Hydrogen, electricity trade-offs for energy islands – pv magazine International

Picture: LCopenhagen Faculty of Vitality Infrastructure (CSEI), Utilized Vitality, Inventive Commons License CC BY 4.0

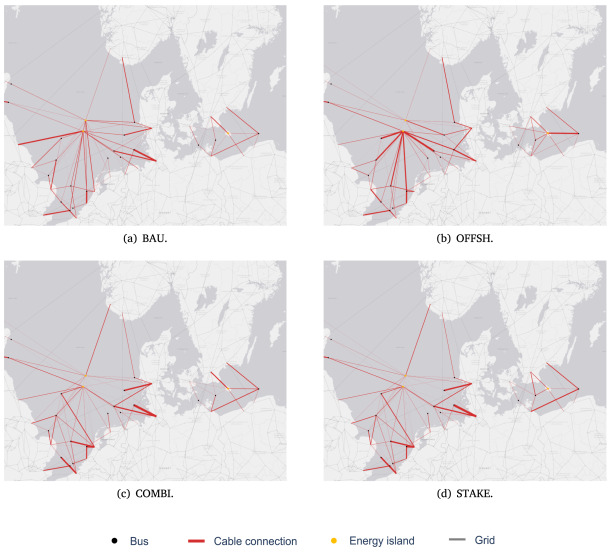

A Danish-Norwegian analysis group examined methods to combine vitality islands powered by renewables into the regional vitality system by energy cables or hydrogen infrastructure. They discovered that connecting the near-shore wind farms by energy cables would profit the electrical energy system extra. “We see that the electrical energy system advantages extra from being related nearer to the coast wind farms by energy cables,” they mentioned. “Alternatively, electrolysis is extra invaluable for distant vitality islands as a result of it avoids costly long-distance cable infrastructures.” Capability funding in electrolyzers is dependent upon hydrogen costs and onshore community congestion, they wrote in “Learn how to join vitality islands: Commerce-offs between hydrogen and electrical energy infrastructure,” which was lately printed in Utilized Vitality.

DNV states that repurposing pipelines can value solely 10% to 35% of latest building prices, resulting in a possible financial savings of greater than 50% of hydrogen pipelines worldwide , and as much as 80% in some areas with important pure gasoline infrastructure. Transporting hydrogen in pipelines presents security and monetary dangers, and end-user demand could restrict the standard and amount of hydrogen transported. DNV is increasing its testing capabilities in his labs Groningen (Netherlands) and Singapore.

the Vitality Company of Denmark THERE Workplace has partnered the launch of a assist scheme for renewable hydrogen. It has allotted DKK 1.25 billion ($184 million) to succeed in 5 GW to six GW of electrolysis capability by 2030. The Energy-to-X (PtX) tender is at present within the tendering section, and the company is inviting candidates to submit their bids. . The deadline is Sept.

E. ON SAYS in a brand new report that Germany must rapidly spend money on electrolysis capability, hydrogen import infrastructure, and a “high-performance H₂ community. The German authorities desires to construct at the very least 10 GW of electrolysis capability to supply inexperienced hydrogen by 2030. Its present electrolysis capability is 68 MW.

Canada boosting its hydrogen investments, betting on contracts for distinction (CfD) supported by the Canada Progress Fund and refundable tax credit on investments underneath its 2023 funds. “The extent of assist varies between 15 and 40% of eligible mission prices, with initiatives that produce the cleanest hydrogen receiving the very best degree of assist,” mentioned the Canadian authorities. “If we’re to protect this benefit and place Canada to compete within the subsequent era of electricity-intensive sectors, akin to clear hydrogen and inexperienced metal and aluminum, important investments should be made now. The business’s want for of electrical energy is simply set to develop.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].