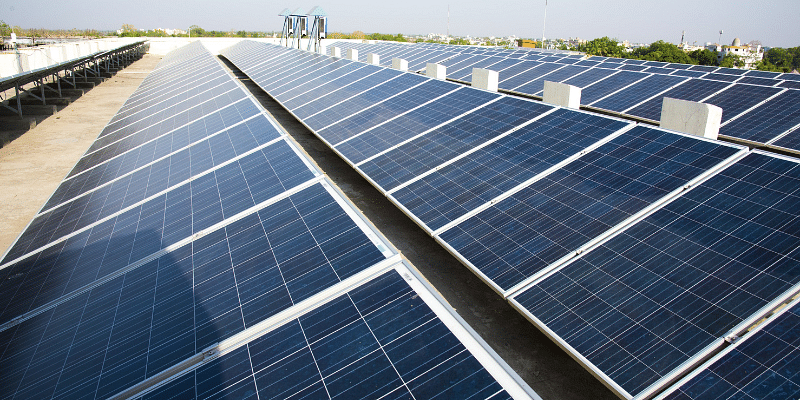

India ranks fourth globally in solar energy technology by 2021. In keeping with the India Model Fairness Basis (IBEF), the nation’s photo voltaic set up capability has elevated from 2.63 GW in March 2014 to 49.3 GW by the top of 2021.

Giant-scale photo voltaic tasks could also be underway, however the residential and small enterprise sectors usually face challenges resembling unavailable financing choices to arrange rooftop photo voltaic installations.

Chennai-headquartered Welfund has created a digital market to carry collectively all stakeholders — monetary establishments; engineering, procurement and building (EPC) corporations; and shoppers – to make it simpler to put in rooftop photo voltaic tasks.

The climatetech startup was based in Might this yr by Shankar Sivan, an IIM Indore alumnus.

Welfund is presently processing about 159 MW of rooftop photo voltaic tasks throughout India, with a price goal of Rs 765 crore. The startup raised an angel spherical of funding from Refex Capital this yr.

Previous to founding Welfund, Shankar was intently related to the technique and operations of Solar Edison, a rooftop photo voltaic firm primarily based in India.

Due to his first-hand expertise within the photo voltaic vitality trade, Shankar is aware of that the residential and small enterprise segments haven’t made a lot progress in tapping photo voltaic vitality, which cuts down on payments. electrical energy and contribute to a greener setting.

Challenges alongside the way in which

In keeping with Shankar, the 2 fundamental causes for the gradual adoption of photo voltaic vitality are the dearth of insurance policies by state governments and the excessive value of financing for such tasks.

He says, “The curiosity value of a mortgage for rooftop photo voltaic tasks for any residential complicated or small enterprise is within the vary of 18-20%, a lot greater than the common mortgage. at dwelling.”

Monetary establishments shouldn’t have the availability to supply loans to corporations serving rooftop photo voltaic tasks, and even when they do present loans, they fall underneath the business class, which attracts greater rates of interest. .

Only a few monetary establishments present loans for rooftop photo voltaic tasks, and the compensation interval could be very restricted (normally round 4 years).

However, EPC gamers don’t wish to handle this phase as a result of the economics of organising a small rooftop photo voltaic mission doesn’t work of their favor. Usually, photo voltaic EPC corporations assist their clients to get loans.

Market mannequin

On account of these challenges, Welfund created a market mannequin that connects all stakeholders and the place everybody advantages.

Customers, together with dwelling homeowners and small companies, can add necessities to the web site, and Welfund affords funding choices at rates of interest equal to a mortgage in home

Monetary establishments like banks and NBFCs additionally get entry to a big buyer base by means of Welfund, which additionally validates their necessities. EPCs are awarded work contracts to arrange these rooftop photo voltaic tasks.

“We’re onboarding clients largely by means of the digital route and we’re additionally serving to monetary establishments to take part in financing such photo voltaic tasks,” Shankar mentioned.

Welfund is about to signal a partnership with 5 monetary establishments. It has partnered with mortgage distributors resembling Yubi, Andromeda, Loanwiser, and DealsofLoan. It has processed about 85 mortgage functions thus far.

The startup has additionally constructed a community of over 200 EPCs, with 48 registered on the platform.

Welfund supplies asset and upkeep companies for photo voltaic tasks, and ensures a purchase order facility when it turns into non-performing property.

At the moment, the climatetech startup is onboarding clients by means of the EPC channel.

Alan Babu, Managing Companion, Sensible Photo voltaic Properties, says, “With Welfund as our associate, our lead-to-sales conversion has elevated from 1.5% to five%. We’re extra assured in our gross sales pitch as a result of we all know We at Welfund facilitate inexpensive mortgage affords.

Welfund presently has a group of about 5 folks. The corporate sees direct competitors from Electronica Finance, one other firm that gives loans to residential complexes and small companies. Some corporations usually present financing for bigger photo voltaic vitality tasks.

Enterprise and the way in which ahead

The startup works on a enterprise mannequin the place it earns a sure proportion as a service price from clients on the profitable closing of every mortgage. It has but to register income.

“Our fundamental goal is to extend using such sustainable property by means of financing,” says Shankar.

As a part of its future plans, Welfund plans to enter the area of photo voltaic water pumps, that are primarily used within the agricultural sector. It additionally seems at vitality monitoring.