Battery power storage has seen an enormous enhance in contracted capability in British auctions this 12 months, with many utility-scale initiatives securing long-term offers. The enterprise case, nevertheless, is just not as robust for all storage durations.

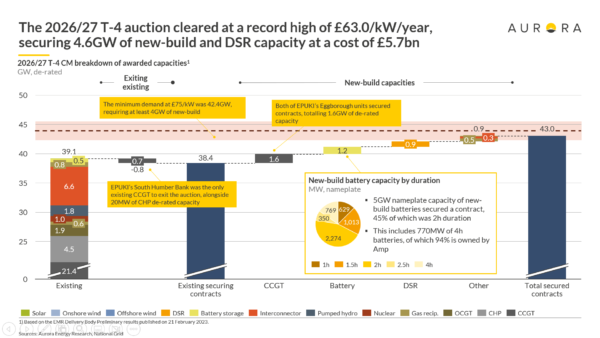

Capability market auctions in the UK have emerged as a significant catalyst for battery power storage system (BESS) deployment. On February 21, 2023, roughly 5 GW of nameplate capability of new-build batteries secured contracts within the 2026/27 T-4 Capability Market public sale – successfully doubling the UK’s present pipeline of approx. BESS mission.

About 45% of the auctioned initiatives include two-hour length storage techniques. About 770 MW from BESS initiatives with a four-hour length, of which 94% is owned by Amp.

Utility-scale BESS initiatives have elevated in Britain in recent times, supporting the UK’s rising reliance on renewable power sources. The grid stabilization companies provided by BESS additionally broaden this deregulated market, bettering the underside line of mission stakeholders.

Aurora Power Analysis Senior Affiliate Tom Smout stated pv journal that “battery initiatives have carried out effectively economically in the previous few years, benefiting from a market with excessive power costs and from elevated necessities for helpful frequency response companies, the place property are extra applicable.”

Nonetheless, Smout famous that large-scale battery initiatives stay unproven in the UK.

“Our evaluation means that durations within the area of two hours are at the moment the perfect by way of return on funding, however a major a part of that is the upfront prices, a lot and longer initiatives will do higher in the event that they obtain important value financial savings or are positioned to make the most of native grid constraints,” he stated.

Based on official documentation, which reveals the derated capability, 1.29 GW of BESS initiatives received contracts within the newest procurement train. The derated capability is the nameplate capability multiplied by the derating issue, adjusting for the anticipated availability of that expertise throughout a system stress occasion.

Picture: Aurora Power Analysis

T-4 auctions – Britain’s primary procurement train – are normally held about 4 years earlier than the supply date. Contracts of as much as 15 years can be found for brand spanking new development capability within the auctions, whereas current capability can solely safe a one-year contract.

As of February, there have been 143 successful battery storage items, greater than 90% of which secured 15-year contracts. Nonetheless, BESS initiatives account for under 3% of the entire capability offered, with fuel claiming the lion’s share of 67.5% of the capability market items.

The T-4 capability public sale was cleared at GBP 63 ($71.07)/kW per 12 months, representing the best clearing value on document. The value is greater than double the earlier document because of the record-low prequalifying capability and better capability focused by the Nationwide Grid Electrical energy System Operator.

Based on Aurora Power Analysis, the public sale solely secured 600 MW greater than absolutely the minimal it may produce, which highlights how costly new initiatives are, each by way of absolute value will increase and rising volatility. assurance for buyers.

The most recent T-4 public sale follows a increase 12 months in 2022, when greater than 1 GW of derated BESS capability received contracts, out of practically 250 MW of BESS capability wins. in 2021.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.