March 9, 2023: Nearly 70% of Europe’s whole deliberate pipeline of lithium ion battery cell manufacturing capability by 2030 is liable to being delayed, decreased or canceled, in accordance with a brand new evaluation revealed on March 6 .

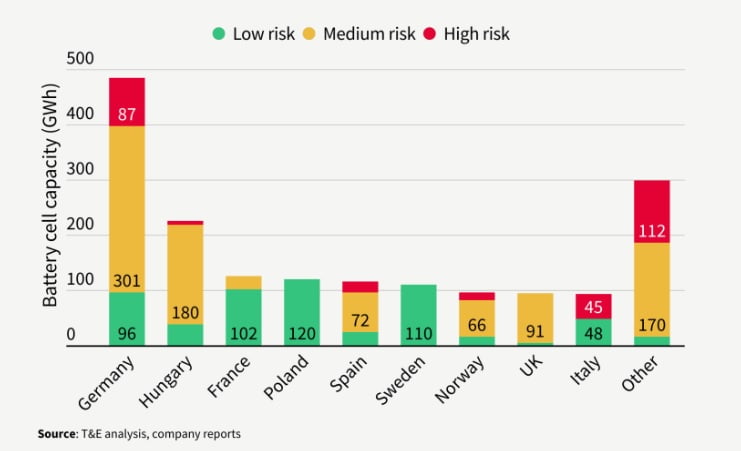

The examine by clear transport marketing campaign group Transport & Atmosphere recognized virtually a fifth (285GWh) of the 1.8TWh anticipated potential of the EV battery manufacturing unit in Europe is at ‘excessive threat’ and an additional 52% (of round 910GWh) at ‘medium threat’.

In whole, 68% of Europe’s potential battery cell provide is in danger if additional motion will not be taken – and the EU can’t fulfill battery demand with out imports from international rivals, the T&E.

T&E’s senior director for automobiles and e-mobility Julia Poliscanova mentioned: “Battery manufacturing within the EU is caught up within the battle between America and China. Europe should act or threat shedding all of it.

Stress

“A inexperienced industrial coverage centered on batteries with EU-wide assist for scaling up manufacturing is urgently wanted to deal with US subsidies and years of Chinese language dominance.”

The examine will increase strain on EU leaders following disaster proposals unveiled in December by the European Battery Alliance to avert a possible collapse in funding for Europe’s gigafactory plans, amid fears that cash in as a substitute flows to tasks within the US and Asia.

The T&E evaluation is derived from publicly out there data that examines the 50 gigafactories deliberate for Europe in 2030 – primarily based on maturity of tasks, financing, permits, secured manufacturing unit websites and hyperlinks to US venture corporations.

On high of China’s dominance of EV provide chains the US Inflation Discount Act, which is predicted to pour in not less than $150 billion in battery parts and metals made within the US or ‘pleasant nations’, is “altering the principles of the sport quickly”, the examine says.

Funding

When it comes to world funding in lithium ion batteries tracked by Bloomberg New Power Finance, Europe’s share fell from 41% in 2021 to a measly 2% in 2022, whereas funding in China and the US continued to development, in accordance with T&E.

Germany, Hungary, Spain, Italy and the UK stand to lose essentially the most if battery producers change their plans, in accordance with the examine.

“Tesla’s Giga Berlin plant has the biggest volumes liable to being delayed in Europe after the corporate mentioned it could focus cell manufacturing within the US to benefit from incentives below the Inflation Discount Act.

“There’s a medium threat to Northvolt’s deliberate gigafactory in Heide, Germany, as the corporate has solely acquired a part of the funding and has not but began development. Additionally, Northvolt’s CEO mentioned in October that the plant and prioritize US enlargement.

Italvolt’s Italian giga venture is in peril of shedding precedence in favor of its sister Statevolt venture in California.

The examine precedes the anticipated publication by the European Fee on March 14 of a ‘Internet Zero Industrial Act’, as a part of the EU’s response to the tax advantages and subsidies supplied by the IRA for the localization of US battery provide chain.

Suggestions

The examine’s predominant suggestions embrace Europe “locking in” the 2035 engine phase-out for brand spanking new vehicles and vans and introducing the identical deadline for vehicles.

The examine additionally joins the European Battery Alliance in calling for simplified authorization and approval processes for battery-related tasks, whereas making certain “robust social and environmental safety and engagement with native communities”.

Easy tax breaks and manufacturing finance are additionally advisable for best-in-class tasks.

In the meantime, a brand new European Vital Uncooked Supplies Act ought to prioritize EU tasks in refining, processing and recycling, whereas working with companions to import responsibly sourced supplies.

In a associated transfer, the EU and Canada launched a ‘matchmaking’ service to encourage funding in companies important to battery manufacturing – click on right here to learn our separate report.