a variety of product lines, including utility-scale solar, energy. storage, and EV charging infrastructure. The Shoals could be a buying opportunity for patient investors who believe supply chain issues and regulatory hurdles are temporary.

In this analysis, I explain why I am bullish on long-term fundamentals, but rate the stock a hold – I acknowledge that shares may have limited upside until some worries will be removed.

Overview

Shoals provides electrical balance of systems (EBOS) solutions for utility-scale solar, solar storage, and EV charging infrastructure. EBOS has all the pieces needed to transfer power from a solar panel to an inverter and, finally, to the grid. They sell these critical components to engineering, procurement, and construction firms (EPCs) that build solar energy solutions. The benefits of the “plug-and-play” design of EBOS is that it requires very little technical knowledge or experience to install the components.

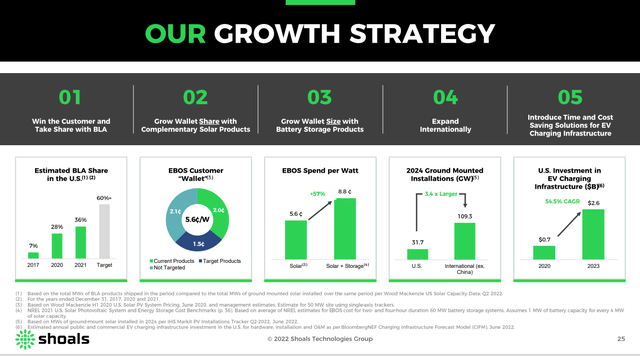

The management strategy for the company so far has been focused on growth. Opportunities for growth abound, and the company is executing well by signing new customers, developing new products, and expanding internationally. Shoals is in the early stages of growth and is developing many pieces of its business model, and as they all come together it should translate to higher profits in the future.

Q3 2022 Presentation to Investors

From a financial standpoint, the company has a proven track record since its IPO in 2019. Revenues, gross profit, and adjusted EBITDA grew at a CAGR of 22%, 37%, and 31%, respectively. Additionally, Shoals reported Q3 2022 results that beat analyst expectations and reaffirmed FY22 guidance. Backlog and awarded orders increased 74% and 44% compared to the same period last year, respectively, suggesting potential upside in the FY23 outlook.

Cash Conversion Cycle

One of the many measures of management effectiveness and profitability is to analyze the company’s cash conversion cycle (CCC), also known as operating working capital. This metric measures how much time it takes a company to turn inventory into cash. For industrial companies, the cycle begins when a business buys raw materials, turns them into finished goods, then sells them, and receives payments from customers to complete the cycle.

The three core accounts that make up operating working capital are Accounts Receivable, Inventory, and Accounts Payable. Companies that are disciplined in controlling the collection of receivables, effectively managing inventory, and delaying payments to vendors have a low cash conversion ratio.

The metric is calculated in three parts:

Days of Inventory Outstanding (DIO) = Inventory / COGS * days

Days of Sales Outstanding (DSO) = Accounts Receivable / Revenue * days

Days of Payables Outstanding (DPO) = Accounts Payable / COGS * days

Cash Conversion Cycle (CCC) = DIO + DSO – DPO

Shoals Cash Conversion Cycle Metrics:

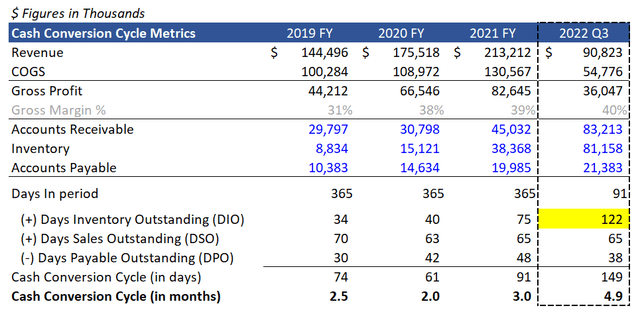

Company Filings Prepared by Author

The conventional nature of Shoals system solutions and the long development cycle for solar energy projects is evident due to their relatively high conversion ratio. For the 2021 fiscal year, Shoals took 91 days (three months) to convert its inventory to cash, up from 61 days (two months) at the end of 2020. In their 2022 Q3 earnings results, the cash conversion cycle jumped to 149 days (4.9 months). You can see that the outstanding days of inventory is increasing while the days receivable and payable remain flat, which is the result of excessive increase in balance inventory. Shoals is sitting on $81m of inventory in 2022 Q3 compared to $9m at the end of 2019. In the end, it appears that too much money is tied up.

The basic concept of the inventory cycle begins when the product is finished and ends when a customer places an order. For Shoals, excess inventory can mean that they have an unnecessary amount of raw materials or finished goods in the queue that they cannot sell. Management stated that they do not stock many finished goods, so they are likely sitting on a lot of raw materials.

Inventory build-up will eventually flow into COGS on the income statement, which may suggest that gross margins will deteriorate in the future. Gross margin increased from 31% at the end of 2019 to 40% in 2020 Q3. At the same time, inventory turnover days grew from 34 days to 122 days. Therefore, as the inventory turnover ratio decreases (increases) and products move faster, gross margin should decrease as COGS is affected. During their recent earnings call, management noted that it has “opportunities to optimize working capital, particularly inventory and accounts receivable, in the coming quarters.”

Solar Demand Stifled by Regulatory Barriers

Two key assumptions threaten Shoal’s long-term success. First, the demand for solar projects is less than expected, and second, the government policy hinders the deployment activity of renewable projects.

