As Longi and other solar manufacturers embark on major increases in hydrogen production capacity, large price reductions are expected as a result of long learning curves, echoing the rapid growth. which the solar power industry has experienced since the 1970s.

From pv magazine Global

Longi Green Energy, the world’s largest producer of solar panels, has been instrumental in driving solar to become “the cheapest energy in history,” according to the International Energy Agency. The company now joins a wide field of competitors as it sets its sights on hydrogen electrolyzers.

Looking at the convergence of technological advances and rapidly growing investments in hydrogen, one cannot help but wonder if the price of the world’s lightest energy storage medium will soon collapse, like the price of solar cells. BloombergNEF’s hydrogen market outlook recently published a chart showing what looks like the beginning of a dramatic S-curve. Remember – everything has a lower conversion rate.

Longi expects to have 85 GW of solar module assembly capacity built by the end of the year. pv magazine USA spoke briefly with Longi at RE+, where we asked the company about its green hydrogen plans.

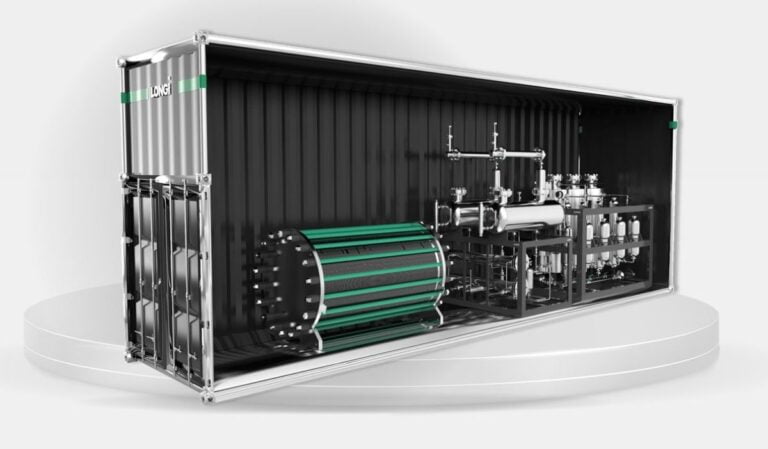

The company launched three models of electrolyzer. At the company’s booth it was suggested that the 5 MW alkaline water electrolytic bath – the LHy-A1000 – is the most efficient of the three models. The unit produces approximately 90 kg of hydrogen per hour.

Longi stated that it hopes to expand its Wuxi manufacturing facility to 1.5 GW by the end of 2022, and to produce 5 GW to 10 GW of electrolyzers by 2025. These targets mean growth of several gigawatts per year. .

The company started thinking more about hydrogen in 2018, as wind and solar prices dropped, and renewables grew significantly in China. Since electricity makes up 60% of the cost of producing hydrogen, solar surplus is considered a perfect partner.

Meanwhile the need for net zero industrial processes is coming. Longi cited some of the main industries: cement, fertilizer, and oil refining.

In his booth, pv magazine USA pried for pricing data for Longi’s electrolyzers, asking if they are under $1,000/kW. The company responded that their products cost less than $500 per kW. Bloomberg NEF recently reported that alkaline electrolyzers made by an unnamed Chinese manufacturer cost less than one-third the price of those made in the United States, at only $343/kW.

Since Longi is the largest producer of electrolyzers, it is probably the manufacturer of the $343 electrolyzer. However, since six companies already produce more than 1 GW of capacity per year (per chart, below), we are not sure who is leading these cost reductions.

The Bloomberg NEF analysis also predicts that we should expect an additional 30% reduction in costs due to scaling by 2025. However, some of the gains will be offset by increases in labor costs and commodity.

This scaling process is still in the early stages, so it is likely that the 20% reduction in price, associated with each doubling of capacity, should outweigh the relatively small increase in labor costs that can be expected. . External forces played a strong role in these developments, too. The US Inflation Reduction Act pays $3/kg for green hydrogen. And since other forces cause energy pains, such as the war in Ukraine, it is likely that manufacturers will find new markets for these components.

By JOHN FITZGERALD WEAVER

This content is protected by copyright and may not be reused. If you want to cooperate with us and want to reuse some of our content, please contact: editors@pv-magazine.com.