The worldwide demand for sodium-ion batteries is anticipated to develop to lower than 70 GWh in 2033, from 10 GWh in 2025, at a compound annual development fee (CAGR) of 27%, based on the UK-based market analysis firm IDTechEx.

Whereas in its infancy, sodium-ion expertise represents a viable different to lithium-ion battery applied sciences. With higher uncooked materials prices, improved security, and higher sustainability credentials, sodium-ion holds the promise of easing the pressure on lithium-ion provide chains.

As world commercialization efforts for sodium-ion batteries intensify, IDTechEx predicts that by 2025, about 10 GWh of sodium-ion batteries might be put in as vital manufacturing capacities come on-line and present lithium-ion traces are transformed to sodium manufacturing.

At a CAGR of 27%, sodium-ion is forecast to develop to below 70 GWh by 2033, says the UK-based market analysis firm. “There could also be potential for quicker development than forecast as soon as the expertise is dependable, certified, bankable, and accessible,” it added.

An earlier forecast from Wooden Mackenzie was extra conservative. In keeping with the US-owned Scottish knowledge firm, sodium-ion batteries are anticipated to interchange some elements of lithium iron phosphate (LFP) in electrical passenger autos and vitality storage, which is able to of 20 GWh in 2030 within the base-case state of affairs.

At the moment, manufacturing is proscribed to pilot crops, and some small factories have began. Nevertheless, IDTechEx calculates that “the capacities introduced to the general public by numerous uncooked materials producers alone enhance by greater than 100 GWh within the subsequent three years.”

IDTechEx stated in its newest report that it has recognized about 15 firms which can be growing their very own Na-ion battery applied sciences. It additionally checked out patents and located that China is as soon as once more within the lead.

For instance, battery trade heavyweight CATL launched its first technology sodium-ion battery in 2021, with an vitality density of 160 Wh/kg and guarantees a rise to 200 Wh/kg. Earlier this 12 months, it confirmed that China’s Chery could be the primary automaker to make use of its sodium-ion battery expertise.

HiNa Battery, which was spun off from the Institute of Physics of the Chinese language Academy of Sciences in 2017, turned the primary firm on the planet to function a gigawatt-hour sodium-ion battery manufacturing line final 12 months. It additionally revealed plans to increase capability by 5 GWh.

Final week, BYD subsidiary FinDreams stated it had discovered a accomplice in Huaihai Holding Group to start out producing sodium-ion batteries within the Xuzhou Financial and Technological Improvement Zone in Jiangsu province. In a press launch, the businesses stated that the three way partnership is the most important provider of sodium-ion batteries on the planet for mini and micro autos.

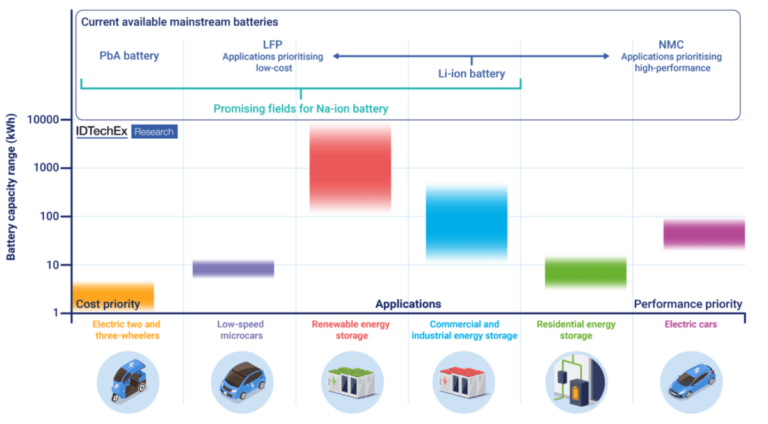

Till now, sodium-ion batteries are primarily utilized in electrical two-wheelers and for stationary vitality storage as a consequence of their low vitality density in comparison with lithium-ion batteries. The sodium-ion is thrice heavier than its lithium counterpart and has a decrease redox potential, leading to at the very least 30% decrease vitality density.

Sodium-ion batteries are quoted as being between 20% and as much as 40% cheaper, however the problem is bringing the expertise to scale. Due to this fact, vital financial savings in lithium-ion batteries are unlikely, at the very least initially.

In keeping with IDTechEx analysis, the common cell price for Na-ion batteries is $87/kWh contemplating completely different chemical substances. By the top of the last decade, the manufacturing price of Na-ion battery cells utilizing primarily iron and manganese is more likely to drop to round $40/kWh, which is round $50/kWh on the pack stage, the corporate calculated. .

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.