Demand risk is less of a concern as a central theme of the last decade has been a push for green technology and a shift towards a zero-carbon based world. Most countries have committed to carbon neutrality by 2050, which has led to a surge in investments in renewable energy. Shoals will benefit from demand tailwinds as more solar projects are deployed. It is unlikely that the demand for solar energy will slow down, especially after the Inflation Reduction Act (IRA) encouraged the adoption of solar by allowing energy tax credits.

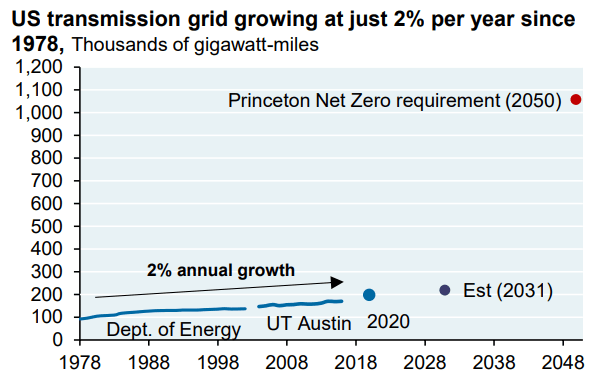

In JPMorgan’s 2022 Annual Energy Paper, they highlight why it is so difficult to get transmission projects approved and built. In summary, the current process is ineffective due to poor project management, and it can take up to 4 years to obtain a connection permit. Obstacles such as federal eminent domain, jurisdictions blocking multi-state line projects, and interconnection queue capacity issues can hinder the achievement of a permit. US transmission infrastructure has grown only 2% per year since the 1970s, and some projections now estimate only 1% transmission growth through 2030. Compare that to the grid expansion needed to achieve net-zero requirements, and you can see that we’re not on track to achieve this lofty goal.

JP Morgan 2022 Annual Energy Paper, pg 12

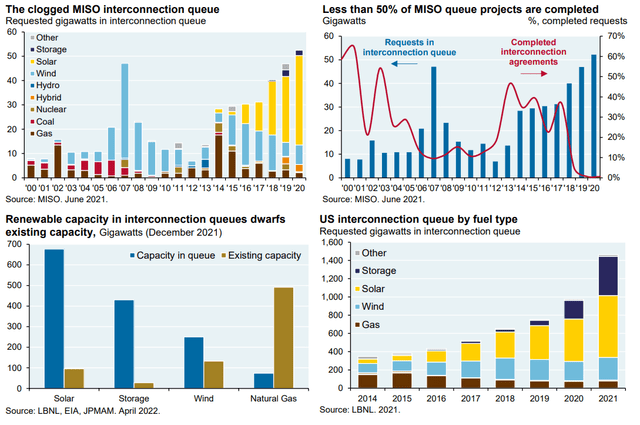

The paper also examined transmission projects in 15 midwestern and southern states (MISO region) and found that less than 50% of renewable energy projects have been completed. Evidence for this is shown in the chart on the upper right.

JP Morgan 2022 Annual Energy Paper, pg 14

The graph above does not show the requested GW of generation entering the interconnection queue each year by renewable type. The yellow bars represent the growing backlog of solar projects, and you can see the large pipeline of projects. The timetable for the completion of these projects is still being determined due to the obstacles mentioned earlier. The graphs below continue to highlight that there are many solar projects “in limbo” relative to existing capacity and that solar energy is the preferred fuel source compared to wind and natural gas.

There is a disconnect between what lawmakers are lobbying for vs. what regulatory groups are opposed to highlighting the inefficiencies of adding more renewable sources to the grid. Despite the political risk, I believe the solar project success rate will increase over time as regulators are forced to meet net-zero carbon goals and forced to unclog the backlog of solar projects. which is waiting to be connected. However, this may take time to work as the jurisdictional process is known to be slow moving.

Peer Comparison

Below is a table of relevant valuation metrics for Shoals compared to its peers SunPower Corp. (SPWR), Array Technologies (ARRY), and First Solar (FSLR).

| Shoals Technologies Group, Inc. | SunPower Corporation | Array Technologies, Inc. | First Solar, Inc. | |

| Market Cap ($M) | $3,759 | $3,837 | $2,902 | $16,377 |

| Price/Sales (TTM) | 10.9 | 2.2 | 2.1 | 6.7 |

| EV/EBITDA (FWD) | 33.3 | 39.6 | 31.1 | 53.4 |

| 3 Year Revenue (CAGR) | 27% | 16% | 43% | 2% |

| Gross Profit Margin | 38% | 17% | 11% | 12% |

| Cash From Operations ($M) | $7.6 | $ (172.3) | $(53.3) | $112.6 |

| Capital Expenditure ($M) | $(4.0) | $(43.0) | $(7.8) | $ (771.5) |

| 10 Year Price Performance | – | 759% | 519% | 587% |

| Altman Z Score | 3.5 | 1.4 | 1.8 | 4.8 |

Source: Search Alpha

The metrics above illustrate how the market views Shoal’s current valuation. With the highest price-to-sales ratio relative to peers, Shoals investors are paying a premium for their high revenue growth and strong gross margins. Gross margin is 14% higher than its peer average. Shoals is the least capital-intensive of its peers and generates positive cash flow from operations.

Shoals competitors have been around for a decade and have generated an average absolute return of 620% (20% CAGR) since then. The market is pricing in the assumption that shoals will generate similar returns because they trade at higher multiples.

Additionally, Shoals has an Altman-Z score of 3.5, which is in the “safe zone.” This is an important metric for emerging growth companies because the Altman Z-Score model is an accurate forecaster of failure up to two years before the crisis.

Final Thoughts

Shoals is a great company that has created a faster and more efficient electrical installation solution for its customers. While the focus has been on solar solutions so far, EV system solutions are being deployed, providing additional growth and diversification benefits as the electric battery storage market develops. Additionally, increasing demand for solar energy will help the company grow in the long term.