The year it all changed – pv magazine International

From pv journal 06/23

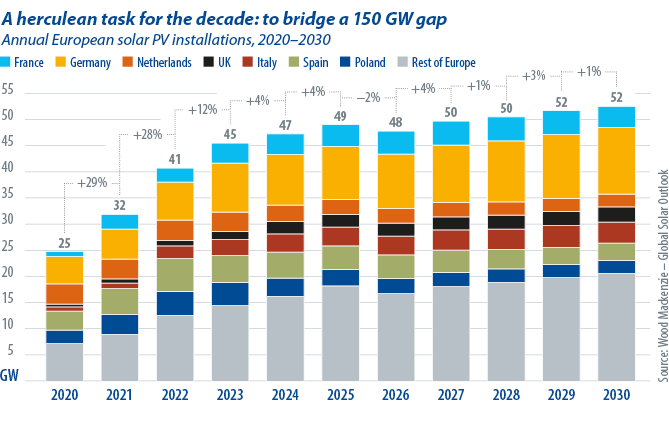

It could really feel like outdated information to speak about 2022 in the midst of 2023 however the affect of a very powerful yr for vitality markets in a long time shall be felt till 2030. The European Fee has doubled the photo voltaic targets to chop pure gasoline in Russia beneath the REPowerEU plan, goal 415 GW of complete photo voltaic by 2025, and as much as 750 GW this decade. The size of the ambition is unprecedented: Europe needs to triple its capability in eight years. Decarbonization is important and vitality safety has additionally been prioritized, beneath the EU Photo voltaic Technique.

On the regulatory entrance, taxes and caps on member-state vitality firm income improve threat premiums, particularly for tasks supported by photo voltaic and energy buy agreements (PPA), with extra extensions that are likely to decelerate building.

With electrical energy payments rising by a mean of 38% within the euro space over the previous 18 months, the distribution of annual photo voltaic capability progress has damaged earlier yr’s information. Residential installations hit practically 15 GW in main EU markets whereas industrial and industrial additions rose to 13 GW.

Company PPAs

Wooden Mackenzie’s base case state of affairs sees Europe including round 400 GW of photo voltaic by 2030, which means the EU will miss the goal by round 150 GW – with present cumulative capability of round 200 GW. The one method to bridge that hole is to sort out grid, allowing, and provide chain constraints.

Company PPAs will drive utility scale photo voltaic as tightening environmental, social, and company governance (ESG) necessities and structurally greater electrical energy prices encourage enterprise take-up. Spain stays the most important PPA market in Europe however volumes are rising in Germany, France, and Poland.

Native opposition and approval processes will proceed to sluggish progress, particularly in Italy, and grid points are acute within the Netherlands, the place congestion administration has been used lately.

REPowerEU is betting on rooftop photo voltaic due to its modular nature and the huge, untapped potential of the continent. The European Photo voltaic Rooftop Initiative targets 52 GW to 58 GW of extra capability by 2025 in its conservative state of affairs. That is an formidable however achievable aim amid structurally greater retail electrical energy costs and a return to a downward trajectory in part prices. We predict that distributed-solar’s levelized price of vitality (LCOE) will lower practically 30%, on common, this decade.

Roof settings

With internet metering changed by much less beneficiant funds for prosumer electrical energy grid exports, the European Fee’s toolbox to spice up rooftop PV depends on building mandates ranging from 2026 to 2028 and likewise returning vitality communities . It’s unclear what number of member states will apply to the mandates, what exemptions shall be granted, and whether or not extra capital expenditure subsidies or tax incentives will assist the launch.

Regardless, dwelling photo voltaic will proceed till 2030 and the sector ought to appeal to low and medium earnings clients and collective programs for flats. Vitality communities assist democratize residential photo voltaic.

Upfront prices stay the most important barrier to entry for households. Third-party, subscription-based possession fashions can alleviate monetary constraints and cut back know-how dangers related to subpar installations.

Heating and transportation electrification will achieve steam by 2025. Warmth pumps and home electrical car (EV) charging stations will additional push residential photo voltaic. As family hundreds improve so do electrical energy prices, reinforcing rooftop PV.

Upfront prices can be a barrier so warmth pumps and EV chargers require subsidies and interest-free financing in addition to restrictions on pure gasoline heaters and inner combustion engines. autos.

Along with dwelling vitality storage options, heating and transport electrification assist align dwelling vitality consumption and peak technology profiles, offering flexibility to the grid. This shall be a priceless profit as governments section out funds for surplus-electricity grid exports. The case for maximizing self-consumption will solely develop.

On the industrial photo voltaic entrance, the 2026-27 rooftop mandates for industrial buildings shall be main progress drivers; together with fluctuations in retail electrical energy costs, and enhancements in set up and operational price efficiencies.

Costs are important

Provide chain volatility poses a big threat to the expansion of photo voltaic buildout in these segments. Gear price inflation since 2020 has already led to challenge cancellations and public sale undersubscription throughout Europe, as ceiling bid costs stay low in comparison with LCOE ranges and company PPA costs.

Nevertheless, PV part costs have began to fall and can proceed to fall as provide and demand stabilize. However this story of complete price discount might look totally different if the European Fee achieves its aim of implementing the uptake of home-made tools for public public sale tenders, including price for builders.

This localization technique is partly a response to the Inflation Discount Act in the US but additionally a push to diversify the provision of PV know-how in Europe from China, in an surroundings of heightened geopolitical rigidity. If these efforts strengthen, and are supported by native content material requirement insurance policies, we’ll see PV part costs rise anyplace between 10% and 40%. That can rely on how a lot the EU implements reshoring of the general PV manufacturing provide chain.

In regards to the authors: Juan Monge is a principal analyst in Wooden Mackenzie’s energy and renewables group, protecting distributed photo voltaic market developments throughout Europe. Previous to his present function, Monge was a senior convention content material supervisor, main content material growth for Wooden Mackenzie/Greentech Media’s vitality transition convention portfolio in partnership with the heads of the analysis follow at WoodMac.

Daniel Tipping is a photo voltaic analyst in Wooden Mackenzie’s vitality transition follow, specializing in European PV markets and PPA traits. Previous to becoming a member of WoodMac, Tipping labored as an offshore vitality analyst for a consulting agency in London the place he additionally helped forecast wind turbine vessel dynamics. He graduated from the College of Bristol with a grasp’s diploma in civil engineering, specializing in photo voltaic and renewable vitality know-how.

This copy was amended on 31/05/23 to point that the European Photo voltaic Rooftop Initiative is concentrating on 52 GW to 58 GW of latest technology capability slightly than the “nearly 60 GW” acknowledged in our print version.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].